How Star and Star Plus Move Disney ($DIS) Away from Netflix ($NFLX)'s Model

The emergence of Star and Star Plus reflect a very different streaming business model than the one Disney went to market with in April 2019

I was interviewed by Brandon Katz of the Observer after Disney's Investor Day:

“My rapid reaction is that this is a company that knows it needs to improve ARPU and is highly focused on that,” Andrew Rosen, former Viacom digital media exec and founder of streaming newsletter PARQOR, told Observer. “It also seems to be savvy to the fact that Disney Plus, on its own, has upper bounds in its growth that Star, Star+, and Hotstar burst through globally. It’s no accident their projections tripled to quadrupled.”

The premise that Disney Plus had upper bounds on its growth seems contrarian, but Disney’s Investor Day confirmed, if not rewarded, my skepticism about Disney's ability to execute a Direct-to-Consumer model.

Given that Disney announced 137MM total subscribers worldwide, and expects to triple its previous subscriber base estimates for 2024 (at least), why would anyone argue this contrarian take unless they were trying to be unnecessarily provocative?

There are two answers to that question: Star and Star Plus.

When compared the original value proposition of Disney Plus, Star and Star Plus read like an unusual departure from building out a streaming service with Disney IP:

with Star, Disney Plus is no longer only about family-friendly IP, and,

with Star Plus, Disney Plus appears to need a companion app to grow in Latin America.

Simply put, the vision for Disney Plus has changed in that Disney now realizes its library of IP can drive extraordinary scale, but cannot sustainably drive extraordinary scale.

If Disney’s original strategic vision was to evolve more like Netflix, its new vision with Star and Star Plus has pushed in completely different competitive territory than pure-play streaming. The question is why this happening only one year into Disney Plus's existence, and after an extraordinary year of growth. The answers lie in Disney+'s technological back-end, its creative pipeline, and its new economics.

Revisiting My Disney Plus Skepticism - Tech

In February I was skeptical about Disney Plus the questions that loomed despite an extraordinary first quarter. In particular, I wrote "I still do not completely buy Disney’s optics here - not in a "BAH humbug" type of way, but a 'I still don't buy 28.6MM consumers love old library content in the long run'".

I added:

...it is notable how Iger sold Disney Plus's success to investors: "...I think the user interface also got incredibly high marks in terms of the ease of use, the ease of navigation, the quality of the product, the value of the brands and... a very accessible price point". He is selling it, hard, with all evidence suggesting that both his technological integration plan, and his Disney+ interface (with limited algorithmic recommendations), may perform better than Hulu's current back-end and front-end internationally (NOTE: I have assumed that Iger may change the back-end only, but after this call it is harder not to question that assumption).

So, the takeaway is that if there is a solid story for Disney's original content plans above, there is a problematic story for how Disney envisions it will reach scale internationally for both Hulu and Disney Plus across two separate platforms. Because Disney is performing the technology equivalent of upgrading an airplane's engine mid flight by combining Hulu and BAMTech back-ends now, but also implying it will keep some elements of both platforms behind on Hulu and Disney Plus, respectively. This seems to be an unusual risk for Disney to be taking with this success story already in the books.

My skepticism then was largely technological: I understood that it was hard to argue with the quality of the Disney Plus app and library, but it had two back-ends, and the interface for Disney Plus seemed weak.

The Star and Star Plus announcements decidedly establish BAMTech as Disney's back-end going forward. So that red flag (which I wrote about on the blog) has been solved for. [NOTE: Conveniently, it also likely reduces its payout agreement with Comcast for 2024 for Comcast's 33% stake in Hulu, which was priced at minimum total equity value of of $27.5 billion at the time of the agreement. The payout assumed Hulu scaling internationally, which it is not.]

Weak interfaces mean less personalization, which in turn means fewer reasons/incentives for the user to click and/or come back. Add in a content pipeline weakened by COVID, and they reduce those reasons/incentives for users to return even further.

In other words, the weaknesses in UI and UX design mean more churn for Disney Plus. Data from analytics firm Antenna told a story of churn for Disney Plus in the U.S., with 30% more subscribers sticking around a year later for Netflix than for Disney+.

Of Disney Plus Subscribers who Signed-up in the launch month, 56% remain Subscribed (and never cancelled) through the first year pic.twitter.com/R0hwONdjwF

— ANTENNA (@AntennaData) December 17, 2020

Is it reasonable to assume that the same issue of churn is also playing out in the places where Star is launching - Europe, Canada, ANZ, and Singapore? I think so.

