Mic Drop #37: discovery+ vs. Creator Economy

A digital-first launch of Magnolia Network *should* help discovery+ grow. But the Gaines' direct-to-consumer relationships are more offline than online.

There has been a somewhat subdued publicity push for yesterday’s launch of Magnolia Network, including this long profile of Chip and Joanna Gaines in The Hollywood Reporter.

The whole article is worth a read. The question I had after reading it was best said by Chip Gaines, himself:

“We couldn’t have chosen a worse time to have done this,” Chip acknowledges, almost amused, comparing their decision to launch a cable network in 2021 with a housing development that nearly bankrupted them when the bubble burst more than a decade ago.

He’s not wrong. Even Chairman of ESPN and Disney sports content Jimmy Pitaro told Variety yesterday that cord-cutting trends are at the point where “I honestly cannot tell you where I think the traditional side of our business will level off.”

His worry reflects both the business logic of a prediction I made in my Lessons from 2020, Predictions for 2021 presentation, and a repeated red flag I’ve highlighted for Discovery’s streaming strategy.

First, my prediction was:

At least two high-profile Discovery cooking talents will make Substack-esque moves towards monetizing their brand outside of the Discovery ecosystem.

Second, I have often red-flagged how Discovery Chairman David Zaslav has shown no signs of aspiring to build more consumer-centric ecosystems for streaming.

This was best reflected in this excerpt from The Information about Zaslav’s dynamic with former Global Direct-to-Consumer unit head Peter Faricy:

The two differed over how much autonomy Faricy would have as well as how fast new streaming services should grow and how much priority to give to big distribution deals with cable firms and other companies, say people with knowledge of the situation.

I think both the prediction and the red flag shed light on how the launch of the Magnolia Network’s launch neglects both discovery+’s need to grow, and direct-to-consumer (DTC) relationships with fans of the Gaineses who are increasingly accustomed to creator economy-type DTC relationships.

An offline creator economy in Waco

CB Insights has a good description of the creator economy:

The creator economy refers to the numerous businesses built by independent creators, from vloggers to influencers to writers, to monetize themselves, their skills, or their creations. It also encompasses the companies serving these creators, from content creation tools to analytics platforms.

The Gaineses already have taken advantage of the creator economy offline:

…the Gaineses draw devotees with the 5-acre Magnolia Market shopping complex, the Magnolia Press coffee shop, the Silos Baking Co. bakery and, yes, Magnolia Table, all under the Magnolia umbrella. Thanks to the married home-renovation team who catapulted to fame in 2013, Waco now rivals The Alamo as the state’s top tourist destination. Nearly 2 million annual pre-COVID visitors are expected to return now that the pandemic is in retreat.

David Zaslav offered the money quote on this point:

“People tell me, ‘You don’t have The Mandalorian or The Morning Show,’ ” Zaslav says, alluding to his almost exclusively unscripted portfolio. “But The Morning Show hasn’t been on the cover of People 20 times in the last four years. The Morning Show doesn’t sell a million cookbooks. There’s a big underestimation of this kind of connection to the audience.”

So, the Gaineses offline business seems already substantial (2MM annual visitors!), suggesting that building out online DTC, creator economy-type relationships is a nice-to-have-but-not-a-pain-point for the Gaineses.

My prediction was more focused on online: Substack or Patreon or Gumroad or any of these emerging Creator Economy platforms could enable the Gaineses to build a direct-to-consumer relationship from the 18.2MM collective Instagram followers, alone, and monetize them in new ways way online.

But online is the pain point for discovery+, which needs scale badly enough that it recently merged with WarnerMedia.

Too many clicks for the consumer

The simplest advantage of the creator economy is that it puts a digital transaction one-click away from consumers anywhere the creator is online. So, in theory, the logic is if you want more content from the Gaineses, signing up for discovery+ to watch their content should be one click away.

That is how Netflix markets its service.

But looking at Magnolia.com, Discovery seems to be selling The Magnolia Network as a brand more than the Gaineses as a brand. It’s adding clicks where there don’t need to be clicks.

