Streaming, Product-Channel Fit, and Roku ($ROKU)

Thinking through a problem related to my business helps me to better understand product-channel fit on Roku and in the streaming business

I had a fun conversation with Pico founder Jason Bade yesterday. We have been having good exchanges on Twitter Shortly after the call, he tweeted the below out.

The knowledge –> creator economy transformation:

For creators monetizing their ideas and expertise at scale, simply launching a newsletter is not enough. You need to figure out:

1. product-market fit 2. channel-market fit 3. product-channel fit

(Borrowing from @bbalfour)

👇

— Jason Bade (@jasonwbade) September 24, 2020

The thread is related to what I do - monetizing my expertise - and also what I need to do - find the right channels for my PARQOR content about the streaming marketplace.

I just launched a Substack for fun called Landing & Rolling. I make a lot of predictions, and the premise to promote predictions that I got right. I don't know what works for experts like me on Substack - I know Sinocism, Petition, and Pomp are similar expert-led offerings, but they different niches from me. Put in terms of Jason's tweet, above, these experts have found product-channel fit on Substack, and it would seem the network effects of Substack's growth (more than 250,000 paying subscribers) have helped these experts to scale, too.

For Landing & Rolling, I basically said "f*ck it, let's have some fun"

Jason links to a longer series of posts about product-market fit, channel-market fit, and product-channel fit from Brian Balfour, who writes about growth, strategy, & user acquisition (this is the first in a series).

How This Relates to Streaming: Roku

I read Jason's tweets and Balfour's posts and something made me think of a line from Roku's Q2 letter to shareholders:

In Q2, the most-used subscription services on the Roku platform grew quickly, with key services nearly doubling their aggregate streaming hours year-over-year. Roku was the No. 1 connected device based on hours streamed for Disney+ in the week following the release of Hamilton, according to Comscore, OTT Intelligence, July 2020. U.S. Premium Subscription services within The Roku Channel, such as Showtime and Starz, achieved significant subscription gains through extended free trial offers.

In those three sentences, we learn a lot about why streaming services are willing to share 20% of all subscription revenues earned: Roku, as a Channel for streaming services, is unusually valuable for driving customers to the content because of its user base of 43MM users, and growing. That means they have product-market fit for their software and devices.

