Mic Drop #11: A 2021 discovery+ prediction comes true, already

It's about Product Channel Fit; also, Quibi-like vibes from discovery+

I connect the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. Here, I will be highlighting and celebrating “mic drops” on my predictions from past PARQOR Member mailings.

First, I published PARQOR's "Learnings from OTT streaming in 2020, Predictions for 2021" presentation just before the holidays. If you haven’t seen it yet, you can view the PDF here, or the SlideShare here.

The Lessons and Predictions leverage four analytical frameworks from Member Mailings over the past year. The four frameworks focus on the incentives and psychology of executives and businesses across the OTT streaming marketplace - from incumbents to visionary disruptors to investors.

Second, discovery+ launched on Monday, and 72 hours later it is down from #9 to #42 on iOS App Store top charts (it went as low as #48 last night). By comparison, Netflix is at 13, Hulu is at 17, Disney+ is at 23, and HBO Max is at 29.

Why isn’t it performing better? Because discovery+ launched without Product Channel Fit.

Discovery’s Challenge with Product Channel Fit

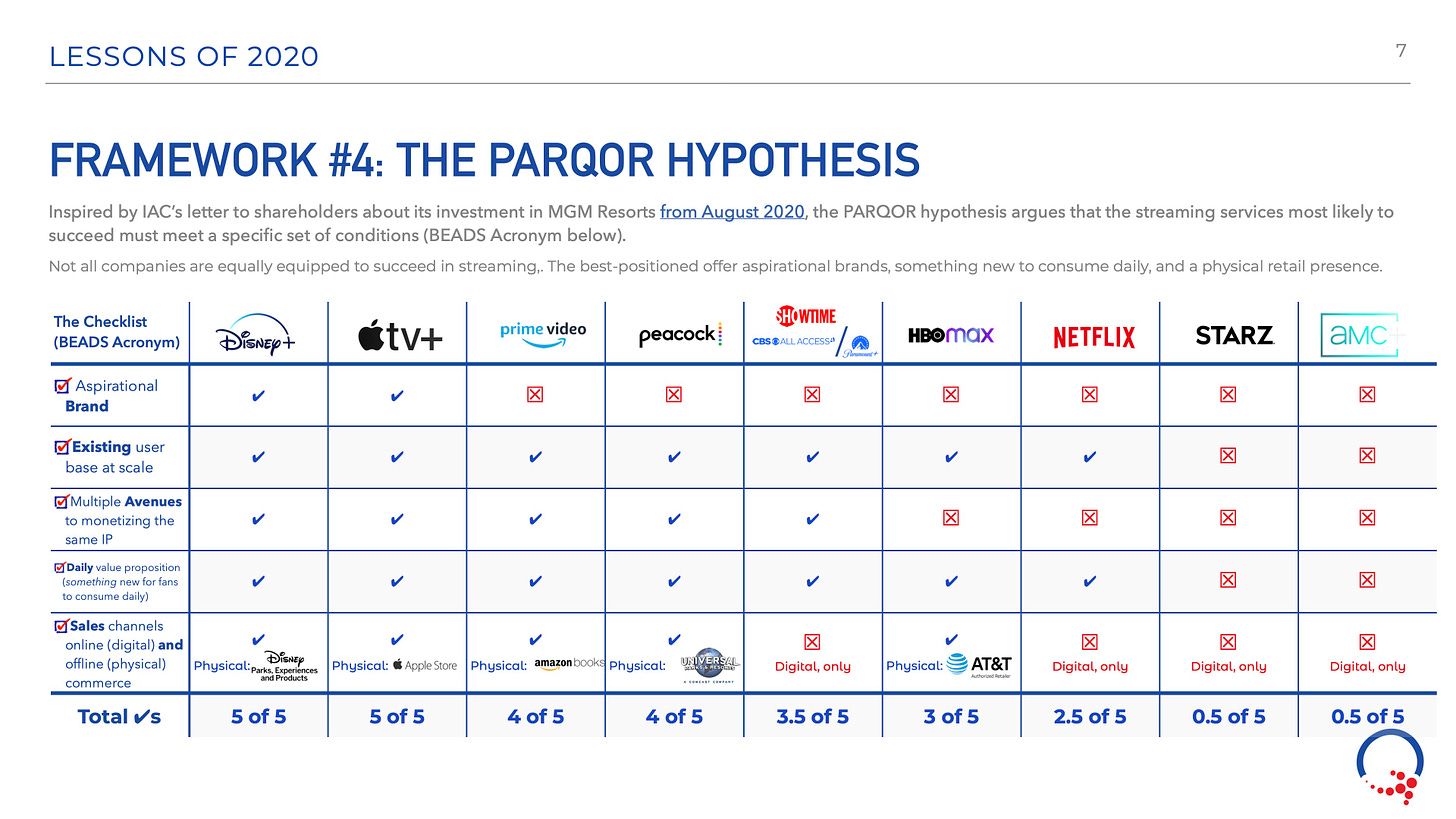

In the the Learnings and Predictions presentation, I am generally bearish on discovery+. I wrote “there is a compelling unscripted-only streaming business to be built with Discovery’s IP, but not with discovery+ as is.”