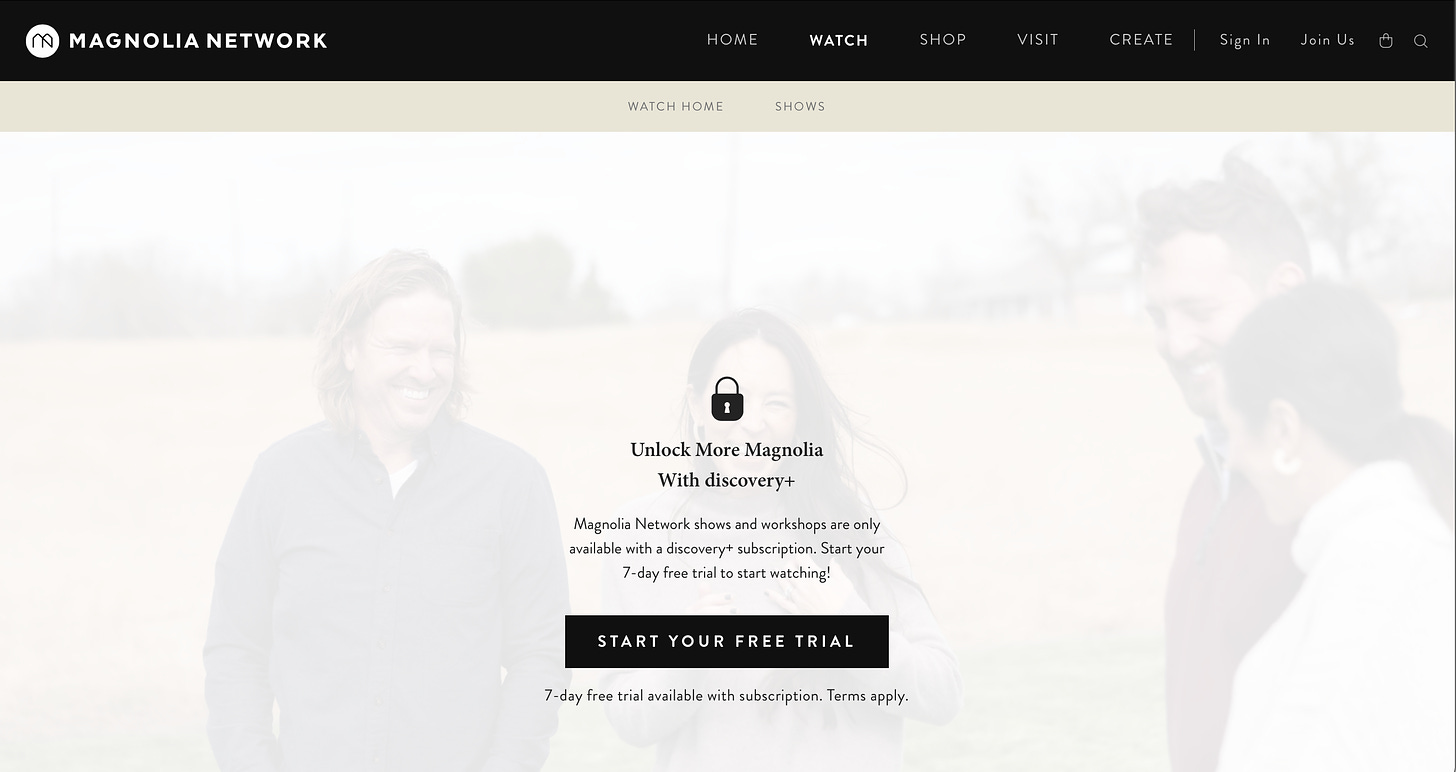

For example, users who want to watch the Gaineses on Magnolia.com (1) click on Watch, (2) then click the play button on a video, and (3) are taken to the page below that asks to click-thru to sign up for discovery+. That’s an unusually long conversion funnel.

Rather than give fans of the Gaineses what they want and what DTC enables - more content from the Gaineses immediately - Discovery’s DTC launch of Magnolia Network makes it unusually difficult for consumers to reach that content.

An Underestimation of the Connection to Audience?

Coming back to Zaslav’s quote, “There’s a big underestimation of this kind of connection to the audience.” It’s hard to argue with the connection to the Gaineses. The evidence is overwhelming - they are a powerful DIY brand.

But I wonder if Zaslav’s B2B-first approach has underestimated the connection of the audience to the Gaineses in a marketplace where near-frictionless relationships with content creators are growing in importance?

Everything can and should be one click away. For discovery+ to scale more it should be one-click away anywhere the Gaineses are as the only destination for Magnolia Network content. But, it isn’t.

Discovery’s B2B-focused strategy continues to underestimate the consumer to the detriment of its DTC plans. Questions about whether this is the right long-term strategy for discovery+, and for Warner Bros. Discovery, will only grow from here.