Mic Drop #15: STARZ's finds wins in the "Genre Wars"

Its results from Q3 Fiscal '21 is an impressive success story built around narrow, audience and genre-focused bets

I connect the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. Here, I will be highlighting and celebrating “mic drops” on my predictions from past PARQOR Member mailings.

I published PARQOR's "Learnings from OTT streaming in 2020, Predictions for 2021" presentation just before the holidays. If you haven’t seen it yet, you can view the PDF here, or the SlideShare here.

This week, I am dropping the mic on my “Genre Wars” read of the marketplace.

…one way to think about product channel fit in streaming is to think of the “streaming wars” more as ‘the genre wars”, which are more like focused, zero-sum conflicts around specific content genres than broader head-to-head, zero-sum conflicts between platforms for the same audience.

Why? Because STARZ just had another great quarter in OTT with its emphasis on genre and demographic-targeted content:

We've been converting and scaling Starz into a modern data-driven global subscription leader that has become the first traditional service to have more over-the-top and linear subscribers, a critical digital inflection point. By the end of next quarter, we expect streaming revenue to surpass traditional for the first time, as well.

Domestically, our programming for a broad spectrum of women and traditionally underserved audiences is differentiating us from our competitors, driving subscriber acquisition and retention, and setting new viewership records. New series P-Valley and Hightown, and the docu-series Seduced, are resonating with our audiences. Power Book II: Ghost set viewership and acquisition records in its first season, becoming the highest performing new series ever on Starz. With its initial season ending on a viewership high, we're bullish on the performance of future seasons, as well as upcoming installments of the Power franchise, Raising Canaan and Force.

We've established ourselves as the go-to premium service for grown-up audiences.

Yesterday, Lionsgate updated investors on the growth of its STARZ OTT service worldwide:

Media Networks quarterly revenue was $406 million and segment profit came in at $82 million driven largely by domestic OTT subscriber growth, as well as the strong performance of STARZ International as we continue to roll out in new markets and platforms.

Globally, including STARZPLAY Arabia, the company grew OTT subscribers 900,000 sequentially, or 7% as you could see in our trending schedules. Domestically, OTT subscribers increased 3% sequentially, while international OTT subscribers grew 26%. Total global Media Networks' OTT subscribers reached 14.6 million while MVPD [ph] subscribers stayed constant at 13.4 million for a total of 28 million subscribers. We now expect our previous guidance on Global Media Network OTT subscribers to exceed the top end of the 13 million to 15 million subscriber range by the end of the current fiscal year, approaching 50% plus growth year-over-year.

STARZ OTT is growing domestically and internationally, is exceeding guidance, and is profitable, despite operating at ~7% of the global scale of Netflix, or 17% of the scale of Disney+.

It is a growing and profitable streaming business - despite the relentless skepticism from the “streaming wars” lens suggesting it cannot win against Netflix, Apple, Amazon, or Disney.

But, it is winning by focusing on “a broad spectrum of women and traditionally underserved audiences”, and “driving subscriber acquisition and retention” with a data-driven model (NOTE: I wrote about STARZ and pause last March, free download with coupon SUBSTACK).

The success of STARZ’s bet on specific audiences and genre being defensible territory has been predicted by PARQOR’s Product Channel fit and “genre wars” frameworks, and is being confirmed by the data.

STARZ & Genre Wars

In my Member Mailing, “In Q3 2020 Earnings, Ecosystems and Genre Drive Scale for Streaming Services”, I wrote:

Both Starz and AMC+ are cases for a focus on genre being defensible territory and a good business to be in within the streaming marketplace.

AMC’s Shudder, which is part of the AMC+ bundle, is a helpful example of why genre is defensible territory in OTT streaming. As I wrote in November (?):

…Shudder is finding success with its focus horror year-round, and notably in October despite The Haunting of Bly Manor and Hubie Halloween being the number one show and number one movie on Netflix. Meaning, there are genres where the big streamers are simply willing to concede defeat except for the month where horror matters to broader audiences. For the rest of the year, horror is Shudder’s to own.

If Shudder is “the service you get if you want just horror, thriller and supernatural” STARZ has bet on Power winning African-American audiences, and content like Outlander to win over a “premium female audience”. Both AMC and STARZ leverage genre as a unique advantage to find and establish product channel fit.

