Member Mailing #253: AMC Networks, Starz & "Genre Wars" Strategies

AMC's Q4 earnings revealed big wins in its "genre wars" strategy, but a comparison to Starz, a "genre wars" competitor, reveals big weaknesses, too

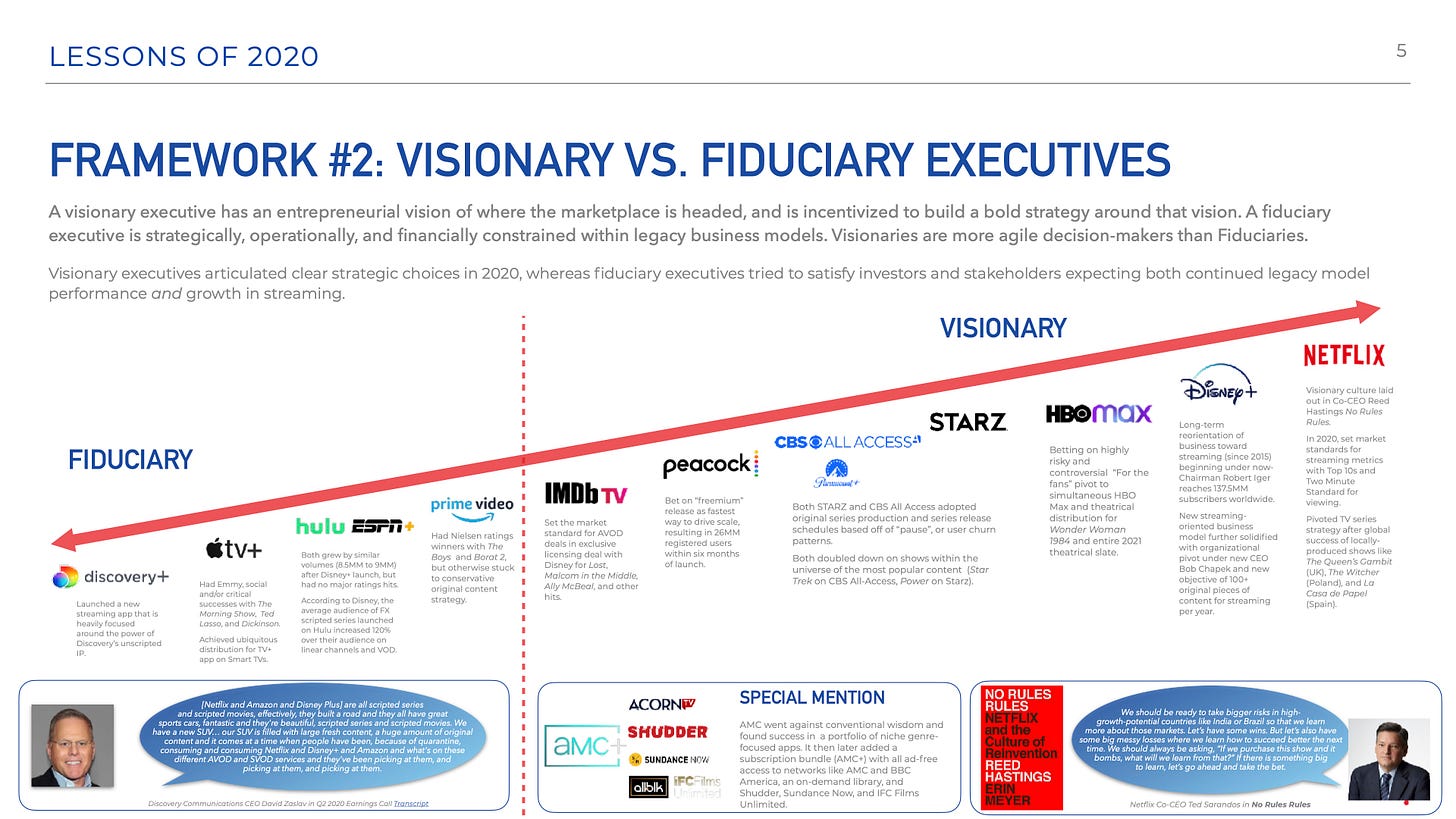

AMC Networks reported its full year and Q4 earnings last week. I gave AMC Networks a special mention in the Fiduciary vs. Visionary slide of my Lessons from 2020, Predictions for 2021 presentation:

AMC went against conventional wisdom and found success in a portfolio of niche genre-focused apps. It then later added a subscription bundle (AMC+) with all ad-free access to networks like AMC and BBC America, an on-demand library, and Shudder, Sundance Now, and IFC Films Unlimited.

