Member Mailing #256: Amazon, NBCU, The NFL, & Addressable Advertising

Does Amazon Advertising 's narrow CTV/OTT offering meet advertiser demand for targeted ads? Or, does NBCU One's Linear + CTV/OTT + Digital Video meet it better?

Key Takeaways:

A key question to play out from now through 2029 is how both Amazon and NBCU will sell advertisers with the buying rationales of both contextual and targeted advertising. Each offers a very different answer to that question.

Amazon’s answer seems narrowest but more sophisticated given its technology and first-party data

NBCU’s answer with NBCU One seems broadest but less sophisticated given that it is in the early days of building out NBCU One across linear, streaming, and digital video.

There is one slide from my Lessons and Predictions deck which I have yet to revisit: my predictions for the AVOD marketplace.

The short answer for why I haven’t yet is, it’s complicated.

But, in writing about both recent sports deals (NHL, NFL), and AVOD streaming services (IMDb TV, Peacock, Roku, HBO Max), the dynamics of those predictions are lurking in the background.

A question towards the conclusion of yesterday’s short essay on the NFL Deal sums up how I think these dynamics are playing out:

What will be more valuable to NFL advertisers in 2029: a bet on addressable advertising on national TV, connected TV and digital video? Or a bet on the hyper-targeting of audiences within Amazon based on Amazon’s invaluable first party data?

Because whether cord-cutting is going to accelerate or slow down by 2029, the ability of legacy media companies to deliver addressable advertising solutions that advertisers will want seems to be the determinative question driving their definition of success for the NFL deal. If they prefer Amazon, advertisers will be less likely to buy advertising on the legacy media companies to target NFL audiences.

In this light, it may be no accident as to why NBCU’s Peacock remains in a standoff with Amazon over distribution.

When we look at the Peacock standoff with Amazon through the lens of the NFL deal, the standoff seems even more reasonable. Both parties have a relationship with the NFL, and both will need to recoup on substantive investments of $1.71B (NBCU) and $1.32B per year, respectively.

Neither service’s bet on the NFL right is otherwise in competition with each other: Amazon owns Thursday Night Football, and NBC owns Sunday Night Football.

But the dynamic gets dicey when we imagine a Sunday Night Football game broadcast on Peacock that is watched via Amazon Prime Video and/or a Fire TV device. If NBCU is giving up 30% of its inventory to distribute Peacock within the Amazon ecosystem, from whom is the advertiser better off buying ads to reach Sunday Night Football viewers? Peacock or Amazon?

There currently are no easy answers to this question for the ad buyer in 2021. Effectively, what the NFL example tells us is advertisers are navigating whether their growing demand for ad targeting is met better by NBCU’s portfolio approach of Linear plus OTT/CTV plus Digital Video, or by Amazon’s narrower, OTT/CTV-focused approach.

A Helpful Perspective from Roku

Although Amazon has been generally silent about the dynamics it sees in the ad marketplace, Roku has been more open. There is a terrific exchange about this problem in the Roku Q4 earnings call between Lightshed’s Rich Greenfield and Roku management around this question:

If you're a brand and you want to reach connected TV viewers, I was wondering if you could just help us understand the difference between two different scenarios. One, you go out and you buy Hulu or Peacock Direct, and a portion of that ad time that you're buying ends up on Roku devices. Choice 2 is you buy Roku directly, and a portion of your spend may end up on a Hulu or a Peacock or even both.

I guess if I'm thinking about this, if I'm a marketer brand, why do I buy Roku Direct versus the other way around? And what is buying Roku Direct achieve that simply can't be achieved by buying from the programmer directly and ending up on a Roku device?

SVP and GM of Roku’s Platform Business Scott Rosenberg pointed out Upfronts as an option in his response, which Greenfield then told him to assume “there is no upfront”. He then asks, “if you just had to put dollar to work, why would I put a dollar into direct[?]”

Greenfield got two answers. First, from Roku CEO Anthony Wood:

…one advantage is the ability that we also have access to what linear ads that you've been seeing through our ACR and our Roku TVs. And so in terms of unduplicated reach, we can help you do that. An app who doesn't have that data can't really do that.

Second, from Rosenberg, who added that it is also about “the ability to reach users that you aren't going to reach just through those select couple of publisher direct buy”:

So one of the things we regularly do with our advertisers is produce [an only/both] view of who they reached with each of their buys.