We do not have AMC Networks’ results, yet, but we do have STARZ, and the economics of STARZ’s genre-focused model are compelling, as Allison Hoffman, President of Domestic Network at Lionsgate, told investors:

…we've got returning franchises like Power. I think we've got three installments of power coming next year. We've got Outlander coming next year. So, in terms of driving the business, in terms of subscriber acquisition and in terms of retention, we've got sort of that nice flow of flowing viewers from one show into the next as well as sort of adding and building viewership and building the subscriber base as we go. We're always -- as per Jeff's note about in terms of the data, we're really always driving to the lowest subscriber acquisition cost. And so that's really how we manage the business. We are managing the business, to have a really good return on our marketing investment and a really strong return on our content investment as well.

STARZ has found a legacy media model where a focus on genre and target audiences can find those audiences at scale, at higher lifetime value, at lower churn rates, and at a profit.

Product Channel Fit

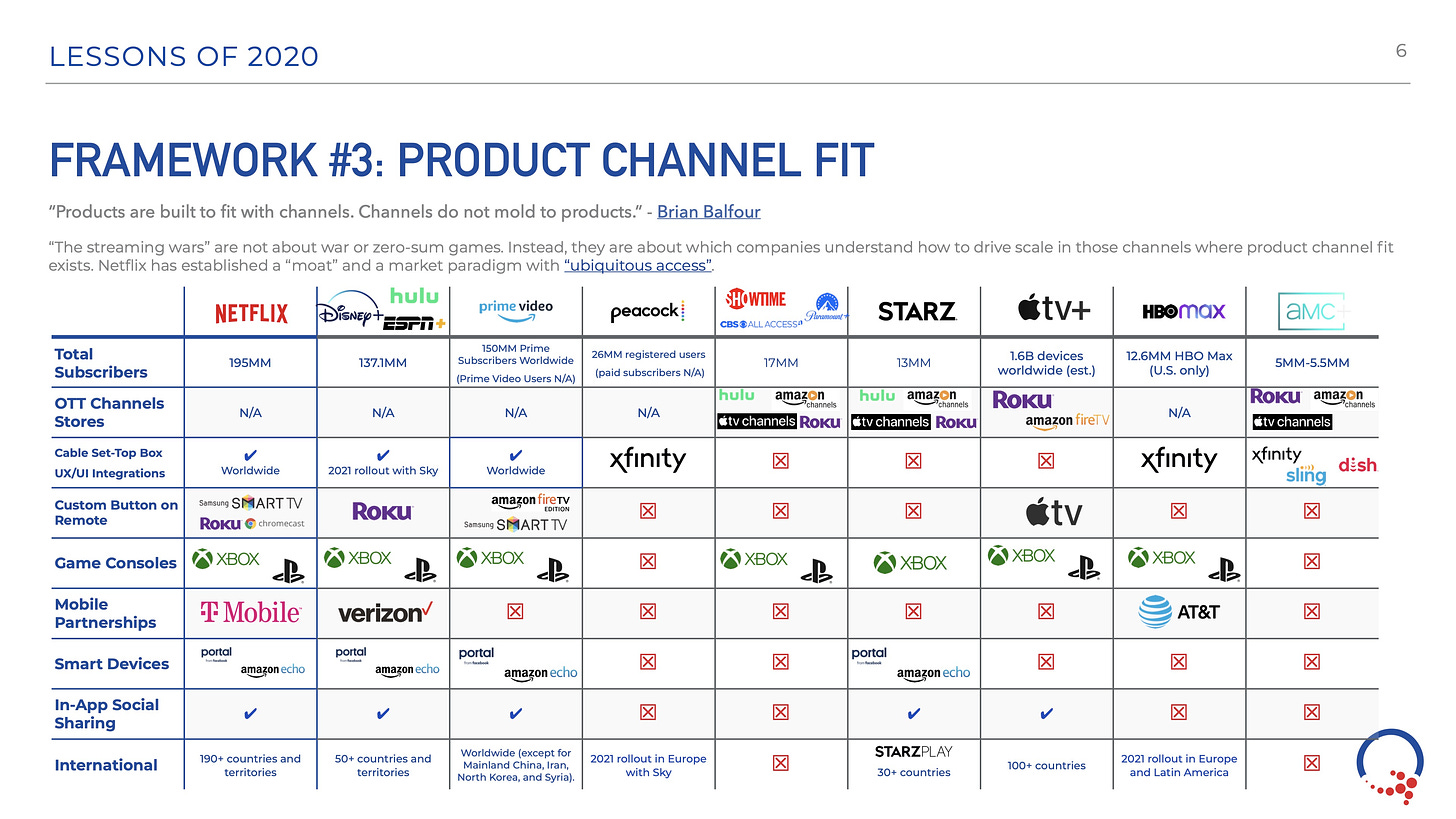

The most interesting element of STARZ’s strategy (and AMC’s) is that it relies most heavily on Product Channel Fit with OTT Channels stores, as you can see in the slide from PARQOR’s Lessons of 2020, below.

What that means is, STARZ is willing to trade ~20% of subscriber revenues to grow its service on a platform like Amazon, Roku, or Apple TV Channels. Roku highlighted STARZ’s success on its platform last Q2:

In Q2, the most-used subscription services on the Roku platform grew quickly, with key services nearly doubling their aggregate streaming hours year-over-year. Roku was the No. 1 connected device based on hours streamed for Disney+ in the week following the release of Hamilton, according to Comscore, OTT Intelligence, July 2020. U.S. Premium Subscription services within The Roku Channel, such as Showtime and Starz, achieved significant subscription gains through extended free trial offers.

Roku’s logic is win-win: as STARZ grows, Roku’s platform revenues grow. STARZ”s focus on genre and target audiences has been a key differentiator in those wins because it facilitates Product Channel Fit.

STARZ vs. Netflix’s Bridgerton and the Romance Genre

Bridgerton and its 83MM households watching it worldwide should be the obvious counterexample: Netflix reinvigorated a genre (romance) that had “rarely made it onto the screen”. If Netflix can find product market fit for the Romance genre (which podcaster Gabriella Mirabelli argues was “ghettoized” by the book industry), why can’t it find product market fit for competitive titles to Power or Outlander at a similar price point to STARZ?

The short answer is, it does and doesn’t compete with STARZ.

