I connect the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. Here, I will be highlighting and celebrating “mic drops” on my predictions from past PARQOR Member mailings.

This week, I revisit my prediction for Sinclair Broadcasting Group and its big bet on Regional Sports Networks (RSNs), which I wrote about in March (and revisited in June in a blog post).

If you are an existing PARQOR Member, you can download the PDF of my predictions from March on Sinclair for free, or if not, at the same link with the coupon code SUBSTACK (automatically appended to this link).

The Prediction

I wrote back in March [key prediction in bold]:

…RSNs' programming bundles live broadcasts alongside nostalgia. OTT enables the disaggregation of nostalgia from livestreaming, and can deliver it in an experience more tailored to passionate fans. Fox, NBCU, and ViacomCBS all building nostalgia-driven channels for their original content on their AVOD services. Peacock will offer channels like Pluto TV, and also hubs for its content with specially curated channels (e.g., sketches on SNL with Kristen Wiig in the SNL hub), which will be a deeper experience than what Pluto offers.

NBCU, Fox and ViacomCBS arguably are in a place to monetize sports nostalgia content over OTT better than RSNs or the teams who own the livestreaming rights. They have a better understanding of what advertisers want, are able to sell both national and programmatically targeted campaigns, which in turn results in higher CPMs, and with their AVOD services will be able to reach U.S. audiences at scale immediately. So, there is good reason to believe that as RSNs get phased out, their nostalgia programming will be aggregated and bundled into OTT services.

That leaves RSNs stuck with an old, expensive model that is on the brink of being disaggregated. In an effectively zero audiences, zero revenues, post-cord-cutting, and digital consumption-mostly world, RSNs are seeing their future, now. With a recent development of MLB franchises owning their livestream rights (as of December 2019), and with AVODs needing to expand their content offerings to scale further while offering a better user experience for super-fans, disaggregation of RSNs may come sooner than later. In particular, Sinclair's recent bet on RSNs is looking increasingly short-sighted in this marketplace.

And, here is Sinclair’s update to shareholders on its bet on RSNs yesterday, eight months after my prediction:

During the third quarter, we estimated impairment loss on the local sports segment of approximately $4.2 billion relating to Goodwill indefinite-lived intangible assets of $2.6 billion and $1.6 billion respectively. This was driven by a decline in distribution revenue brought on by a number of factors including the recent loss of two virtual MVPDs as well as elevated levels of subscriber eversion influenced by numerous factors including fragmentation of content distribution platforms, shifting consumer behaviors, the current economic environment, and the COVID-19 pandemic.

Putting COVID and “the current economic environment” aside, I’m starting this mic drop with a YES Network GIF…

[NOTE: YES Network, which broadcasts Yankees games, is owned by Sinclair]

Why I Write About Sinclair

I have written twice about Sinclair and its big bet on RSNs because the bet is a head-scratcher.

Sinclair has bet $9.6B on Fox’s RSNs, which include exclusive local rights to 42 professional teams consisting of 14 Major League Baseball (MLB) teams, 16 National Basketball Association (NBA) teams, and 12 National Hockey League (NHL) teams. So, to be fair, this reads like a smart bet at a time when sports and news remain the two most promising bets for linear viewing.

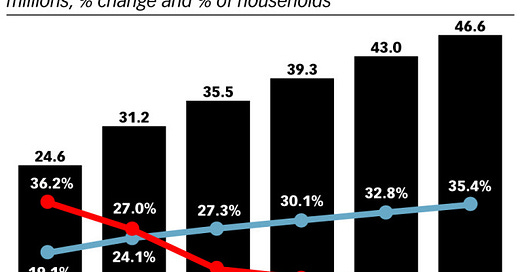

But, Sinclair is doing so at a time when cord-cutting is accelerating (eMarketer estimates 31.2MM cord-cutters in the U.S. by the end of 2020, above), and at a time when virtual MVPDs (vMVPDs) like Hulu+Live TV and YouTube TV are engaging in juggling acts with legacy cable bundles like Sinclair’s RSNs or Viacom’s suite of channels to keep prices from inflating too quickly for consumers (YouTube increased its price 30$ from $50 to $65 in June, and by keeping RSNs in its bundle would have driven that price higher within less than six months).

As Sinclair CEO Chris Ripley said on the earnings call:

…on the one hand, we are certainly disappointed that Hulu and YouTube made the decision they did. It seemed contrary to their previous stance. Hulu, for instance, picked up marquee at the beginning of this year, and if you take a look at all their advertising, it's very, very focused on live sports. But on the other hand, due to COVID, the timing of their renewals was such that we don't have any live sports right now. And probably will not have live sports until the beginning of next year. And that's sort of a moving target right now, based on what the NBA and NHL are trying to figure out for those seasons.