The question is, what is likely driving that churn? We do not have much evidence of that. What we can assume from the inclusion of mature content in Star’s value proposition is that a lack of content for mature audiences is driving churn worldwide, and pushing Disney to test a different value proposition and user experience with Star in Europe, Canada, ANZ, and Singapore.

As for Star Plus, it is notable that Disney is taking the Star interface out of the Disney Plus app, and adding both live sports streaming and advertising to it. In other words, Disney has effectively taken Hulu’s Live TV model, focused it around ESPN streaming content exclusively, and added in Hulu’s library.

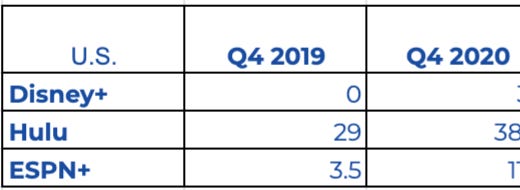

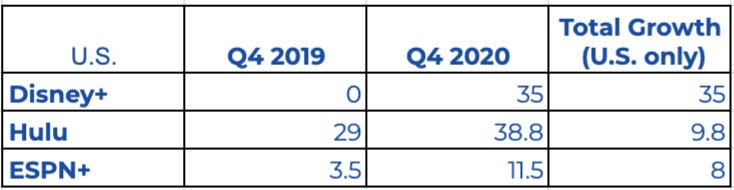

How does Star Plus help Disney Plus churn? With the business logic of being bundled together. Although we do not know churn metrics from Disney DTCI, we do know that both ESPN+ and Hulu have grown almost by exactly the same volume since Disney+’s launch and being included in a bundle (NOTE: Disney+ U.S. number is an estimate partially based off my own estimates, and partially based off of some helpful analysis from The Entertainment Strategy Guy).

So, feasibly a Disney Plus and Star Plus bundle can generate and retain around 30% more subscribers than Disney Plus on its own.

If Disney Plus's launch in April 2019 was a story about the promise of scale, Investor Day 2020 was about Disney navigating the strategic, operational, and financial demands of that scale.

Revisiting My Disney Plus Skepticism - Economics

In streaming, a key financial question is recoupment: streaming services need to both grow and retain subscribers to ensure a Customer Lifetime Value that funds the recoupment of investments in content. Recoupment is a risk for Netflix globally at a higher ARPU ($10.80) and 2.25x greater scale, and it has only seen positive free cash flow recently due to some pandemic-related accounting (NFLX Q2 earnings call.

So, for Disney Plus, it is even riskier to be operating at a relatively smaller scale to and at 42% of the ARPU of Netflix (Disney Plus's overall ARPU this quarter was US$4.52, and excluding Disney Plus Hotstar, it was US$5.30),

Disney announced the following price increases on Investor Day:

A $1 increase for Disney Plus in the U.S.

A €2 increase for Disney Plus in Europe to reflect the inclusion of Star ($2.50 more)

Star at €8.99 in continental Europe (or $11.50), and

Star Plus at $7.50 on its own $9.00 bundled with Disney Plus.

The obvious rationale for the price increases is, after an extraordinary year of growth, the increases are justifiable. That said, Disney is also in the position to shape and drive audience demand over for the next 12 to 24 months, as its “shock and awe” content strategy was intended to communicate (and, as this week’s formal announcement from Marvel confirming its theatrical and streaming releases also communicated).

But, when looking at the pricing for Star and Star Plus through the lens of Average Revenue per User (ARPU), a different story emerges.

First, the addition of Star helps to drive the ARPU up of Disney Plus in Europe by 2.5x the price increase in the U.S. So, Star not only solves for library, it also helps to improve ARPU to 85% of Netflix’s EMEA ARPU of $10.60. Netflix’s EMEA region has over 62.2MM subscribers as of Q3.

Disney seems to be aggressively betting that the combination of Disney+ and Star can help it to reach Netflix levels of market penetration in continental Europe, Canada, ANZ, and Singapore. But, in making that bet, it also appears without Star, Disney is conceding that Disney+ as-is could not retain its user base at Netflix levels in the long-run.

That may read like too cynical a take. But, at the same time, the addition of Star and more mature content in the Disney+ app is a move that goes against the original plan for the Disney+ brand as “family friendly”, one which in its early days pushed more adult-themed fare like High Fidelity to Hulu (where it only lasted one season), and the failure to reboot Disney Channels’ Lizzie McGuire for not being “family friendly” (the show was officially cancelled last week).

