Mic Drop #17: We know more about IMDb TV than Amazon Prime Video

More a "Mic Check" on my Prediction for IMDb TV in 2021, which picked up the right signals from the noise

On February 2, Amazon announced its results for Q4 2020. It offered three bullet points on both Amazon Prime Video’s Original movies and series and live sports streaming, from Q4, but nothing about its OTT advertising services or IMDb Tv.

On February 4, Amazon Advertising shared in a blog post that it now reaches 55MM+ monthly viewers of OTT content across IMDb TV, Twitch, Broadcast and network apps, and Live Sports, “almost tripling” its viewership from 20MM last year.

The title says “Mic Drop”, and I’m writing about my 2021 prediction for Amazon’s IMDb TV. But, my prediction hasn’t come true just yet (there is an entire fiscal year ahead of us, and four earnings reports and one annual report to come). So this is more of a “Mic Check”, or checking in on the status of my prediction.

I wrote that for Amazon:

IMDb TV will be the streaming growth story for Amazon, and not Prime Video. Amazon investor messaging will emphasize IMDb TV alongside Amazon’s rapidly growing ad business ~40% YoY).

It’s more that less than two months into 2021, my prediction is playing out as predicted… so far.

This initial bit of news confirms my instinct: Amazon is going to have a better story for IMDb TV with its OTT advertising data than Amazon Prime Video will have with its data in 2021.

The news also helped to flag a deeper questions:

Why do I believe this? and

What does it mean if we know more about Amazon OTT advertising than Prime Video in 2021?

Why Predict a Better Story for IMDb TV than Prime Video?

The first reason is, Amazon shares little about Prime Video. We know how many subscribers to Prime there are worldwide (~150MM), but we don’t know how many actually stream Amazon Prime Video regularly. I have read estimates as low as 35MM, and as high as 65MM.

In in its Q4 letter, it shared that “Amazon Original movie Borat Subsequent Moviefilm, starring Sacha Baron Cohen, generated tens of millions of customer streams globally on opening weekend.” According to Nielsen, Borat Subsequent Moviefilm generated 570MM minutes of viewing in the U.S. between October 19 and 25, or about 5.9MM views for a 96 minute movie (assuming everyone watched all the way through). But, Nielsen only measures TVs and not smartphones or tablets. Those two signals reveal little, too.

My Curse of the Mogul framework aside, a streaming service which does not share metrics is doing so because there likely are no good metrics story to share. In the case of Amazon, it values those Prime subscribers as regular shoppers more than as media consumers.

But we know that IMDb TV has a great story in terms of raw numbers for IMDb.com and Fire TV devices:

150MM downloads of the IMDb app,

250MM monthly unique visitors, and

50MM Fire TV devices

Unlike successful AVOD upstarts like Pluto TV (30MM+ registered users) or Tubi (33MM), which built their scale from the ground up, Amazon has an existing audience for the IMDb service for which to market a free, ad-supported service. It has also included IMDb TV content in a row on Amazon Prime Video, though Prime Video users have to scroll for it to reach it.

It also has great content, stemming from deals with Disney and AMC TV for titles like Mad Men, Lost, and Malcolm in the Middle.

Amazon’s closest competitor is Roku with its Roku Channel, reaching 51.2MM accounts. But, they are more engaged in co-opetition than competition (meaning, collaboration between business competitors with the objective of mutually beneficial results:

In a classic case of co-opetition, Roku inked a deal with Amazon to bring the IMDb TV free, ad-supported streaming service to the Roku platform in the U.S.

The IMDb TV service competes for viewers — and ad dollars — with the Roku Channel, a similar ad-supported VOD service. Under Roku’s standard distribution agreements, it takes 30% of ad inventory on partner channels but the terms of the deal with Amazon for IMDb TV were not disclosed.

The deal will dramatically expand IMDb TV’s reach….

IMDb TV launches with scale, and has an extraordinary Total Addressable Market to reach worldwide. Compared to other AVODS, IMDb TV is launching with a head start.