And we do that with linear, too. And we regularly show them that even though, for example, they're heavily invested in Hulu, they didn't reach this whole other big class of users because they're either not active with those other publishers or they're not holistically optimizing across linear and their whole OTT buy. There are a lot of other reasons that advertisers invest directly with us. One is we excel at optimizing for performance using data.

I mean, we've been investing for years in our data and our ad stack, and we excel there. We're not in the business, as you know, of selling context. So if you got to buy the office, you got to buy a specific show, you're going to do that directly with the network. But if you're optimizing for reach and frequency and performance, investing with Roku is a key factor.

The other thing I'll mention here is that OneView is a key component in this discussion. One of the reasons we've invested so heavily in the OneView capability is -- so that in the case where you're doing a publisher direct buy, you can still leverage Roku identity, Roku data, and capabilities to help optimize that publisher direct buy against all your other activity.

This is an invaluable answer which we can easily restate as an answer to “why would an advertiser buy from Amazon instead of Peacock?” Unlike Peacock, Amazon:

has data on which linear ads its consumers have been seeing, allowing them to offer unduplicated reach

offers ad buyers another class of users who are active across a portfolio of publishers within the Amazon ecosystem,

helps ad buyers who are not holistically optimizing across linear and their whole OTT buy

offers targeting capabilities to optimize a buy based on identity and data and target

That reads impressive. So why would an NFL advertiser buy from Peacock rather than Amazon?

Scott Rosenberg suggests the reason is context and demand for a specific show:

Look, our focus as a company is on data and performance and outcomes for advertisers, but there are lots of reasons why advertisers also care about context and want to be in that show. And that's not our lot. That's the focus and capability of a lot of networks. But look, we agree.

We're focused on leveraging our data and our tech and capabilities to drive outcomes for advertisers and help them orchestrate their OTT investment even in the case where they're doing it directly with a publisher.

“Context” implies buying to 100% ensure the ad will be seen with Sunday Night Football, whereas Roku and Amazon ensure the ad will target audiences across a portfolio of apps.

But the key phrase in that answer is that advertisers “want to be in that show”: the buyers specifically want to buy a spot with Sunday Night Football, and not reach, frequency, and performance with a specific target audience.

In other words, advertisers wanting to guarantee advertising served alongside the Sunday Night Football show will buy from NBCU, but advertisers wanting to target particular audiences around demographic, identity, or “behavioral signals” will buy from Amazon. If an Amazon-bought ad gets served on Peacock, it will be because of one or more of a variety of audience attributes.

If we apply Roku’s value proposition as a one-to-one comparison to Amazon’s, we could reasonably conclude that Peacock should not be worried about direct competition.

The problem is, NBCU should absolutely be worried about direct competition when selling NFL game inventory for Peacock: Amazon has been selling 30-second spots in packages for Thursday night NFL games since 2017.

It sold those packages for $2.8MM each, consisting of 10 30-second spots during the Fox broadcast, and which would run on the digital live-stream when local ads aired on network TV.

National spots run by network broadcasters were shown on the live-stream. It is not unreasonable to assume the Roku statement, “we also have access to what linear ads that you've been seeing through our ACR and our Roku TVs”, is also true for Amazon.

With or without Upfronts, Amazon can go to the market with both its first-party data on its users and data on the linear ads its user have consumed while watching Thursday Night Football. They are not new to the linear advertising game, despite all obvious indicators otherwise.

How and Why Will Amazon Be A Competitor?

It is easy from 36,000 feet to say that Amazon is well-positioned to compete for NFL advertiser dollars based on top-level bullets like first-party data on 126MM+ Prime subscribers with access to Prime Video, 50MM+ Fire TV households, and 55MM+ monthly viewers of OTT content. It is harder to say what it means for Amazon to compete for these ad dollars when they do not have Upfronts, where NFL inventory is pre-sold.

That said, Amazon will be at IAB’s NewFronts in May, so we will soon find out how they are competitively positioning themselves for ad buyers, soon. Amazon will have a leg up on the streaming competition in May, as their streaming inventory is becoming a favorite of ad-buying agencies, according to Sahil Patel of The Wall Street Journal ($ - required):

Amazon’s streaming-TV ad sales grew faster in 2020 than its more-established ad segments such as search and display, albeit from a much smaller base, according to a person familiar with the company’s ad business. Streaming TV now comprises roughly 15% to 20% of two top ad-buying agencies’ spending with Amazon, executives at the firms said.