In other words, the addition of Star is the antithesis of Disney’s original plans for Disney+.

There is nothing wrong with a streaming service like Disney+ evolving its plans and learning as it proceeds. But, in making this particular move of adding Star to Disney+, which offers a broader library than Disney+ and for a broader base of audiences, Disney is conceding that it understands its target audiences' needs very differently than when Disney+ launched.

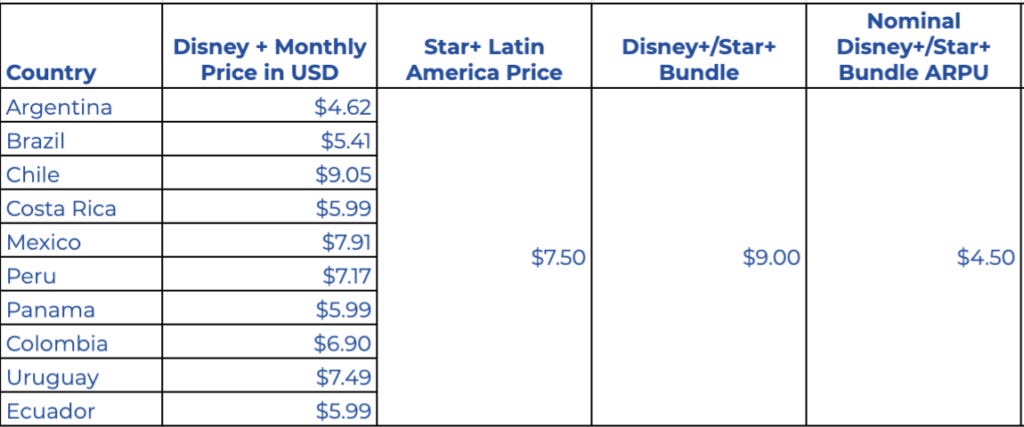

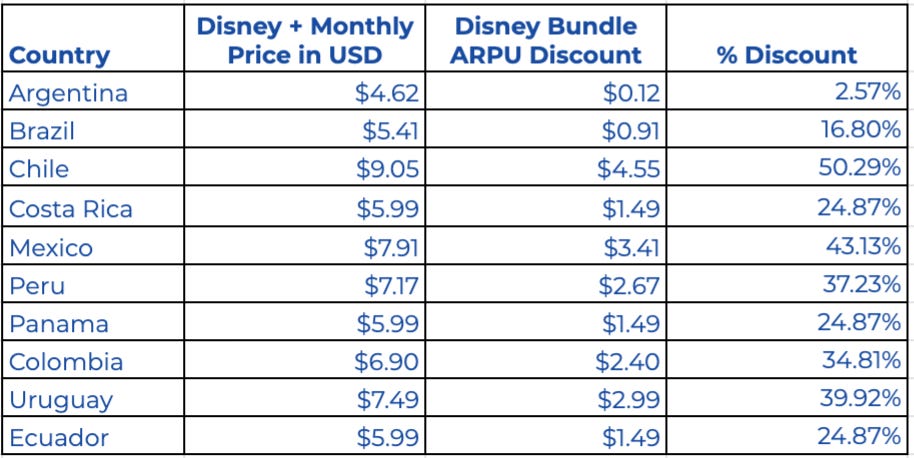

Second, as for Star Plus its bundle with Disney+ is fascinating from a pricing perspective. Disney+, on its own, varies in price across Latin America, adjusted to local currencies:

However, Disney announced Star at a fixed cost of $7.50, and the Disney+ and Star Plus bundle at a fixed cost of $9.00. As a result, Disney+’s ARPU in the bundle is impacted negatively, and in Costa Rica by as much as 50%.

In all likelihood, this probably reflects a Weighted Average approach to ARPU in Latin America, which would mean certain countries are driving more volume than others, and we do not know (yet) which of those countries are doing so.

Both Star and Star Plus end up revealing a really interesting dance between growth and ARPU that Disney is navigating in Latin America. With Star, Disney sees an opportunity to boost ARPU both because it can after an extraordinary 2019, and because Star fundamentally changes the value proposition of Disney+ in order to drive more growth. In Latin America, Disney+ remains the same, and adding Star Plus via a bundle can boost growth by 20-30%, even if it means discounting the ARPU of Disney+ by as much as 50%. In both cases, the key takeaway is that Disney+, alone, is not strong enough to sustain growth and market penetration in those markets.