Let’s not forget about Amazon Advertising…

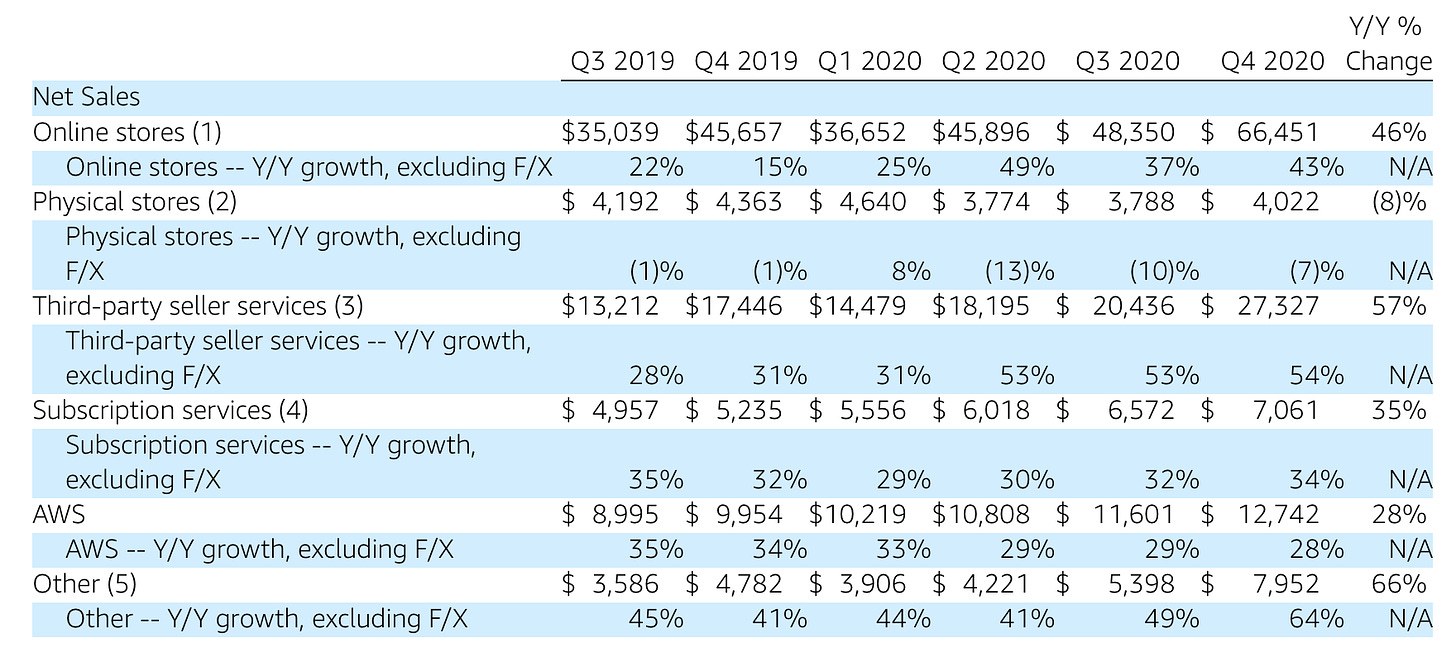

Amazon reports its Advertising division as “other” under Net Sales, which primarily reflects advertising sales but it also includes sales related to other service offerings.