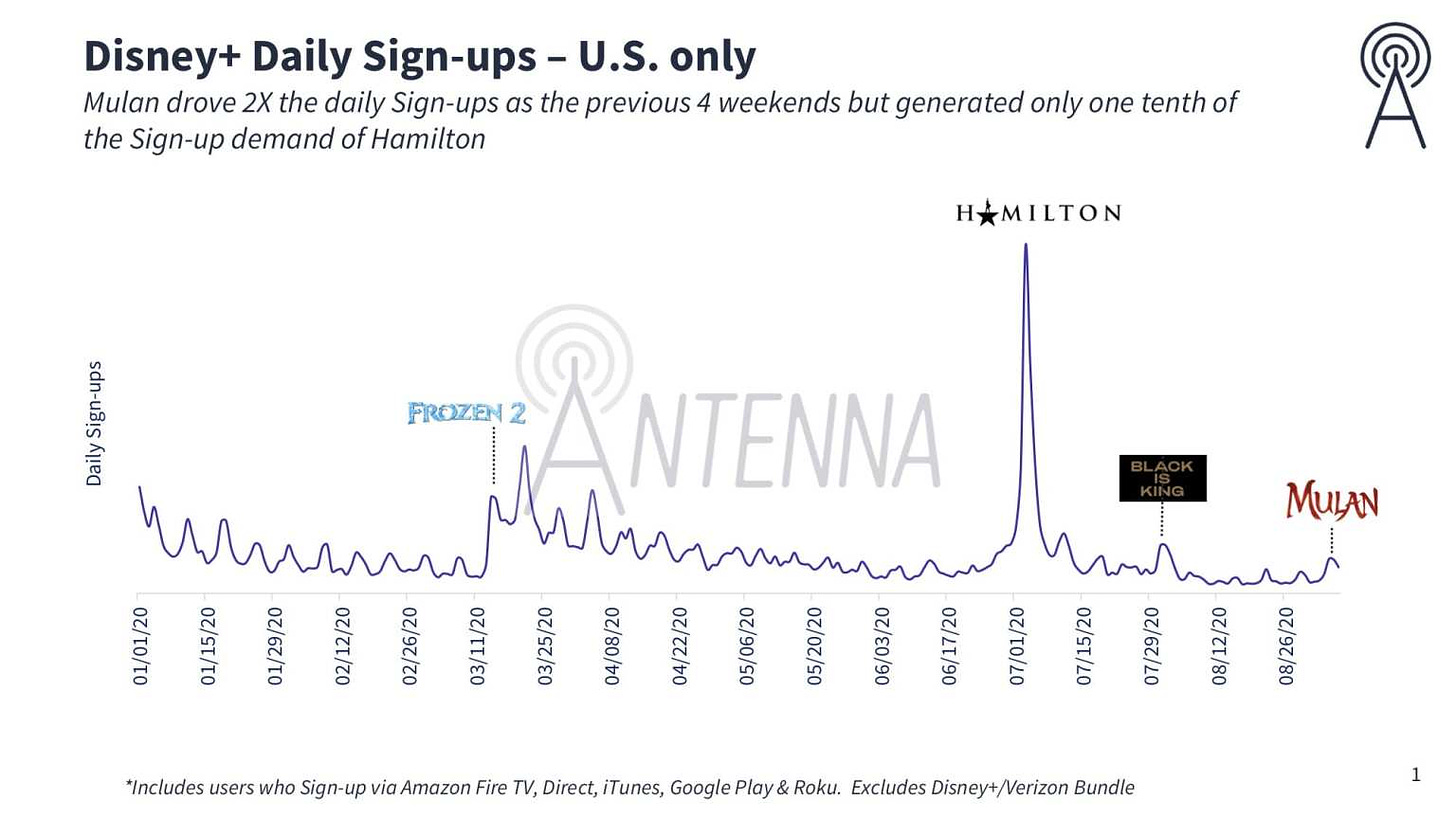

The rev share means that their revenues grow as a channel as the app's subscriber base grows, creating channel-market fit. For Disney+, it was crucial to driving subscribers who CEO Bob Chapek described as "a different target audience, a different demographic than what we normally get". And, they came at scale, according to subscription metrics firm Antenna:

So, according to both Roku and an independent third party measurement service, Disney found product-channel fit in Roku with Hamilton, and Starz and Showtime also found product-channel fit in Q2. But notably, Roku does not highlight more success stories than those three.

That leaves an interesting implication for both Peacock, which just started distributing on Roku, and for HBO Max, which is still in a standoff with Roku: will they find product-channel fit on Roku with its 43MM users?

Roku has a shared investment in the success of Peacock and future HBO Max (somewhere south of 30% of ad inventory and 20% of subscription revenues). The open question for those two services, and other new entrants, will be product-channel fit. As Brian Balfour writes:

You control your product, you do not control the channel. So you need to change the things within your control to fit with the things that you do not control.

Disney+ was able to do so. It is an open question whether HBO Max and Peacock will be able adapt to Roku, too.

Conclusion

Here's a good quote from an interview with Roku SVP Scott Rosenberg by CNBC's Alex Sherman:

Just to clarify, when you say zero- sum game, why are you saying with Roku that this is not a zero-sum game when it is with pay-TV providers?

In linear, viewership is pretty well capped. In fact, it’s declining. So dollars into that ecosystem are fixed or declining. So a dollar that an operator, say, a Comcast, gives up to a programmer is a dollar that’s lost by Comcast and gained by whomever it is. Discovery, whomever.

Whereas in OTT, all of these services are in launch mode and in growth mode. So a close partnership with the platform that itself is growing very quickly and has the home screen and all these marketing tools to help them grow is an essential ingredient to be successful in these new OTT services. Content apps doesn’t exist in a vacuum. They have to be carried by big platforms and have to be promoted heavily to users who have more choice than ever.

The relationship between Roku as a channel, and a streaming app as a product, in non-zero-sum: both parties gain. But, it is incumbent on the streaming service to figure out how its service adapts to the channel in order to scale with "users who have more choice than ever".

As for me...

Coming back to me, you can get a sense of the question I am dealing with as an expert in my space. As Jason also wrote in his thread:

Tl;dr: Expertise is VERY VALUABLE.

BUT it will take multiple formats and revenue models to optimize *product-channel-market fit* for every niche of knowledge.

It's the relationship that matters most. Not the specific medium.

— Jason Bade (@jasonwbade) September 24, 2020

If large, well-staffed organizations with some of the best talent in the world need to figure out product-channel fit for every channel they distribute on, you can imagine very quickly the pain points for experts like me working alone.

These are the types of questions I am thinking through now:

What is the best channel for distributing my longer mailings (2,500+ words)?

Right now, that is Wordpress+Mailchimp

What is the best product for other channels like Substack? Twitter? LinkedIn?

I have found my voice on Twitter, still don't have a clue what to do with LinkedIn (which has become more feel-goody and self-promotional than thoughtful... which is fine, but reduces the value of contributions there)

What is the best product I can deliver?

I am thinking through how to simplify the core value proposition more, making the content choices for visitors simpler to navigate but keeping the same voice

Even a short exercise like this reflects the challenges a streamer has: what is the best product Peacock can deliver with 15,000 hours of content? And does that product need to adapt to Roku in order to scale?

As you can see, the question of product-channel fit is very much on my mind.