DC Fandome and The Future of WarnerMedia, HBO Max

What is the value of the content? What is the value of the fans?

This paragraph from The Ankler's post, "A Goodbye to Team Window: Earth, Window and Fire", struck a chord with a couple of folks I follow on Twitter:

The battle really was lost when the legacy studios accepted the term "content" as the definition of what we were making. With that change, we were no longer in the business of creating movies and TV shows—things that the studios had a unique knowledge of—they were now just another business creating "content," i.e. stuff to fill the various tech funnels that would pour out data on the other end. Didn't matter much what it was; it was all just content to the machine, and with that turn of the mind, the studio's special role in entertainment history vanished.

When I read it, I realized it plays into what I wrote about the types of bets IAC's Barry Diller is bullish on:

aspirational brands, only

an ecosystem with multiple business models and revenue streams

an existing user base at scale

a service that is accessible, daily, in both digital and physical worlds

enables IAC to contribute with its strengths in online commerce and offline to online conversion

Or the shorter version I tweeted, "If a film is just a film and not serving or creating broader IP and multiple opportunities to monetize, a film is effectively DOA as an investment."

And that quickly led me to ask this follow-up question:

One immediate implication: did we all underestimate the significance of #DCFanDome to WarnerMedia’s and Kilar’s futures? Because if they can’t develop DC IP...

— Andrew A. Rosen (@aagave) August 26, 2020

DC IP Is WarnerMedia's Future... If Barry Diller Is Right

If IAC Chairman Barry Diller is right, for DC to be significant to WarnerMedia's and HBO Max's futures (and thereby WarnerMedia CEO Jason Kilar's future), WarnerMedia must monetize "the same intellectual property between streaming, theatrical releases, merchandise, and theme parks".

WarnerMedia is not in the theme parks business, but it is in gaming; so, that leaves streaming, theatrical releases, merchandise, and gaming as its avenues for monetizing the DC IP.

If The Ankler is right, then DC is "just another business creating "content," i.e. stuff to fill the various tech funnels that would pour out data on the other end". In other words, all four business models have limited upside.If WarnerMedia can build an ecosystem around DC IP...

The distinction between DC IP driving an ecosystem and DC IP as "content" is a key question not just for the future of WarnerMedia, but for AT&T.

DC IP as Ecosystem

If WarnerMedia can build a media business ecosystem around DC IP where,

DC is an aspirational brand like Marvel,

has an ecosystem with multiple business models and revenue streams

has an existing user base at scale

offers a service that is accessible, daily, in both digital and physical worlds

and, enables WarnerMedia to contribute with its strengths in online and offline-to-online conversion

If WarnerMedia can do that, it will be closer to Disney's model than it is today, and therefore will in a stronger position going forward. Because theatrical will reinforce gaming (Batman and Suicide Squad IP in particular) and streaming (The Batman and Justice League Snyder Cut); and, in turn, streaming will reinforce theatrical (Shazam and Superman titles) tie Black Adam, Justice League ties into The Flash). 22MM superfans drive engagement across all platforms. If those superfans represent householders in the U.S., that's 60MM total consumers and an additional 38MM consumers for games, streaming, and theatrical.

For what it's worth, I think Jason Kilar understands this.

DC IP as "content"

The danger is if audiences simply want "content", then audiences will demand more free content (influencer livestreams, fan tweets, images, and video clips of DC Fandome panels). DC will be a popular brand, but without a larger ecosystem to monetize that brand, the future of DC content will be zero revenues.

In that scenario, WarnerMedia finds itself in the position of every other legacy media company, carrying a valuable IP library but without a solid infrastructure for monetizing that library:

COVID threatens the theatrical revenues that The Flash, Black Adam, The Batman, and Wonder Woman 1984 can bring in;

WarnerMedia's botched launch of HBO Max and existing consumer confusion about the service threatens the potential growth Justice League Snyder Cut could singlehandedly attract to HBO Max;

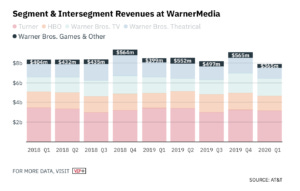

WarnerMedia makes a 5% of its revenues from Gaming (see below), and AT&T is seeking to sell the gaming division for $4B to help pay down its debt.

As the foundation an ecosystem, DC IP may mark the next chapter of the WarnerMedia ecosystem. With WarnerMedia and AT&T as the backbone of an ecosystem for DC IP, DC faces a risky future.