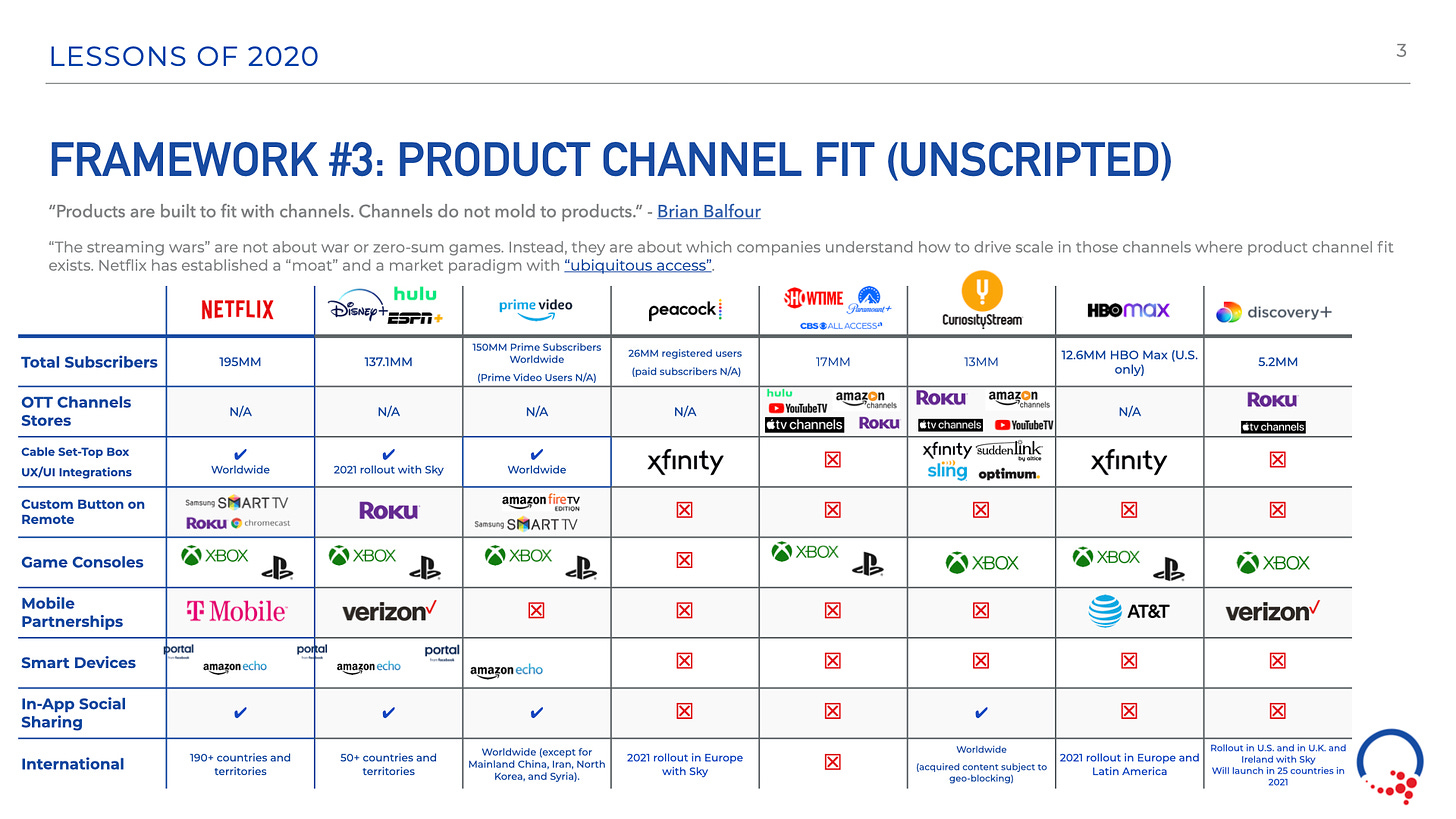

For PARQOR Members this week, I wrote about how discovery+ and CuriosityStream offer two very different lenses (subscription required) on the opportunity for unscripted in OTT. I included the slide above, which is an updated version of slide from the Learnings and Predictions presentation.

What we can see above is how heavily CuriosityStream has relied on OTT Channels Stores and multiyear, third-party partnerships for global distribution, and especially in the U.S. Its closest analogue in strategy is ViacomCBS, though CuriosityStream relies on cable set-top box partnerships whereas ViacomCBS does not, limited by its reliance on affiliate revenues from MVPDs (40% of Q3 revenues and 34% of Adjusted OIBDA).

To date, Discovery has relied heavily on Amazon for its streaming strategy. With the launch of discovery+, we see Discovery taking a very different approach to product channel fit, relying on Verizon for a third-party distribution partnership in the U.S., Sky in the U.K. and Ireland, but otherwise narrowly focusing on getting the app in app stores. Discovery is nakedly imitating the Disney+ strategy across the board (but without In-App Social Sharing or Smart Devices, yet).

In short, Discovery seems to have focused on getting discovery+ out to its target customers, but without a clear definition of what its target audiences want on streaming from Discovery. All of its distribution partnerships were announced on Monday, suggesting there is a lot of work to be done on product channel fit.

