Mic Drop #14: HBO Max Had More Wins in Retail Than Wholesale in Q4

But, because AT&T’s subscriber math is messy, did it really?

I connect the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. Here, I will be highlighting and celebrating “mic drops” on my predictions from past PARQOR Member mailings.

I published PARQOR's "Learnings from OTT streaming in 2020, Predictions for 2021" presentation just before the holidays. If you haven’t seen it yet, you can view the PDF here, or the SlideShare here.

In the spirit of the name of this Substack, “Landing & Rolling”, this week’s post will be the essay equivalent of an ugly landing in Parkour.

(Yes, it’s a Peacock GIF… no gif sums up a good jump and an ugly landing better… moving along).

Last July, I asked “Does AT&T Need To Rethink Its Conversion Funnels for HBO Max?” In that Member Mailing (download for free, with code SUBSTACK)

…can Jason Kilar succeed within this dysfunctional marketing ecosystem Stankey has created across AT&T?

There seems to be more wins to be had in the Retail side of the business than in Wholesale. Meaning, at this moment third-party partners may be more reliable sources of traffic than AT&T-owned businesses. Kilar's division has already outperformed wholesale by 3x with 3MM retail subscribers to 1.165MM wholesale subscribers activating their HBO Max service. Interestingly, according to The Information's report on Kilar earlier this month, Kilar made a big hire by poaching Brad Wilson from Disney, a former marketing executive at LendingTree who most recently spent five months working on marketing for Disney+, to manage HBO Max marketing.

AT&T’s Q4 2020 earnings, announced earlier this week. confirmed that HBO Max has indeed been finding wins on the retail side.

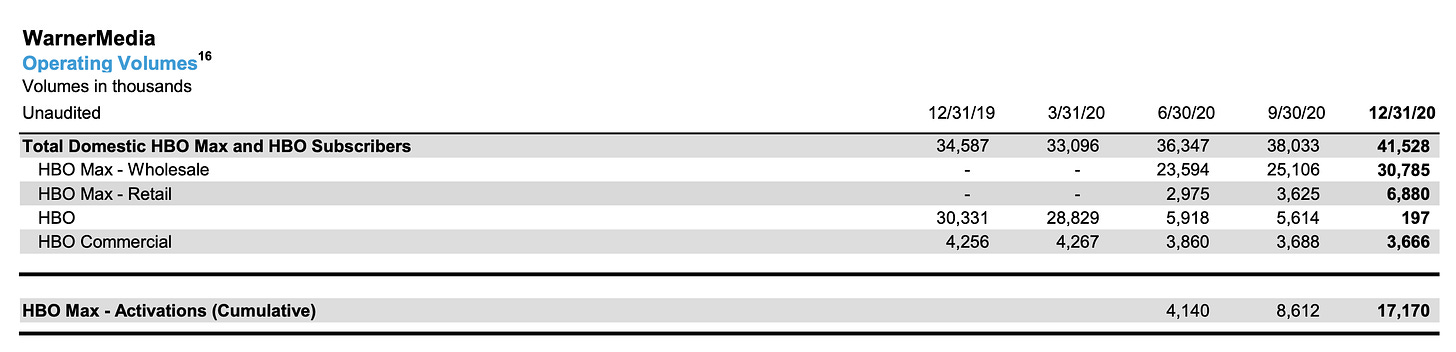

There have been 17.1MM cumulative activations of HBO Max - both retail and wholesale - since his arrival at WarnerMedia in Q2:

6.9MM have been Retail Activations, and

10.3MM Wholesale Activations.

So, at first glance, Wholesale activations have outperformed Retail activations by 50%.

But, diving into the numbers Retail has actually outperformed Wholesale. Why? Because AT&T’s subscriber math is messy, my prediction is right, but also messy.

Can Jason Kilar succeed in the AT&T ecosystem?

Yes.

There have been 17.2MM cumulative activations of HBO Max - both retail and wholesale - since his arrival at WarnerMedia in Q2. And, more importantly, Kilar’s team directly oversees marketing for Retail, which has grown by 7MM since Q2. Even 70% of what Disney+ accomplished in its first month (!), HBO Max Retail is growing.