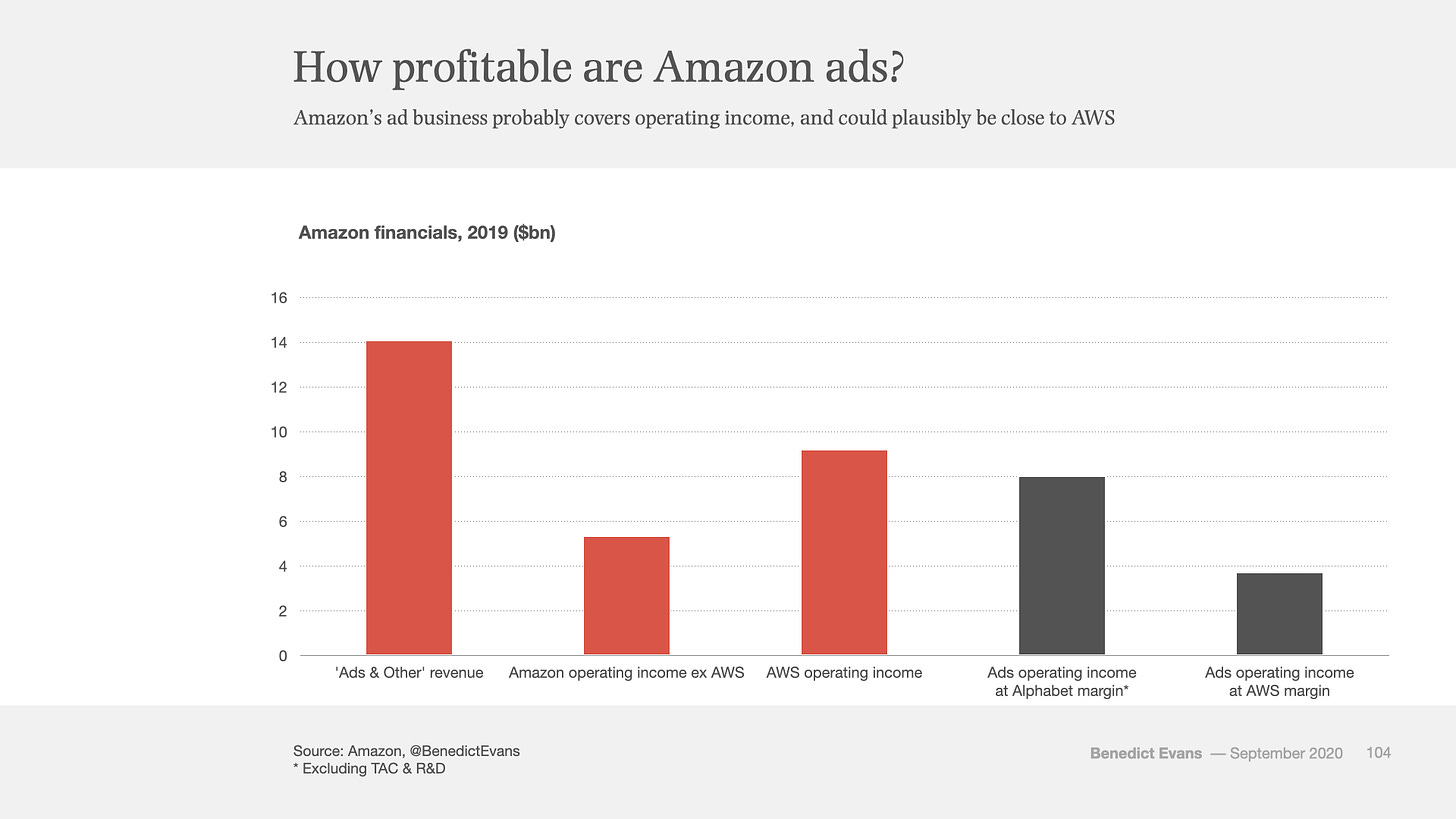

It has grown 66% Year-over Year, from $4.78B to $7.95B. As Benedict Evans has pointed out, Amazon is run for cash, not net income, so presumably Advertising is a highly profitable business outside of AWS (chart below).

The Amazon Advertising blog post announcing the new reach of 55MM+ monthly viewers of OTT content emphasized a couple of key drivers of growth:

Amazon’s first-party insights to understand viewers based on streaming activities and shopping signals across Amazon, including apps and devices

tools like includes OTT Studio, which enables Amazon DSP advertisers to customize their existing video creatives with Amazon shopping elements such as product details, star ratings, and Prime eligibility

So, the other reason to be bullish on IMDb TV is that it leverages video advertising built around Amazon’s first-party data and it offers bells-and-whistles like OTT Studio to make the ads more interactive and therefore valuable to Amazon viewers. IMDb TV objectively reads like a natural fit, and powerful engine for Amazon Advertising’s ambitions given its scale and its value proposition of free content.

What does it mean if we know more about Amazon OTT advertising than Prime Video in 2021?

There is an obvious answer to this question: Amazon Advertising is a growth story outside of AWS that may be as profitable. It is a competitor to Roku’s $470MM in Platform revenues (advertising plus share of subscription fees), and quickly emerging to compete with Google and Facebook in the digital advertising space.

We will know more about Amazon Advertising, and specifically OTT advertising, because investors like a growth story, and both Amazon Advertising and ad-supported OTT consumption on Amazon are growing.

But why won’t we know much about Amazon Prime? This question is really about Kremlinology, or Amazon-ology, of the broader vision of Amazon Prime Video under Jeff Bezos and soon-to-be CEO Andy Jassy. Again, we don’t have much info, only that Jassy appears to be more of a sports fan than Bezos. JohnWallStreet of Sportico speculated about Jassy:

With a sports-minded chief executive set to take over, it’s reasonable to wonder if the e-commerce giant is finally on the precipice of acquiring a full slate of exclusive, elite, tier-one rights.

I think a helpful way of describing the strategy for Amazon Prime Video is, "what is the best possible service for Amazon Prime subscribers that also wins Amazon awards?"

Amazon Prime Video is a high-quality service for its users, despite reasonable complaints that “its UI sucks”, as Rick Ellis wrote in his Too Much TV Newsletter in December. It offers Golden Globe and Emmy Award-winning content. These are good reasons to use the Prime Video service, and give Amazon credibility and weight in Hollywood, Bollywood (more recently), and the broader entertainment industry (though one Anonymous Amazonian cheekily described Prime Video “a loss leader for Jeff’s sex life.”)

With that lens, something like live sports doesn’t make Amazon Prime Video the best place to consume live sports. But, it does make Amazon Prime Video the best place to consume live sports for those Amazon subscribers who are fans of those sports (Cricket, Rugby, and the NFL were all highlighted in the Q4 earnings release). In other words, Amazon uses sports rights as a means of attracting and engaging Prime members.

That is a story about product channel fit, which may be the best framework for thinking through Prime Video vs. IMDb TV in the broader streaming marketplace:

Amazon Prime Video is focused on the genres of content and sports verticals which outperform within the Amazon Prime Video ecosystem, while

IMDb TV is focused on about monetizing an enormous existing user base at scale, across platforms and devices, with a growing, evolving, and increasingly sophisticated ad business.

Investors love that second story, and as I argued in November, the “streaming multiple” cares less for the product channel fit argument.

So to summarize, IMDb TV in 2021 is…

But Prime Video in 2021 is…