Essentially, I believed the strategy AMC Networks has pursued under CEO Josh Sapan is visionary, and I believed that the strategy merited its own highlight.1

The challenge with AMC Networks’ streaming strategy has always been the nominal scale: at 5MM subscribers across five apps as of December 2020, the business strategy seemed still in the early stages of being proven out. That said, it has found Product Channel Fit by almost exclusively relying on OTT Channels Stores and Cable Set-top box integrations to scale.

It was AMC Networks’s Product Channel Fit strategy which led to me coin the term “the genre wars”:

…one way to think about product channel fit in streaming is to think of the “streaming wars” more as ‘the genre wars”, which are more like focused, zero-sum conflicts around specific content genres than broader head-to-head, zero-sum conflicts between platforms for the same audience.

In that essay, “AMC+(AMCX) & Shudder, Netflix ($NFLX) & Animation, and Product Channel Fit”, I identified three important points about AMC Networks’ streaming strategy:

Shudder’s success with its focus on horror year-round reflects how there are genres where the big streamers are simply willing to concede defeat except for October, the month where horror matters to broader audiences.

The AMC+ bundle is a portfolio approach to packaging popular shows from different genres, allowing AMC Networks to find wins year-round in the genres that Netflix, Disney+, and Amazon Prime Video simply are not focused on year-round.

AMC+ is finding product channel fit especially via Apple TV and Prime Video Channels

AMC Networks’ full year and Q4 earnings fleshes out a much more robust and detailed picture of its streaming strategy we had in October and December 2020. The service now has 6 million aggregate AMC Networks Streaming Services subscribers across AMC+, Acorn TV, Shudder, Sundance Now, and ALLBLK streaming services. It projects it is on track for 9MM aggregate subscribers by end of 2021.

CEO Josh Sapan’s prepared comments to analysts in the Q4 earnings call offer an invaluable roadmap that fleshes out the drivers of success in a “genre wars”-oriented strategy. But, answers in the Q&A betray the weaknesses of that model, too.

“Genre Wars” Strategy

In the earnings call, Sapan delivered an unusually detailed walk-through of AMC Networks’ streaming strategy for investors. AMC’s strategy is “to identify highly distinct editorial areas that we can thrive in and grow”. In other words, like Starz, AMC focuses on genres and target audiences where it can find wins. The second part of his explanation of their “targeted approach” reads like a default explanation of “genre wars”:

This targeted approach includes British focus dramas and mysteries with Acorn TV, Horror and suspense with Shudder, drama documentaries and true crime with Sundance Now and Allblk, our services -- our service targeting black audiences, formerly known as Urban Movie Channel or UMC, which we rebranded to Allblk last month.

By targeting audiences who were particularly passionate about these content areas, we don't compete with larger general entertainment streaming offerings. Rather we complement them. Our subscribers relate to and value our services not on the basis of one specific show or film, but rather because we provide a level of depth and quality in these highly specific content areas, that they can't get anywhere else.

Sapan here is effectively confirming that genre (“highly specific content areas”), more than specific show brands, is what drives growth and reduces churn on AMC streaming services.

This strategy compares and contrasts with Starz in nuanced ways. Whereas AMC prioritizes providing “a level of depth and quality in… highly specific content areas”, Starz prioritizes specific demographics and produces content, and not genres, targeted to them: “our programming for a broad spectrum of women and traditionally underserved audiences is differentiating us from our competitors”.

In other words, AMC’s priority in the “genre wars” is to focus on producing highly specific content within genres that have passionate audiences, like horror (Shudder) or fans of British TV (Acorn). Whereas, Starz’s priority in the “genre wars” is to focus on target demographics and to produce shows within genres that will likely convert those audiences to paying subscribers.