Prediction: There are more wins to be had in Retail side than in Wholesale

AT&T’s math for how they define a subscriber is messy.

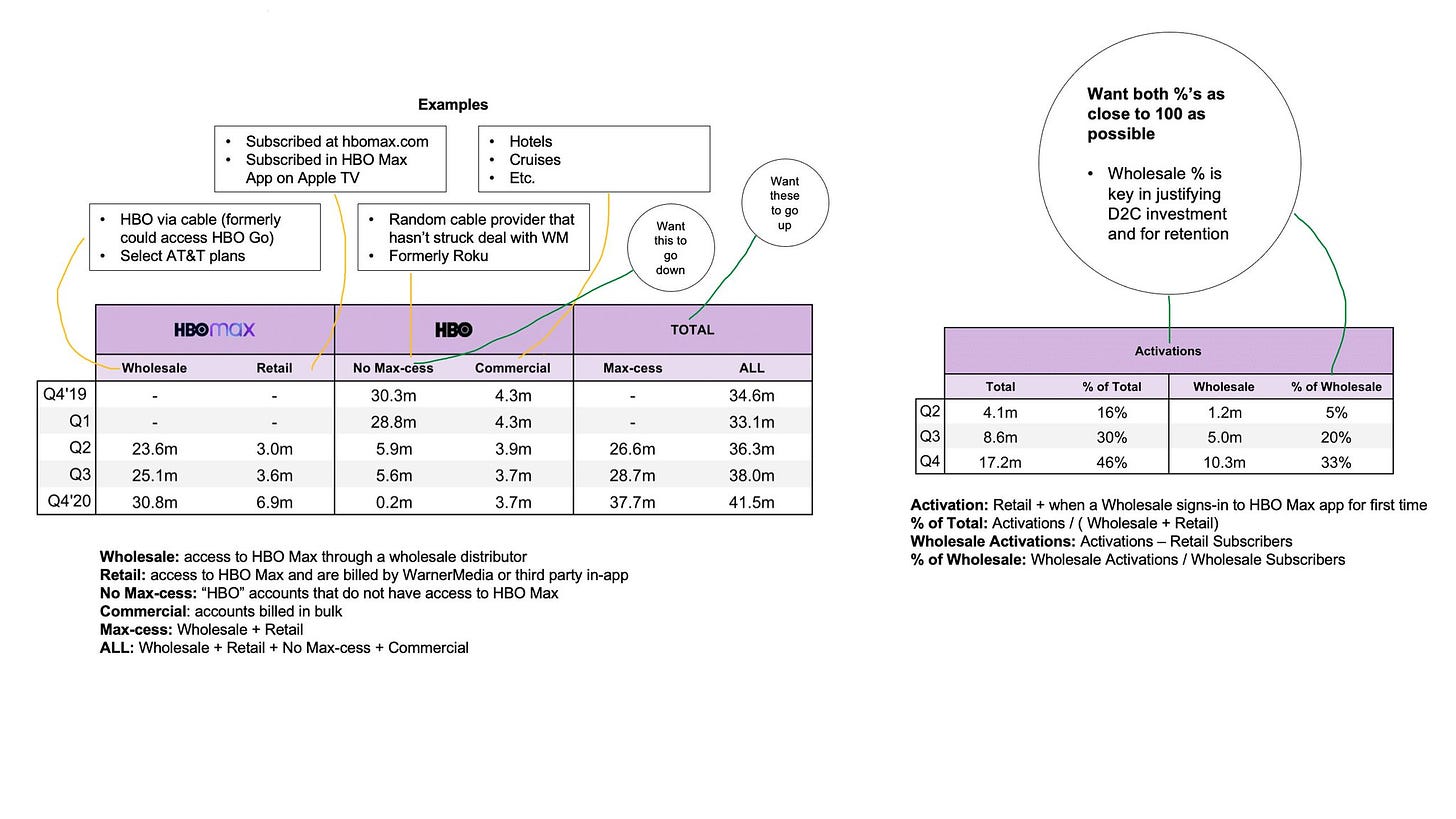

A good, helpful visual explainer of the complexity comes from Brendan Brady of ANTENNA Research:

The point he makes here is, before pre-Roku and Amazon Prime Video deals in Q4, there were 5.6MM HBO-only domestic subscribers who had no access to HBO Max, or “No Max-cess”, in Q3. At the end of Q4, that number went down to 197,000.