It is also harder to say what it means for Amazon to compete for these ad dollars at the addressable advertising level. Meaning, they can tell advertisers “on average, OTT video ad campaigns that leverage both demographic attributes and behavioral signals see a 38% increase in consideration, and using behavioral signals alone, on average, results in a 44% lift in consideration.”

But, there is less transparency around which advertisers will want to buy either or both of ad packages or addressable advertising specifically for NFL broadcasts from Amazon, and why. Amazon Advertising has plenty of posts about its OTT business, but no evident case studies about the success of advertisers with the NFL.

Production is going to be the biggest question here. Unlike its previous live-stream deals, which were retransmission of live broadcasts, Amazon will be building its own production from the ground up, including new pre-game, half-time, and post-game shows (but retaining some custom functionality it had created for the live-streams). It will likely deliver a high-quality production that advertisers want, but as always, there are no guarantees.

The good news for Amazon is its deal with the NFL does not start until 2023, so it has at least two years to work with advertisers to build new pre-game, half-time, and post-game shows they will want to sponsor.

How will NBCU and Peacock (and Everyone Else) Compete with Amazon?

Legacy broadcasters are selling advertisers a premium production with their NFL broadcasts, with a proven, decades-long track record and with Nielsen ratings over the past decade.

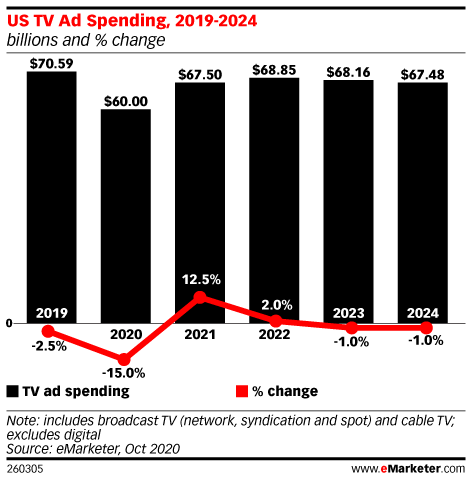

So, it is safe to assume that on the supply side, NFL inventory gives legacy media companies a strong sell at Upfronts for linear TV ad spend, which is projected to remain around the same size through 2024 (below). Advertisers will pay a premium to be in front of NFL linear TV audiences ($5B across all networks in 2019).

Where the question gets harder to answer is around Connected TV ad spend. Because what advertisers will be buying on Peacock will be the equivalent to what Amazon has been marketing all these years: a live broadcast feed from a network. The only difference will be, the Peacock broadcast feed will be from NBCU, and NBCU will own 100% of the linear and streaming inventory.

An important question is how much targeted inventory Peacock + will be allocated initially, and in the future. The default appears to be 10 local spots. For that number to increase, NBCU will need to reconfigure the portfolio of its targeted inventory across both linear and streaming.1 In the simplest version of that model, a single Sunday Night Football ad slot will enable a local TV advertiser to reach linear TV audiences, and a digital advertiser to reach Peacock audiences.

That simple scenario gets more complex when we add ad targeting to the picture. In that local ad slot on linear TV, NBCU simultaneously will be calculating which ads should be targeted to linear audiences, and in that local ad spot on Peacock, calculating which ads should be targeted to streaming audiences on Peacock. If we increase the number of advertisers serving ads from two (one per linear and per streaming) to 10, we have expanded the permutations of ad delivery to from two ads into the millions.

That puts the onus on NBCU to navigate the growing complexity in ad delivery created by the advertiser’s demand for more targeted inventory without compromising its ability to meet the requirements of the advertisers’ ad buy. The onus is particularly on the ad serving software’s ability to efficiently allocate the advertiser’s spend across NBCU platforms. The question for NBCU in this instance is not whether it can deliver the permutations of the ads, but whether targeted delivery results in the most optimal and efficient allocation of the advertiser’s spend (which is the question Rich Greenfield was hinting at, above).