“Genre Wars” Distribution Strategy

This means, a core difference in those two strategies is distribution.

For both AMC and Starz, distribution is not only about product channel fit, but product channel fit with those channels where target audiences can be found at scale. The difference is AMC appears to bet more on finding scale by marketing content across fans of a genre than with particular demographics, and Starz bets more on marketing specific content to specific demographics.

A good example of this is when Sapan highlights its newer AMC+ offering as fundamental to its bet to expand its TAM and find product channel fit:

…AMC plus is an ad free premium service, that extends our targeted streaming focus, offering Shudder, Sundance Now and IFC Films Unlimited, in addition to some of the best of the scripted content from the AMC channel, BBC America, IFC and SundanceTV with a focus on two content areas that we have traded and excelled in.

One is Epic World materials such as The Walking Dead Universe, and the other is prestige dramas, including the likes of Killing Eve, Better Call Saul, Mad Men, and others in our history and currently on the air.

Effectively, the bet is that a service focused on “Epic World materials” and “prestige dramas” helps to expand the TAM beyond linear without compromising relationships with MVPDs or Channels partners. Sapan added:

[AMC+] allows us to expand the reach of the AMC brand from the roughly 85 million or so US cable video subscribers to a universe that in the US includes every broadband home available now and in the future.

And by expanding our overall total addressable market, AMC plus allows us to not only economic mitigate the impact of cord cutting to be a growth business as we inhabit both the linear and streaming areas of the media landscape with our distribution partners. And AMC plus is strengthening our relationship with those partners. Following summer launches with our MVPD partners at Comcast, DISH, and Sling, we substantially expanded availability of AMC plus in the fourth quarter with distribution on Apple TV channels, Amazon Prime channels, as well as Roku, in addition to AT&T's DIRECTV, with additional planned launches to come later this year. By making our affiliates key partners in our streaming ambitions, while maintaining the most cost effective wholesale rate for our basic cable channels, we are aligned with our MVPDs as we work with them to deliver multiple options for their customers.

In some ways, this win-win approach mirrors how Disney solved for distribution of Disney+ on Amazon, which licensed older library content like Lost and Ally McBeal to IMDb TV to ensure Disney+ was distributed outside of Amazon Channels. AMC is licensing library content to AVOD services can keep channels partners happy and help create favorable economics in these deals.

There is a sophistication in AMC’s approach to finding win-win situations with MVPDs and channels partners. We are rarely seeing that sophistication elsewhere. including at Discovery with discovery+, which elicited this reaction from Dish Chairman Charlie Ergen last week:

I think Discovery has got great content. And we've had a long-term relationship with them. But obviously, to the extent that you can get it on a la carte basis, it will affect future negotiations. Because if our customers -- some of our customers don't watch Discovery. A lot of our customers don't watch Discovery, should we burden every customer with Discovery if they can get it somewhere else? I mean, that's the -- so it has to be a relatively -- has to be a fair rate that we can burden customers who don't watch it and you have to run that math.

And that's just the economics. It's not rocket science. We know our customers who watch it, how long they watch it in real-time.

Where Discovery bets heavily on shifting its library over to its streaming app and risking its distribution deals with MVPDs like Dish Networks, AMC bets on more of a nuanced, cross-platform distribution strategy:

Our very strong program development team continues to extend not only our currently owned intellectual property, but is adept at discovering new content that captures the attention of our targeted base, providing a steady stream of material, that is helping to power our brands and to power our growth. Most recently, this includes a series called Gangs of London, that debuted on AMC plus in the fourth quarter and was a sleeper hit for us, that built each day and each week. Also a very popular show called A Discovery of Witches, that is extraordinarily strong with the second season streaming on Sundance Now and AMC Plus, and which will come to AMC's Linear later this year, enabling us to maximize the impact of our content spend across multiple platforms.

The A Discovery of Witches example is worth highlighting here. AMC is leveraging streaming content on two services, and then moving it to linear to reach broader audiences. With one series, they are maximizing the win-win possibilities across platforms. As Sapan later adds in the analyst Q&A:

We have multiple products as you now well know linear and streaming. So in some instances, we will go streaming first and linear second window. In other instances there'll be absolute propriety between linear and stream, and there will not be overlap. And in other instances, we'll go with linear first and streaming second. So there is really not a one size fits all Mike, approach to what we're doing in streaming.