“Products are built to fit with channels. Channels do not mold to products.” - Brian Balfour

The quick drop in iOS store downloads reflects that discovery+ does not yet “fit” into iOS as a channel for 1B iOS devices worldwide, even with the strength of its partnership with Verizon (which delivered 20% of Disney+’s 26MM sign-ups in Q4 2019).

In fact, other than on Amazon, it’s not yet clear where discovery+ will find Product Channel fit.

Getting Quibi-type Vibes from discovery+

My biggest issue with discovery+’s strategy is this, as I wrote on Monday:

“discovery+ reflects a bet that the limitations of the OTT model can be bulldozed with the power of TV personalities and globally known linear TV brands.”

But, when thinking about Product Channel fit, the most successful strategies outside of Netflix have either been IP-focused (Disney) or Genre-focused (AMC, STARZ).

discovery+ falls into neither bucket.

Quibi made a similar mistake, banking on the power of Hollywood celebrity and globally known linear TV brands to “bulldoze” its way into the OTT streaming marketplace.

discovery+’s Best Bet May Be Roku

Today, Quibi announced it is selling more than 75 short form shows to Roku to be run on The Roku Channel.

What advantage does Roku have over Quibi? Product market fit with 51.2MM active accounts and the ability to drive product channel fit for Quibi content on The Roku Channel. Quibi achieved neither in less than a year on the market.