[NOTE In the U.S., Disney+’s ARPU faces three downward pressures:

The number of subscribers worldwide who signed up for the early three year deals (my guesstimate is 4.5MM worldwide, 1.5MM for the first deal at $3.99/month, and 3MM for the second offer at $4.99/month).

The number of subscribers from Verizon, who come in at a wholesale price and constituted 20% as of January 2020.

The number of bundle subscribers, which appears to be somewhere in the range of 8MM, and which discounts Disney+ ARPU, too. ]

Revisiting My Disney+ Skepticism - Creative Pipeline

Dsiney+ delivered a "shock-and-awe" approach to content releases at its Investor Day. It also announced a target of 100+ new titles for Disney+ per year, and 80% of titles announced were streaming-only titles. It also raised the projected content budget for Disney+, alone, from $4B to $8 -9B. As The Verge's Julia Alexander writes:

Last night’s presentation established the undeniable version of Disney Plus that delivers on nearly $100 billion worth of acquisitions over the last 15 years. Dozens of new Star Wars, Marvel, and Pixar projects, all based around multi-billion dollar franchises that are adored by kids and adults around the world, all appearing on Disney Plus one right after the other. Movies that would have gone to theaters are now Disney Plus exclusives, and Disney’s various TV divisions will supply a stream of shows. In 2019, Disney introduced an idea of a streamer. Now, Disney Plus will consistently be fed with content audiences have proven they will gobble up.

I think this is the right take. Back in February I wrote back in February that CEO Robert Iger's resignation reflected weaknesses in the creative pipeline that Disney needed to solve for its pivot to streaming:

All evidence suggests that with a pivot towards DTC, Disney will require a new and different creative pipeline than the one that has worked to date (and phenomenally at the box office).

I proposed that:

...the problem Iger is focused on solving is whether the future of the Disney creative pipeline for streaming looks like its current roadmap for 2020, with the notable delays and cancellations for tentpole properties; or, whether it looks more like a Netflix pipeline with more frequent releases and whether Disney can stomach the compromises that pipeline requires (and to quote Ben Thompson again "Netflix is like a pig wallowing in the mud of junk TV" with the frequency and quality of its content releases, including a recent focus on reality TV).

On investor Day Iger announced a target of 100+ new titles for Disney+ per year, and 80% of titles announced were streaming-only titles. That would imply that Disney+’s upcoming streaming library, alone, will drive its DTC model.

But, looking at ~1,000 titles of original and licensed content for mature audiences on Star, and 2,000 original and licensed titles, and live sports, on Star Plus, it becomes clear that Disney has realized it cannot rely on the power of Disney+’s existing library content and/or IP to drive growth, as Shawn Robbins, chief analyst at Boxoffice Pro told Bloomberg:

For now at least, [Disney’s] primary strategy seems to be extending their built-in generational appeal by revisiting stories and characters familiar to Generation X and older millennials, The inherent risk is the chance of alienating an audience due to overexposure, or a string of subpar content.

Disney also cannot rely on its blockbuster strategy anymore, which took annual movies released down from 36 movies a year - including films from the Miramax label it not longer owns - to just 10 in 2018.

All of this means, Disney will see a large increase in licensing costs.