Ergen’s comment makes it clear that MVPDs are happy to remind cable channels with streaming services that affiliate revenues are not guaranteed. AMC Networks is communicating it is well aware of that risk, and bets on rev share deals across linear and broadband to keep those MVPD partners happy, while keeping its distribution options as flexible as possible.

“Genre Wars” Economics

AMC Networks relies heavily on subscription, content licensing, and affiliate revenues (“Distribution”), and advertising revenues. Almost 100% of its Operating Income comes from Domestic linear advertising and distribution revenues.

For subscription revenues, it had a $300 million run rate at the end of 2020. AMC added very little on the subscription revenues, except for this tidbit from COO Ed Carroll:

I'm going to start first with the targeted businesses, that have really exceeded our expectations. The model we're finding is a lot more efficient than we originally thought and the efficiency is holding as we scale. So we're very pleased with the momentum. Services represent not only a destination for the viewers, but they tend what we're seeing to form a community around the content. And so as you would imagine, that's helpful on churn and [Subscriber Acquisition Cost (SAC)].

Effectively, the “genre wars” model allows AMC to cost-efficiently acquire and retain audiences. A focus on genre also reduces churn and SAC by helping to form “communities” around the content.

For advertising, AMC had two key economic drivers in 2020: (1) adding targeting to linear advertising, which it did with Omnicom Media Group in two national campaigns in Q4, and (2) making revenue share deals with AVOD and FAST channels for distribution.2

Notably, digital advertising is the one area for which they tended to avoid answering questions. That is because the story was not as strong due to production delays caused by the pandemic:

Advertising revenues decreased 5% to $237 million from the same full year dynamics. Again this largely reflects a shift in the timing of originals resulting in lower inventory, partially offset by increased CPMs driven by healthy scatter pricing. In the fourth quarter, the rate of decline moderated significantly on a sequential basis compared to prior quarters

With that answer, advertising ends up being the weak point in the “genre wars” story. Not “weak” in the sense of being a “bad” model, but weak in the sense that there is not a good answer in the earnings report or the earnings call.

Moreover, the elusiveness of answers about advertising revenues throughout the call suggests that AMC is still figuring out how to optimally monetize its content on third-party platforms. This may reflect the pandemic but also the relative recency of the FAST/AVOD partnerships.

On the positive side for AMC Networks, they are early in their model and are not at the scale they could reach yet. On the negative side, other FAST/AVOD bets in the marketplace like ViacomCBS and The Roku Channel have positive stories about ad targeting or higher CPMs from targeting, and AMC does not.

“Genre Wars” Churn & Starz in 2021

There is also a hole in the financial story about subscription fees: the $300 million run rate at the end of 2020 is annualized, which led analyst Michael Nathanson to ask about “the quarterly volatility in subscription fees”. That is effectively a question about churn.