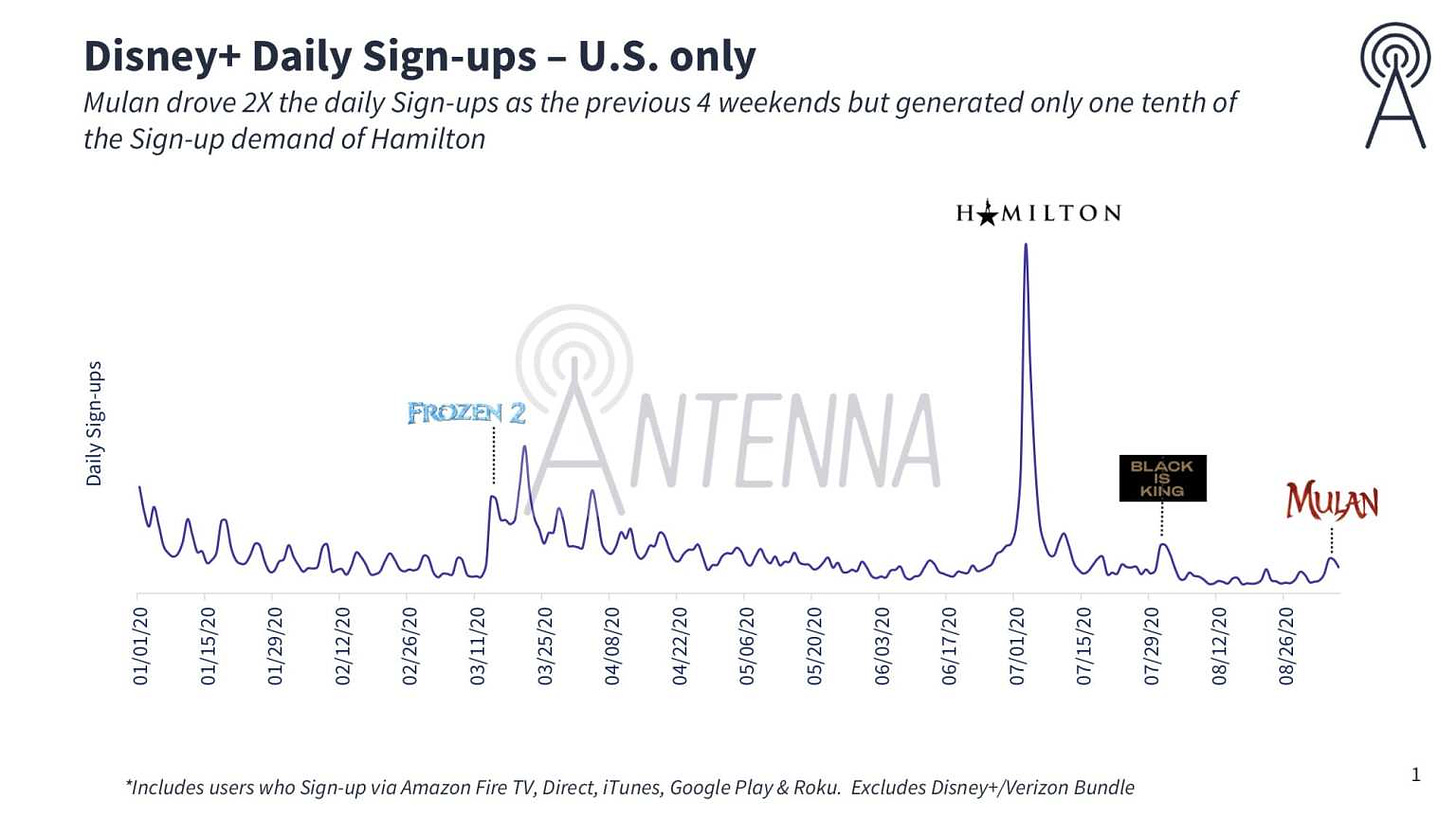

I wrote about Roku’s Q2 Letter to Shareholders back in September, and the significance of its 20% rev share relationship with partners like Disney+ and Starz:

[Roku’s] rev share means that their revenues grow as a channel as the app’s subscriber base grows, creating channel-market fit. For Disney+, it was crucial to driving subscribers who CEO Bob Chapek described as “a different target audience, a different demographic than what we normally get”. And, they came at scale, according to subscription metrics firm Antenna:

So, according to both Roku and an independent third party measurement service, Disney found product-channel fit in Roku with Hamilton, and Starz and Showtime also found product-channel fit in Q2. But notably, Roku does not highlight more success stories than those three.

This means, discovery+ needs to find product channel fit on Roku to succeed; or else, it faces a future like Quibi where its content is better served, and will reach its target audiences, via The Roku Channel.

This points to an important, open question for discovery+ that mirrors the challenge Quibi faced with YouTube and TikTok as competitors, as I wrote in September:

…at what point does Discovery talent look at a Discovery SVOD service operating at a fraction of the scale of Netflix and Disney, and begin to monetize their talent elsewhere? At what point do they realize that an affiliate link on a YouTube Channel or Instagram profile may drive more engagement and revenue than an old or new episode of a show they produced for a Discovery-owned channel?

I think we will see signs of that in 2021. It is becoming easier for talent to drive affiliate sales and views on digital and social channels than it is for Discovery to drive views within a yet-to-be-launched streaming app. These affiliate and commerce dollars are increasingly available, and the rapid success of platforms like TikTok or Instagram's Reels tells us that talent can find scale elsewhere, and quickly. All they need is a production model that makes sense for them and their audiences (not easy).