So where did these 5.4MM subscribers go? Let’s look at Wholesale and Retail growth:

Wholesale grew by 5.6MM subscribers to 30.8MM in Q4, and

Retail grew by 3.3MM to 6.9MM in Q4

Which means one of two things:

Wholesale grew by 5.4MM plus an additional 200K via AT&T or MVPDs, OR

Retail grew by some percentage of Roku and Amazon Prime subscribers plus DTC marketing

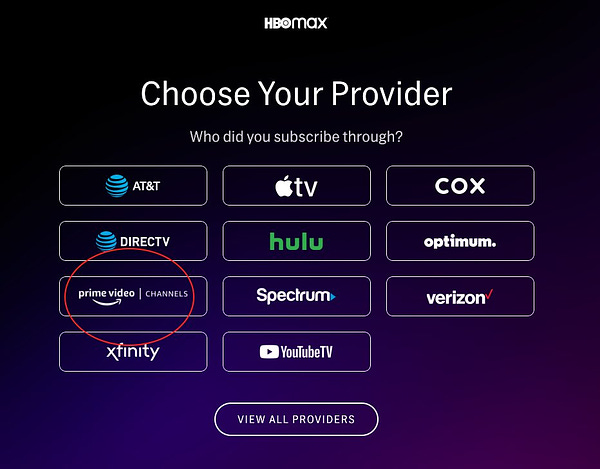

The first is a great story about Wholesale that implies AT&T does not treat Roku or Amazon Prime customers as Retail, which would be surprising because they are DTC but not illogical because they are both third-party “hubs”.

The second would be a bright red flag 🚩 of a story for HBO Max. In Q3, there were 3.6MM Retail Subscribers from retail marketing efforts. In Q4, that nearly doubled by 3.3MM to 6.9MM Retail Subscribers.

3.3MM is a net number that would reflect less-than successful DTC efforts mixed with a small percentage of Roku and Amazon Prime Video subscribers signing up to HBO Max

It is completely reasonable to imagine 3.3MM, or 61%, of Roku and Amazon Prime HBO subscribers signing into HBO Max in Q4.