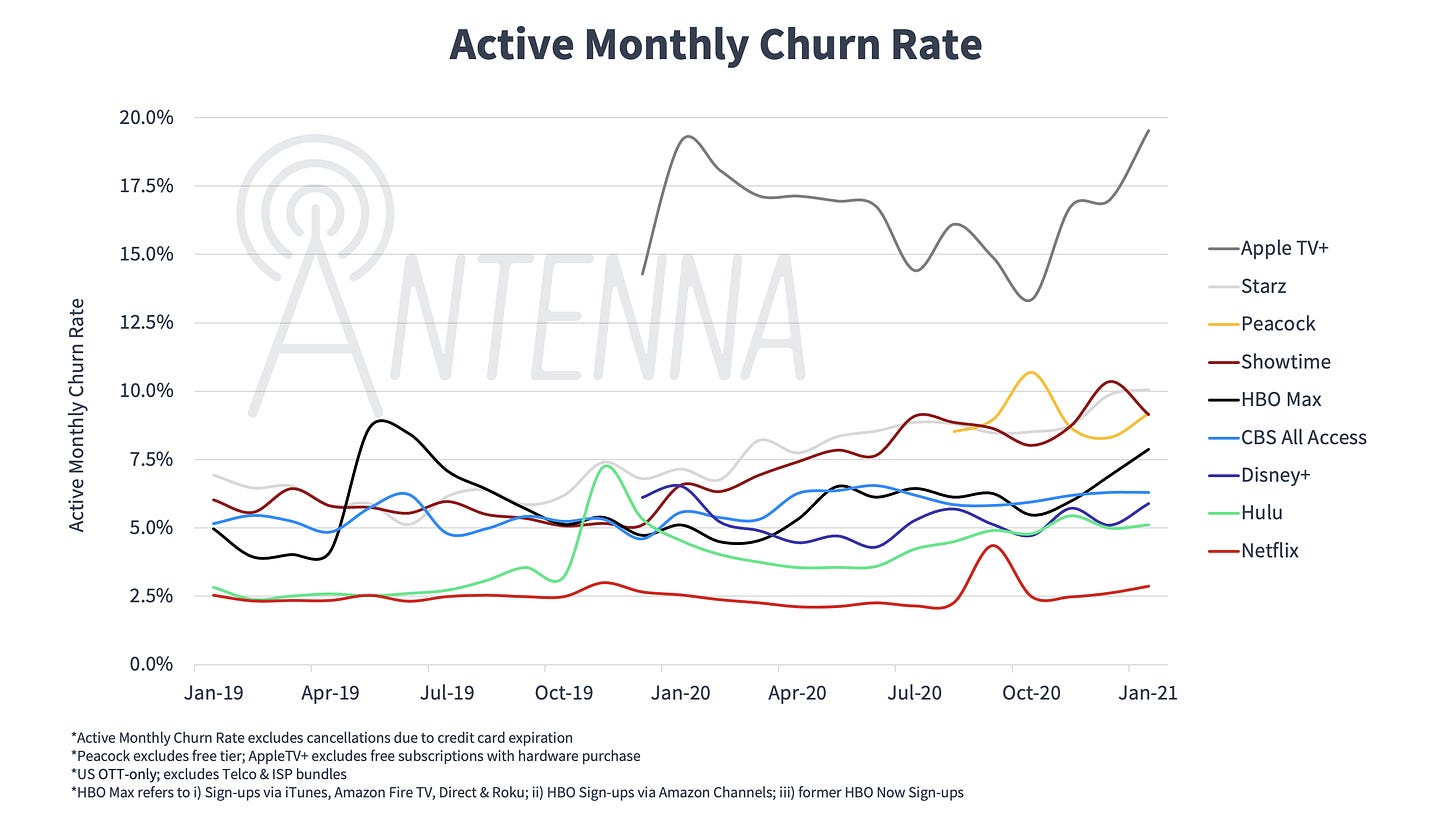

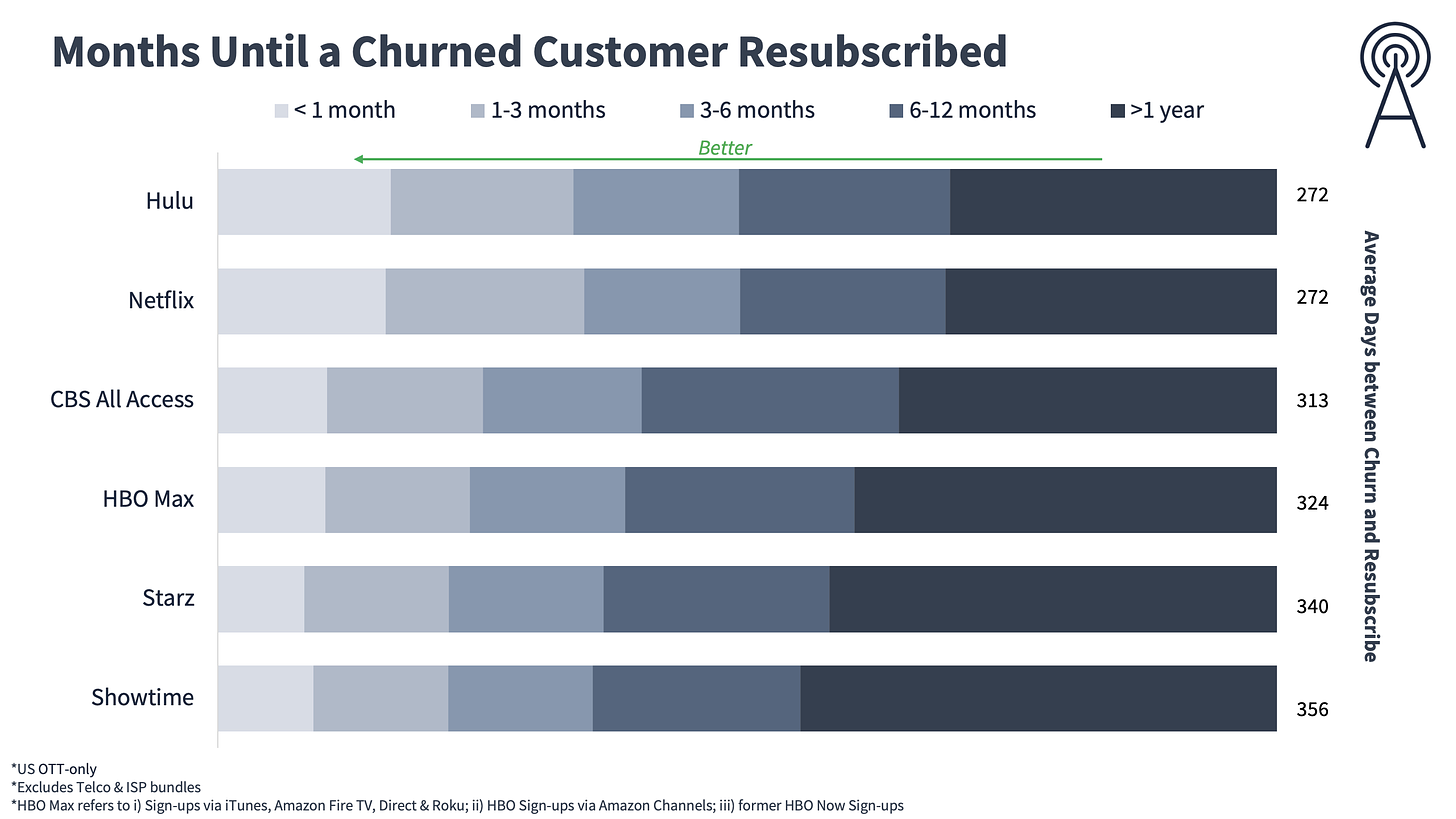

Antenna Data has been tracking audience churn on the Starz app, and that helps us to dive a little deeper into understanding AMC’s model.

Again, AMC’s priority in the “genre wars” is to focus on producing highly specific content within genres that have passionate audiences, like horror. Whereas, Starz’s priority in the “genre wars” is to focus on target demographics and to produce shows within genres that will likely convert those audiences to paying subscribers.

As we can see above, Starz’s strategy generally has resulted in higher churn than almost every model except for Peacock and Apple TV+. Its churn patterns appear to be bumpy but less volatile across quarters than other services.

Churned customers tend to resubscribe after six months, suggesting consumption by target demographics is indeed driven by the distribution strategy for franchises like Power.