It will be more complicated for NBCU to answer that question. Whereas Amazon Thursday night ad slot is 100% OTT/CTV and relies 100% on Amazon Advertising, NBCU’s ad slot is going to rely on two different technologies: linear ad targeting (which relies on third-party MVPD partners) and OTT/CTV ad targeting, both of which it is still proving out with its new, sell-side ad serving technology, the NBCU One platform.

NBCU One vs. Amazon Advertising: An Example

Yesterday, NBCU held a virtual event around its NBCU One platform called "One21," which was for agencies and marketers, and also for partners across the tech stack that work with the company. The presentation was hyper-focused on streaming:

In its pitch Monday, the company framed itself as something of a flywheel, with Comcast's broadband powering streaming, Peacock powering content, and in-house tech delivering that content and creating ad experiences.

"[One21] is more than an overview of ad products. It's an opportunity to see, for the first time, the full depth and breadth of this unified company," NBCUniversal ad sales chair Linda Yaccarino said during the presentation. "And if the future of distribution is broadband, if the future of content is aggregation, and if the future of viewing is streaming — then Comcast NBCUniversal Sky is built perfectly for the future."

"The future is clearly streaming, and our streaming platform is a window into that future," added the company's streaming chief, Matt Strauss.

The basic premise of the pitch was unifying the messaging of the media and technology “stacks” of the business. At its core, the pitch for NBC One seemed to be solving for various customer pain points across tech and media buying:

[a] mission to create a more automated, more self-service, more data-driven future for partners, helping advertisers meet their key KPIs and create real business impact while making the entire process of reaching the right consumers at scale — from audiences to planning to delivery to measurement — as simple as turning on the screen on the wall.

Effectively, the pitch is that NBCU can deliver a robust technological alternative to competitive solutions like Amazon Advertising, while offering a different and broader portfolio of audiences to target (615MM people across Comcast, NBCUniversal and Sky). Simply put, its pitch is CTV/OTT plus linear plus digital video delivery.

By contrast, Amazon is promising CTV/OTT delivery to audiences across its Amazon Video ecosystem of Prime Video AVOD, Twitch, and IMDb TV. Advertisers seeking to buy targeted NFL inventory or targeted NFL audiences will not only find two very different software solutions in Amazon Advertising and NBCU One, they will also find two very different portfolios of audience behaviors to monetize.

There are so many ways to think through how these differences will play out, but the simplest way to think about it may be ad allocation. NBCU One reads like a more robust, broader offering for serving video ads than Amazon Advertising. But, as this recent chart from eMarketer below suggests, that offering also implies NBCU is not focused on meeting growing demand for CTT/OTT inventory head-on.2

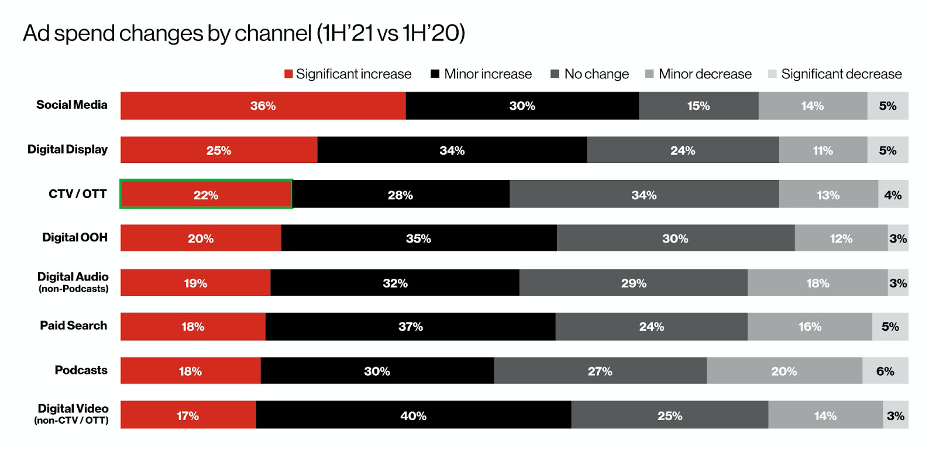

In this chart, it is immediately clear is how ad buyers in H1 2021 need more CTV/OTT while caring less for investing more in digital video.