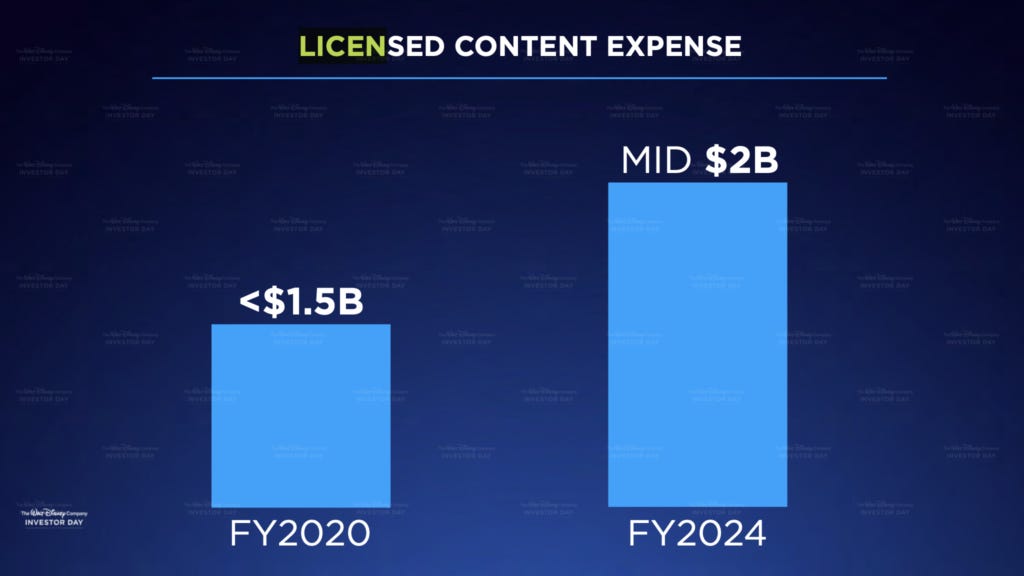

When Disney announced Disney+ at its April 2019 Investor Day, its licensing costs were promised to grow no more than by 30%.

At its December 2020 Investor Day, an increased library of licensed content for Star and Star Plus was discussed, but licensing costs were not mentioned. Why? Odds are they are substantially higher.

In trying to take on Netflix, Disney has quickly learned that its initial advantages of the sunk cost of owning its own IP are an advantage, but now finds itself moving towards Netflix’s licensed content model. Netflix currently licenses $14.2B in content (according to its 10-Q) at the scale Disney believes it can reach and beat.

How much will Disney’s licensed costs grow? If Netflix is the market standard, the most these costs could grow is by as much as 7x.

So, Disney+’s approach of “shock and awe” on Investor Day looks less visionary, and more so risk averse, even fiduciary. Whereas Disney’s reliance on theatrical distribution has constrained its revenues during the COVID pandemic, its creative pipeline’s reliance on theatrical content has constrained its immediate ability to build out a sufficient creative pipeline to sustain its extraordinary growth. In other words, it seems Disney executives are strategically, financially, and operationally constrained by the limits of their strategy from the past two decades.

Conclusion

Diving into Star and Star Plus, what becomes clear is how Disney has shifted away from its original streaming pitch in significant and, in some instances, drastic ways.

With Star, Disney is betting that moving away from the core Disney+ value proposition in Europe, Canada, ANZ, and Singapore is the only way it can continue to grow the service and generate higher ARPU. The addition of Star Plus is much more of a departure. Its value proposition seems closer to a hybrid Frankenstein of Hulu+Live TV and the ESPN+ app, and its economics suggest that Disney is willing to take a 40% discount on Star Plus, and as much as a 50% discount on Disney+ in Costa Rica, in order to grow both Star Plus and Disney+ in Latin America.

Both will be driven by a different library of content than Disney’s existing library, and will include thousands of additional titles, many of which will be licensed.

Put simply, Disney’s Investor Day presentations about Star and Star Plus revealed a change in vision. Perhaps this was to be expected with one original visionary, Kevin Mayer, now gone and the other, Robert Iger, on his way out.

But I think the other reason for the change in vision is reflected in ARPU: Hotstar makes up 30% of Disney+’s 86.8MM subs, and for that reason, Disney+’s ARPU is about 15% lower than without Hotstar. Throw in Disney’s concession that 30-40% of its 2024 subscriber base is going to be from India, and Hotstar creates downward pressure on 30-40% of Disney+’s revenues.

Also, Disney’s competition in India are Amazon Prime Video (Rs. 129 or $1.75 per month) and Netflix (Rs.199 or $2.70 for mobile phones, only, and the next tier up at Rs. 500 or $6.99 per month). Disney’s annual plan for Disney+Hotstar at Rs. 1499/$20 per year/$1.69 per month keeps it competitive, but a ~70% discount to its monthly price of Rs. 399/$5.40. Disney will scale in India, but at a significant cost to its top line revenues for Disney+ and with significant ongoing downward pricing pressure from its competitors.

In other words, the vision for Disney+ has changed because strategic, operational constraints have emerged within Disney around executive planning and decision making, and those constraints are being primarily driven by the downward pricing pressure of Disney+’s success in India.

The vision for Disney+ at Investor Day 2019 was ambitious, and one year later, Disney has far exceeded everyone’s expectations, including its own. But, DTCI is still a loss leader (a loss of almost $600MM in operating income in Q3, alone). Looking ahead, Disney seems much more focused on building a streaming business that drives operating income and higher ARPU. In other words, the visionaries (Iger, Mayer) have been replaced by fiduciaries (CEO Bob Chapek, Chairman of Media & Entertainment Kareem Daniel) at Disney.