In other words, Sinclair imagines it will be back on vMVPDs (10% of Sinclair subscribers, according to the earnings call) when live sports returns.

“Fragmentation of content distribution platforms”

As I wrote back in March, the problem for Sinclair is not specific to vMVPDs. Instead, the problem is specific to the RSNs it has bet $9.6B on.

When I predicted the “disaggregation of RSNs” above, I meant that the fundamental value proposition of RSNs - effectively, live sports, replays, and nostalgia - will be disaggregated. We are already seeing in this in the NBA, as Dallas Mavericks Mark Cuban has said: with audiences are watching less linear television, “we’ve gone from a bandwidth-constrained environment on paid TV to a non-bandwidth-constrained environment”.

Sinclair already faces that disaggregation with MLB teams now able to sell their livestreaming rights individually, which is distribution external to their deals with RSNs. The NBA is also centralizing its digital distribution, as a recent deal with Microsoft Azure cloud computing reflects.

Whereas I had predicted sports nostalgia would be monetized better on OTT, in a fun twist on my prediction Sinclair is now disaggregating content from its sports verticals to help its RSNs: “…we are utilizing content from Stadium and Tennis Channel to provide incremental live and recorded sports programming to the RSNs.” Although not exactly my prediction of “nostalgia programming will be aggregated and bundled into OTT services”, it is certainly mirrors the business logic and a step towards that model.

“Shifting consumer behaviors”

As for “a better user experience for super-fans”, Sinclair does not have an actual solution, yet. But Sinclair management has been talking an awful lot about it, planning a launch of an interactive app in the Spring:

Work continues on a new sports app that is intended to give viewers a more dynamic and personalized viewing experience.

The app is an important part of our growth strategy for the RSNs as people are -- increasingly choose to access live games via digital means. The increased functionality of the app will allow for greater activity and superior viewing experience that we expect will eventually include the ability to participate in sports betting and other gamification activities such as social games focused on fandom. And our new platform will monetize the hundreds of millions of impressions that are currently not being optimized on the existing digital platform. We plan to launch the new app at the beginning of baseball season in the spring.

I've talked previously about the gamification of sports view -- of the sports viewing experience. We have taken steps in this direction as well.

Sinclair imagines that an app can capture viewership that it will be losing to cord-cutting, growing digital consumption, and sports betting. Or, put differently, Sinclair - a broadcast company - believes it can build an app that will capture something Dallas Mavericks owner Mark Cuban describes as an “aggregate audiences”, or audiences streaming via different portals and media, across broadcast and digital, with some portals being interactive.

Aggregate audiences reflect both “shifting consumer behaviors” (above), and a problem of demographics:

Right now the leagues, particularly the NBA and the NHL, we skew a little younger than the other leagues. By having our games on cable and traditional paid TV, we lose some of the 34-and-younger audience who streams everything. problem is, Cuban describes those aggregate audiences as:

So Cuban imagines “aggregate audiences” looking like:

“You might have one [stream] where you have Twitch-like announcers; you might have two of your favorite YouTubers that are doing another stream; you might have your traditional broadcasters doing another stream; you might have a players-only doing another stream”.

Those aren’t audiences watching their favorite team via an RSN. Those are audiences watching their favorite teams across platforms outside of the Sinclair ecosystem. Hulu and YouTubeTV has proved how precarious Sinclair’s access to that “shifting consumer behaviors” outside of broadcasting ecosystem can be.

Behold, The Mic Drop

Sinclair's recent bet on RSNs is looking short-sighted after Q3 because:

Sinclair’s audiences are increasingly outside of the legacy cable bundle due to cord-cutting

vMVPDs like YouTube TV and Hulu control a growing percentage of those audiences (10% as of Q3)

but, as Mark Cuban says, those audiences also are consuming content on platforms like Twitch or YouTube

Instead of seeking to aggregate those audiences on those platforms, Sinclair is building its own interactive app

By narrowly focusing on programming for its RSN channels and an app, Sinclair not building a model that reflects the emerging paradigm of “aggregate audiences”

That reads like “increasingly short-sighted” to me.

[NOTE: these are Indiana Pacers fans, who watch Pacers games on RSN FOX Sports Indiana]

Postscript

There are good reasons for an app, especially sports betting, which Sinclair is seeking to capture. I wrote about those reasons in June, and how they mirror the NBA’s deal with Microsoft around the Azure Cloud Computing.

(Feel free to share this free newsletter to any and everyone you want. It helps spread the word.)

(If this email was forwarded to you, I am a former Viacom executive who connects the dots across the OTT streaming marketplace for your competitive edge at PARQOR.com. You can follow me on Twitter, where I often have fun exchanges with other folks interested in the streaming business, or on LinkedIn, which seems to be a fantastic channel for sharing positivity, but less optimal channel for sharing content).