In this light, Amazon Advertising offers the most targeted solution for this need, and NBCU One offers a less valuable solution.Amazon offers 55MM+ monthly viewers of OTT content across multiple platforms, whereas Peacock offers 33MM+ registered users of Peacock, 11.3MM of whom are active accounts. On these numbers alone, the choice seems obvious to the ad buyer who needs more CTV/OTT inventory in H1 2021: it will be a less risky, and more efficient, decision to purchase inventory from Amazon Advertising and to leverage software to target ads on Amazon than NBCU One.

In this scenario, Thursday Night Football seems like the better purchasing decision for an advertiser who values addressable advertising in CTV/OTT because there is more need for CTV/OTT inventory at scale than CTV/OTT inventory alongside digital video inventory.3

That said, as ad targeted inventory becomes more available around NFL games across linear and CTV/OTT, it is not yet clear whether Amazon’s narrower value proposition will be valued more by advertisers because it more narrowly fits their OTT/CTV needs than the broader, portfolio-driven value proposition of NBCU’s One Platform. Amazon’s larger scale (55MM to 11.3MM, or 5x) is also a factor there.

Coming back to the standoff between Peacock and Amazon, it is understandable why NBCU is reluctant to share inventory with Amazon to help them solve this question for advertisers. Amazon is incentivized to answer this question better and with greater focus. Also, with data from Peacock inventory it is positioned to better frame its competitive advantages with advertisers (remember, above, Amazon tracks all linear ads served within its Prime Video and Fire TV ecosystems). Comcast CEO Brian Roberts recently hinted at a resolution to the standoff in 2021 - it will be interesting to see how they solved for this competitive dynamic.

Conclusion

Assuming an ad buyer will be evaluating Amazon versus Peacock for NFL inventory - effectively a decision between buying against Sunday Night Football or Thursday Night Football - the simplest answer for what will dictate their choice will be context. That is the easiest decision an ad buyer can make: Amazon can deliver prime-time Thursday Night Football audiences, and Peacock can deliver prime-time Sunday Night Football audiences.

Context will always be a more consistent driver of demand for NFL content than the more sophisticated, complex variables of ad targeting like unduplicated reach and audience targeting based on first party data. In some ways, as the Roku earnings call reflected, that is a decision between inefficient spend (buying for context) and highly efficient spend (reaching a valuable target audience).

Of course, the ad buyer’s ask likely will not be either/or: both Amazon and NBCU can deliver a portfolio of options around context and targeting because that is what advertisers are increasingly asking for. That is where the complexity lies. The permutations of demands from the ad buyer, and the executions of the ad buyer’s plan, across both contextual and targeted advertising seem infinite. The ad buyer is ultimately deciding on whether they are confident the seller’s ad serving software will deliver optimal and efficient outcomes with their spend.4

Ad targeting seems to be inevitably more important to the future of both linear and streaming broadcasts, and NBCU is positioning itself to meet advertiser demand for both streaming and linear inventory. The burden will be on their NBC One platform to prove to advertisers that ads can be served across platforms, with a greater burden to prove it can target linear ads nationally.5

Whereas Amazon’s narrower, CTV/OTT streaming-focused value proposition means an advertiser will be able to buy CTV/OTT inventory elsewhere within the Amazon ecosystem, and not just a portfolio of different types of inventory.

Ultimately, how advertiser demand evolves for NFL games on Peacock and Amazon seems to ultimately rely on whether OTT/CTV ad targeting and linear TV ad targeting evolve in parallel, or whether advertisers begin to value CTV/OTT ad targeting more than linear TV.

Meaning, 10 local spots could become 10 targeted spots on Peacock, or other inventory could become targeted and those 10 local spots are local across Peacock and linear- it is all guesswork right now)

As a rule, I prefer not to use eMarketer data. But, after seeing a summary of its data in this WSJ article, I am using it this week because it helps to simplify a complicated story.

There is the scenario of an advertiser buying from both NBCU and Amazon. The issue there lies less with either NBCU and Amazon inventory, and more with requiring a single solution that can track and correlate performance across two different ecosystems run upon two very different sets of data.

These differences will become more relevant as ad inventory available for targeting in NFL broadcasts inevitably expands from the currently-allocated 10 ad slots for local ads towards somewhere closer to 100% of the ad slots.

It also carries an implicit burden of needing to prove that audiences consuming digital video inventory offers value similar to audiences to CTV/OTT inventory.