I connect the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. Here, I will be highlighting and celebrating “mic drops” on my predictions from past PARQOR Member mailings.

In the good old days of the pre-Monday AM Briefing version of the free PARQOR newsletter , I offered my predictions for 2019:

The new "Great Game": video streaming platforms are competing to conquer India by 2023

And in 2019, the opening moves and strategies in the digital video space in India will be *fascinating*

Netflix's bets on content in India met some cultural backlash in 2018. And, until Disney's acquisition of Fox, it had been Netflix and Amazon competing with competing with ad-supported on-demand services like YouTube and broadcaster-backed, direct-to-consumer video platforms. But, now that Disney owns Star India's Hotstar (the second-biggest video service in India by revenue, with a 23 percent market share), India has become a battleground for a ruthless competition where platforms *must* capture necessary international growth they cannot get in China (a competition with echoes to the 19th century "Great Game" between the Russian and the British empires in India) .

The prediction was based off of this Hollywood Reporter piece: “Netflix, Disney or Amazon: Who Wins the War for Streaming in India?”

How did I do?

Amazon’s Mirzapur vs Netflix’s Sacred Games

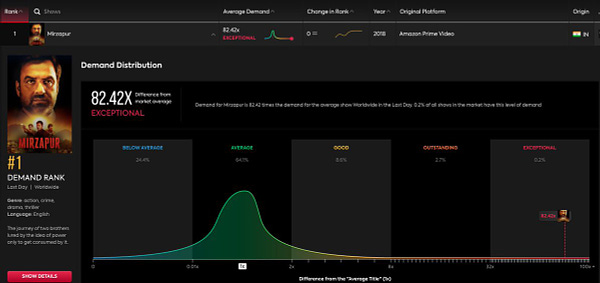

Amazon Prime Video recently released Season 2 of Mirzapur. The crime thriller has emerged as both a local hit and a bona fide global phenomenon among the ex-pat Indian community.

As the first tweet above says, Mirzapur is more popular than Netflix’s Spanish show La Casa de Papel. Netflix saw 65m households watch La Casa de Papel through its first 28 days.

But, Netflix has not seen similar volume for its crime thriller, Sacred Games, globally (second tweet above).

Why the Streaming Competition in India is Fascinating

The Hollywood Reporter piece described the scale of the marketplace opportunity:

India's online video audience reached 225 million in 2018, a figure that KPMG projects will double over the next five years to 550 million — a user base 67 percent larger than the entire population of the United States (where the number of online video users stands at 227.5 million).

Netflix and Amazon were originally presumed to be going head-to-head until Disney+ emerged as a competitor with its purchase of HotStar. Now, there are a quite a few variables at play:

(1) Pricing

According to The Hollywood Reporter piece:

Smartphone adoption has surged thanks to an influx of low-cost handsets from China. In 2016, India's richest tycoon, Mukesh Ambani, launched telecom major Reliance Jio with a $22.5 billion investment, which helped bring mobile broadband to the masses through marketing schemes offering rock-bottom data prices. The percentage of India's 1.3 billion population connected to high-speed internet by phone surged from 24 percent in 2017 to 36 percent this year — and it is expected to climb to 58 percent by 2023, according to MPA.

This means, the success of streaming apps in India is highly reliant on mobile downloads, and mobile downloads depend on pricing. Netflix launched with a high priced offering (499 Indian rupees or $6.69) but in 2020, has introduced a mobile-only plan at 199 Indian rupees ($2.70).

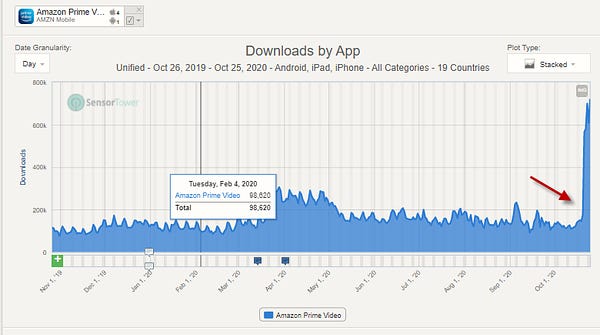

Amazon has bet on aggressive pricing (129 Indian rupees or $1.73/month). What makes Mirzapan interesting is that the show, more than the aggressive pricing, has driven downloads of Amazon Prime Video mobile app in India, and more broadly in Asia.

(2) Production Budgets & ROI

Netflix was willing to spend almost $15MM (in Rupees, Rs.100 Crore) on the production of Season 2 of Sacred Games (almost $2MM per episode). It also set aside $420MM last year to develop India-specific content. It is seeking to outspend the competition.

Amazon has a different plan: A Google Search surfaced this article which suggests Season 1 of Mirzapur was made at a cost of Rs 1-2 crore per episode, or $150-$300K.

This means Amazon is not only succeeding both in India and globally with Mirzapur, its ROI is exponentially better by implication. It also suggests that Netflix’s testing of lower priced plans are out of necessity, as the higher price has likely resulted in Netflix capping out at a fairly niche penetration.

(3) Total Addressable Market

Co-CEO Reed Hastings has been quoted as saying "the next 100 million [subscribers] for us is coming from India." The market opportunity is enormous:

About half of the nation’s 1.3 billion population is now online and the country’s on-demand video market is expected to grow to $5 billion in the next four years, according to Boston Consulting Group.

But there are two challenges for U.S.-based streamers seeking growth in India. First,:

…the propensity — or the capacity — of most of these internet users to pay for a subscription service remains significantly low. Most services operating in India today generate the majority of their revenue from ads. And others, which rely on a recurring model, are making major changes to their offerings in the nation.

And second, “Netflix competes with more than three dozen on-demand video streaming services in India.” Its biggest competitor is Disney-owned Hotstar, which has more than 300 million monthly active users, making it the biggest streaming platform in India.

(4) Disney Plus Hotstar

Despite Amazon’s pricing advantage, and despite Netflix’s production budget advantage, Disney Plus Hotstar has both a built-in scale advantage (8.5MM subscribers after launch) and existing content offerings that include Disney, Cricket (25 million people simultaneously watched a cricket match on Hotstar, a streaming record), and syndicated content from global networks and studios such as HBO and Showtime.

This suggests it will be harder for new entrants like Amazon Prime Video or Netflix to get wins in streaming against Disney Plus Hotstar’s built-in scale and library, but when they do get wins, those wins will be significant.

Why Mirzapur is Fascinating

This brings us back to Season 2 of Mirzapur, which was:

produced at a fraction of the cost,

released while Disney Plus Hotstar launched and scaled quick in India,

distributed on a streaming platform with one of the lowest prices in the marketplace,

and has become both a local and global hit, despite competing with three dozen services locally, and stronger streaming services globally.

Compared to Netflix’s Sacred Games, which has failed to capture a global audience despite Netflix having 30% more users than Amazon Prime Video (195MM to 150MM). In fact, according to Google Trends, Sacred Games has only done as well as the #10 most searched Netflix Original in one of the past six quarters.

What Mirzapur tells us is that Netflix’s big budget playbook may not deliver the next 100MM subs that Reed Hastings envisioned. It is now experimenting with mobile plans to find more reach.

But, Amazon Prime Video has figured out an entirely different calculus for capturing that audience. On top of that, elsewhere Amazon has been struggling with Prime Video - minus recent hit The Boys, there has been little else that has performed well for it domestically in the U.S., or globally. If there is anyone that should be winning in India, it’s Netflix.

Both companies are finding India to be a mirror universe for their efforts elsewhere in the world. That is fascinating.