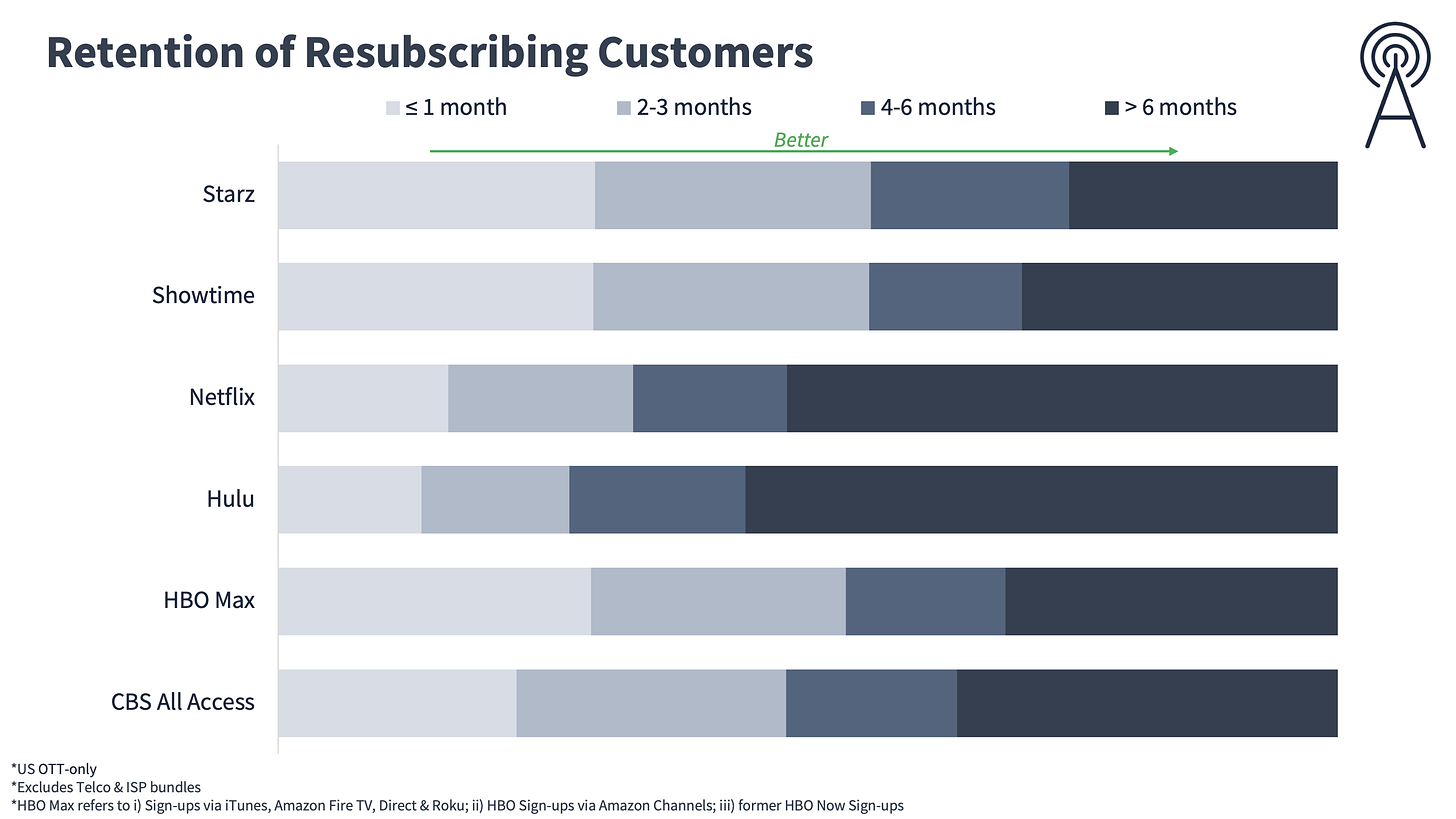

Starz appears to map closest to Showtime in its churn data - almost mirroring each other - and both rank the lowest among this group of six competitors in retaining resubscribing customers, too.

Notably, both Starz and Showtime have been open with the media about pursuing a strategy of “pause”, accepting that their target demographics are loyal to the content, first, but are not loyal to the streaming service. These churn metrics confirm the story of pause for Starz to be:

steady annual churn rates with minor fluctuations;

most churned subscribers returning after a year; and

retention of churned subscribers typically between more than to six months, most within more than one to three months.

AMC does not offer the public a story about pause, and Antenna is not currently sharing any data it has on AMC. So, we can only make assumptions from the Starz data about the “quarterly volatility” of churn that Michael Nathanson is asking about in the call.

I think the fair answer is that AMC has two key differences from Starz that can explain the “quarterly volatility” of churn.

