A populist pivot for the HBO brand with the launch of HBO Max

With the launch of HBO Max, AT&T pivots the elite HBO brand to populism in many of the right ways

Today is HBO Max's launch date, and I have already offered a few thoughts on Twitter already which I can use this new blog to expand upon them.

Initial #HBOMax impression: UX feels like a hybrid of the HBO UX & an airplane movie browsing UX. that is a compliment, implies it feels familiar. Red flag is diluting of HBO content. @iamjohnoliver was once a banner tile, now found as a “featured series”.

— Andrew A. Rosen (@aagave) May 27, 2020

The only way a UI/UX like this works for #HBOMax is if it has $NFLX like understanding of its users and targets content to them in the banners and in featured. Otherwise this is going to be a sh*tshow of a service & a streaming business

— Andrew A. Rosen (@aagave) May 27, 2020

I think the launch HBO Max marks a turn from curation to populism for the HBO brand, and for now, I cannot figure out if that is a good thing. Meaning, for decades HBO was happy with Richard Plepler's "bespoke culture" and “More is not better, only better is better" approach to content. That has gone out the window with AT&T's objective of more scale and more revenue. Harry Potter, Friends, Sesame Workshop, Looney Tunes, Fresh Prince of Bel Air... "better" has been diluted to mean "popular".

As I tweeted above, this is a subpar outcome for existing HBO talent who have benefited from its bespoke culture, to date. The likes of John Oliver and Bill Maher have gone from top banner options to buried in a long list of Featured titles that include The Big Bang Theory and Doctor Who alongside HBO's Westworld. Whatever hurdles Oliver, Maher, and Lisa Joy and Jonathan Nolan (Westworld's creators) each had to overcome to get a show on HBO are now gone with the old HBO brand. They have new obstacles in the form of broader competition for attention - that, too, feels populist.

As I wrote back in April:

HBO Max seems primed for success: HBO has an install base of 140MM worldwide, and will be upsold to AT&T's 75MM postpaid wireless subscribers. The challenge, [memberful_download_link download='6523-newsletter-207-april-6-2020']as I have argued before[/memberful_download_link], is "it is not clear AT&T's business priorities are in outcomes which involve HBO Max getting the tech 'right' to scale globally". In this post-COVID market, AT&T faces an existential crisis about whether it can grow wireless subs with the value proposition of HBO Max during a recession when disposable income is dropping and smartphone vendors face supply chain delays from China.

AT&T's target audience is enormous, with an existing customer base of 170MM worldwide. HBO's maximum audience of 34MM subscribers (plus another 8MM via DTC) implies the value proposition of "bespoke culture" means little to a broader audience, and therefore to the additional 20MM subscribers AT&T intends to add as subscribers over the next five years (NOTE: as of this post, they had not signed deals with Roku and Amazon, which reflects 80MM households between the two, and Amazon in particular has opted for a contentious approach to the negotiations).

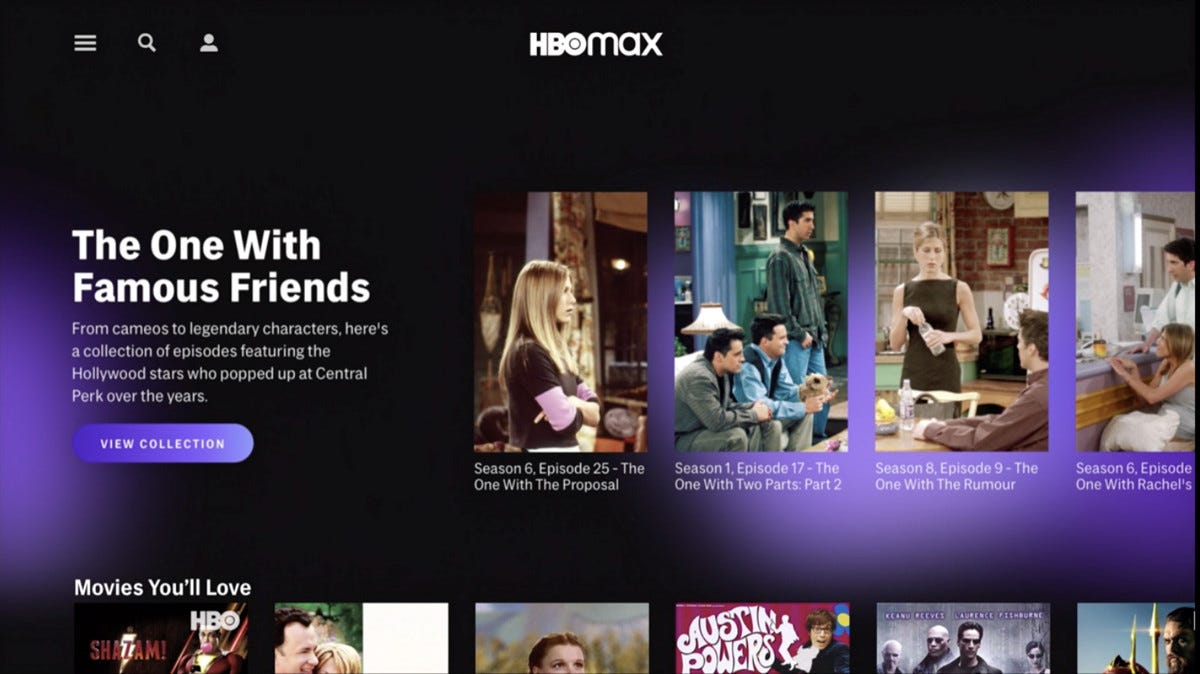

Populism seems to be so much a part of the service that the new HBO Max User Interface, with its vertical rectangles and titles, only, looks an awful lot like an in-flight entertainment experience.

Image via The Points Guy

HBO Max Friends UI screengrab via The Verge

782MM passengers flew domestically in the U.S. in 2019, so over 2x the U.S. population are familiar with these vertical rectangles and a broader movie selection than HBO's "bespoke culture" has offered.

This populist value proposition makes a ton of sense for converting that target customer into a subscriber: an enormous library in a familiar UX at a fraction of the cost of an airplane ticket (which also benefits from a current 92% drop in air travel). But, because HBO Max also includes the HBO Brand and HBO content creators who worked hard for the HBO brand imprimatur, and the guaranteed HBO subscribers eyeballs that brand halo brought. Now, they face different competition within a UI which chooses no favorites (or, at some point is supposed to curate them with human curators), and therefore no more competitive advantages to the HBO brand halo.

I think we are going to see some big-name HBO talent publicly explore their alternatives over the next 12 months, because I cannot imagine they will be happy with the data on how HBO Max's interface promotes them, and in turn, how HBO Max's broader user base will be engaging with them with more to choose from.