It does in the broadest sense of the term: Netflix starts from a place of “ubiquitous access” in Product Channel Fit. Meaning, it has Product Channel fit in the broadest sense of the term. So any new content STARZ produces in a particular genre competes with both Netflix’s marketing muscle and any new and old content Netflix produces for women and “traditionally under-served audiences”.

Netflix doesn’t compete because Netflix and STARZ are making two very different bets on genre. When STARZ describes itself as a “go-to premium service for grown-up audiences”, it is narrowing its Total Addressable Audience to demographics who want a particular quality of content and who can afford it at a particular price point. In marketing terms, they have pre-defined the parameters of the audience who is most likely to pay and watch this content, and finds them by relying heavily on OTT Channels partners like Roku and Amazon.

My favorite quote from the earnings call on this point is from CEO Jon Feltheimer:

…the slate as we continue to increase the marketing and the spending on the domestic content, it has to work globally. So if you look at Girlfriend Experience, as a perfect example, that had been a domestic show, we had moved the storyline to London with a very international cast with a very international storyline. That should work all over the world. The Power franchise is one of the best performing shows in the UK and in France, and in some markets in LATAM.

STARZ’s bet on genre in the U.S. allows it to find international audiences, too, or to reimagine the genre so it can map to those audiences better (i.e., Girlfriend Experience).

By comparison, Netflix is less focused in its bets, both in terms of genre and in terms of target audience. Netflix starts with “ubiquitous access” as product channel fit for 200MM subscribers worldwide. So, when it bets on Bridgerton and heretofore under-served consumers of romance, it is relying on all available channels, both on-platform and off-platform, to find all likely audiences who might consume Bridgerton, both as romance genre or as a Shonda Rhimes show or simply as “a world into which members of all backgrounds and ages could escape”, as Jinny Howe, VP, Original Series blogged for Netflix.

In other words, Netflix’s bets on genre and target audiences are more complex than a head-to-head battle in a “genre war”. This allows the smaller services like STARZ and AMC and Shudder can find strategic and financial wins by being genre- and target-audience-focused. Notably, neither of the smaller services is betting on the Romance genre.

Netflix and STARZ are not engaged in “streaming wars”, they are engaged in infrequent “genre wars”. STARZ is proving genre to defensible territory and a good business to be in within the streaming marketplace.