First, Starz’s SVOD offering is an alternative to its linear channel, whereas AMC’s SVOD offering is complementary to its linear channels. So, whereas Starz relies on product channel fit with distribution partners to scale, AMC relies on the tactics of product channel fit distribution partners and house inventory and “festival” promotions on its linear channels to sell subscriptions to its SVOD services.3 This quote from COO Ed Carroll implies that AMC is still very much on a learning curve with these tactics:

…it is certainly part of our strategy to upsell to our SVOD services. Now we do that in sync with our linear channels and it's interesting, Josh talked a bit about windowing before. We have returning successful series coming back to the SVOD platforms. For example, we're up to the third season of Riviera, which has been a very successful show for Sundance Now. And Discovery which is in its second season, driving to both Shudder and Sundance Now, and we've already added [Phonetic] a third season. And what we find is by running festivals of the prior season on linear and throwing to our SVOD, that is becoming a compelling way of building new sampling on our SVOD platforms. So we like the strategy and we're going to continue to lean into it.

Second, Starz is betting on targeting particular demographics with a single app, and AMC is betting on targeting a portfolio of fans across various genres with multiple apps. It is also offering a bundle deal for those subscribers with AMC+.

It could be argued that Starz is taking on more risk by betting on reaching specific demographics with a single service. In this light, AMC has the substance of a portfolio approach, where risk is spread across multiple offerings, and therefore there is less risk and more flexibility to adapt to changing market conditions and audience behaviors. However, it also could be argued that AMC has the riskier approach because it has more moving pieces to manage across linear and digital. Complexity can undermine the optics of a good strategy.

I wonder, given Starz’s story of steady churn and successful growth story to date, whether the “volatility” of churn that AMC is seeing is a weakness in its “genre wars” strategy. Meaning, for all the upside of managing risk with a portfolio approach across apps, the downside lies in more operational complexity than a single app service like Starz.

Conclusion

The “genre wars” story which emerges from AMC Networks’ Q4 earnings call is compelling. It has scaled to 6MM subscribers, and it is projected to continue to scale to 9MM subscribers in 2021. Perhaps most notably, it is a model which manages to keep both MVPD and Channels partners happy, and for which AMC is happy to sacrifice subscriber and advertising revenues with Channels partners to find win-win outcomes.

But, as exciting as the “genre wars” lens is, the “volatility” of churn discussed on the AMC earnings call also reveals some legitimate questions about the “genre wars” business model AMC is pursuing.

The first is whether AMC has spread its bets too thin across too many apps. Meaning, there may be a compelling business rationale to pursue five different apps across five different genres. However, because this model implicitly has more volatile churn than the Starz app alone, there is also very good evidence that the “genre wars” strategy requires going deeper with specific audiences with fewer apps.

In turn, a second question emerges: what is operationally required of AMC to scale five apps alongside running linear channels facing declining linear audiences? The point is less about distribution, and more about optimizing both the linear and streaming businesses for advertising and subscription revenues. There *is* a compelling story about targeted advertising CPMs to Genre-oriented demographics, but AMC did not offer one beyond its Omnicom story for linear. Questions about churn suggested that subscription revenues are being sub-optimized, too.

Last, the question about the “volatility” of churn sheds light on a key difference between Starz and AMC in their respective “genre wars” approaches: although only app, Starz may have long-term advantages over AMC because of its narrow focus on converting particular demographics. AMC seems less focused by comparison, and “volatile” churn may betray the weaknesses of a lack of focus in a “genre wars” model.

AMC has emerged from the pandemic with a compelling business case for the “genre wars” strategy. It offered a great story for its portfolio of sub-scale streamers in 2020. It has gone against conventional wisdom and found success in a portfolio of niche genre-focused apps. In particular, it has an unusually good story about keeping both linear and Channels distribution partners happy with its existing model. Investors have rewarded them with a 35% jump in stock price, since.

But, when compared with competitors with similar strategies like Starz, an unusual operational complexity to its model emerges which betrays some important weaknesses in its “genre wars” strategy.

The only reason the service was not listed alongside the other Visionary services was a design choice: I ran out of room for all six icons of AMC’s different offerings.

I wrote about that complex rights deal back in July.

Notably, this strategy mirrors two of three drivers ViacomCBS promised to investors for growth: linear TV (house inventory), social video, and Pluto TV.