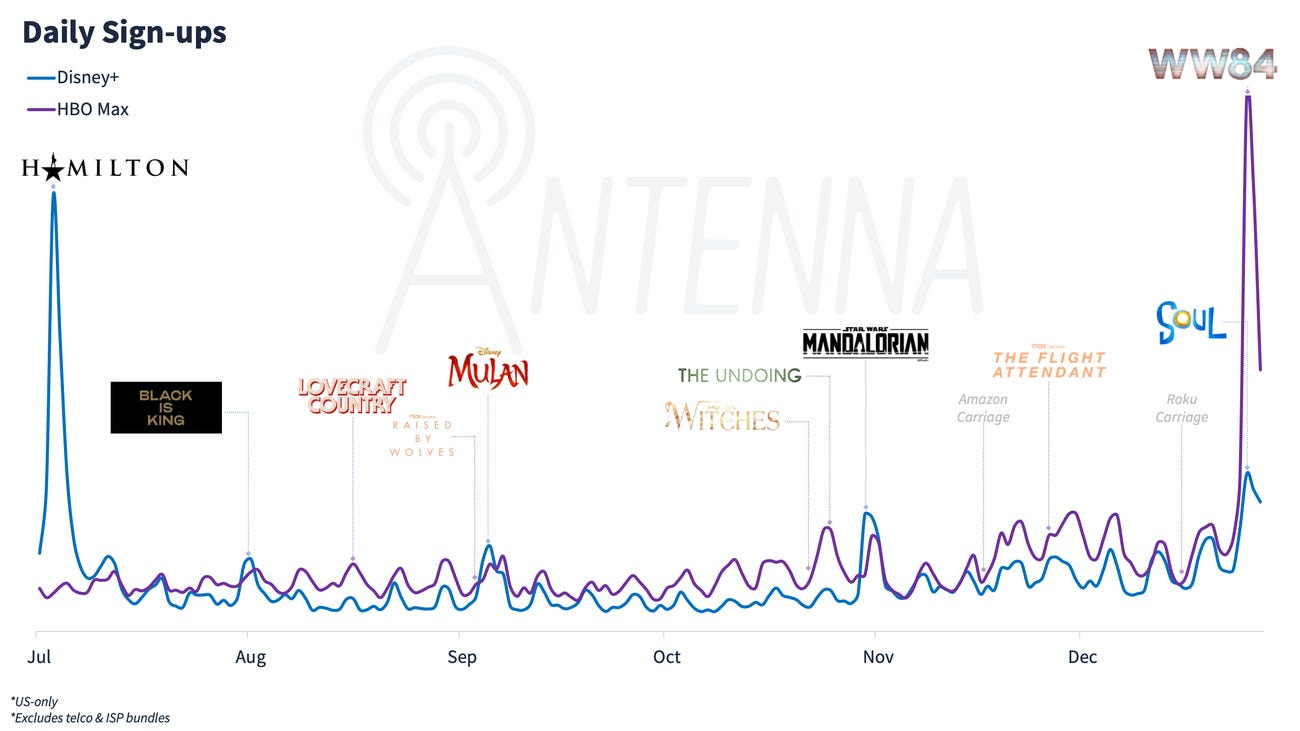

But, it seems completely unrealistic that 100% of HBO Max’s Retail subscribers in Q4 would be from those deals, or that Retail DTC conversions would effectively decrease to zero in the same quarter that Wonder Woman 1984 was getting millions of subscriber gains, as tracked by third-parties like ANTENNA.

So, wait, were there more wins in Retail side than in Wholesale?

The short answer is, yes, but the longer answer is, ugh, AT&T’s math is so messy here.

AT&T is treating all Roku and Amazon subscribers as Wholesale, so 5.4MM of the 5.6MM in growth in Wholesale subscribers are an accounting change.

Turning back to HBO Max Quarterly growth, the numbers are actually:

Net Wholesale subscriber growth of 200K, minus 5.4MM Amazon and Roku additions via accounting (and assuming some churn),

Net Retail growth of 3.1MM

3.1MM is 15.5x the 200K Net Wholesale subscribers HBO Max added in Q4.

So, Retail nominally outperformed Wholesale by 15x?

Yes, but (ugh), it depends on how AT&T is defining Wholesale subscribers.

Wholesale grew more than Retail if we include Roku and Amazon as “growth” in Wholesale subscribers, but

Retail grew more than Wholesale if we exclude Roku and Amazon as “growth” in Wholesale subscribers

In the latter case, Retail outperformed Wholesale in driving new HBO Max Subs by 15x.

But what about Activations?

The only lens where Wholesale nominally outperforms Retail is in Activations:

10.3MM activations in Wholesale in Q4, which is any customer of an MVPD, vMVPD, AT&T (wireless, broadband, or video), Amazon Prime Video, or Roku signing into their HBO Max account

3.3MM activations in Retail in Q4, which is any DTC customer HBO Max acquired directly, billed directly by WarnerMedia or by a third party via in-app purchase.

This reflects the success of AT&T’s efforts to market to a built-in base of 35MM existing HBO Subscribers, 182MM Mobility subscribers, 17MM Video Subscribers, and 14.1MM broadband subscribers.

But, Quarter over Quarter, Retail appears to be outperforming Wholesale as a driver of new customers for HBO Max.

WarnerMedia CEO Jason Kilar is succeeding in the AT&T ecosystem. But even if AT&T’s marketing ecosystem seems less dysfunctional now, the math logic of its subscriber count is a mess.

So, this is not a Mic Drop, but rather a Landing and a Rolling….

(Feel free to share this free newsletter to any and everyone you want. It helps spread the word.)

(If this email was forwarded to you, I am a former Viacom executive who connects the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. You can follow me on Twitter, where I often have fun exchanges with other folks interested in the streaming business, or on LinkedIn, which seems to be a fantastic channel for sharing positivity, but less optimal channel for sharing content).