Member Mailing #269 Preview: Disney, Sinclair & The Sports Streaming Consumer

“Live sports will change to reflect consumer preferences" & ESPN+ seems to be the only sports streaming service that understands the consumer

You are reading a preview of PARQOR Member Mailings. To get read the rest of this Mailing and to help to identify the connections and disconnects between supply and demand, and strategy and execution in the streaming marketplace.

Key Takeaways

"Live sports will change to reflect consumer preferences", but only Disney seems to understand that

Disney is solving for live sports streaming by being more immediately responsive to consumer feedback

Pricing and price-value relationship have been fundamental to Disney’s success in growing ESPN+, to date

Sinclair seems positioned to be unable to deliver on price and price-value relationship, or to adapt to rapidly evolving consumer preferences

It may not be unfair to conclude that while Sinclair is playing checkers, Disney is playing chess in sports streaming

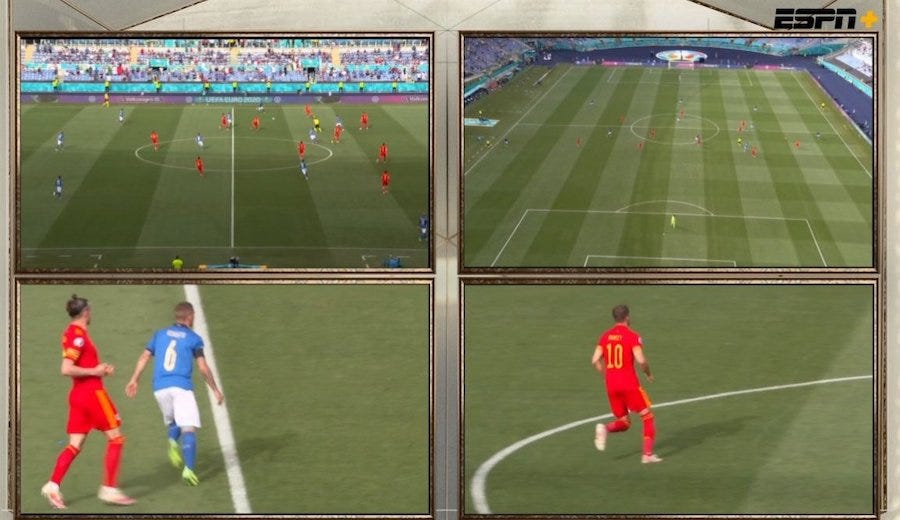

On Monday I watched France’s Kylan Mbappé miss a game-tying penalty kick from four multi-cam angles on my TV yesterday. I was watching the ESPN+ alternate feed of the Euro 2020 quarterfinal match of Switzerland vs. France on the Hulu app of my Roku.

In this sample screenshot, the match broadcast is in the upper left, an aerial view in the upper right, and player-centric cams on key players of each team are on the bottom left and right.

ESPN+ is streaming all 51 Euro 2020 matches live on ESPN+ in this multi-cam format. Those who have the Disney+ or have purchased the ESPN+ add-on within Hulu (at $5.99 per month) may watch the Euro 2020 matches, but only in this format.

It is an unusually innovative move from Disney, made possible only by its unsual focus on negotiating sports distribution rights deals specific to its Direct to Consumer (DTC) business. Those terms permit both multi-cam simulcasts on ESPN+, and those ESPN+ broadcasts to be distributed through Hulu.

Disney CEO Bob Chapek was asked about these deals, and its strategy of “flexibility”, at the JP Morgan Global Technology, Media and Communications Conference last month. He responded:

Well, as you know, we've got new deals with the NFL, with Major League Baseball, with NHL and La Liga. And that flexibility for us, as we need, to pivot towards a direct-to-consumer ESPN+ type platform, has been an important component that we insist upon for each one of these deals. So whether it's an exclusive right or a simulcast right, it's important that we go ahead and utilize our content that we have purchased the rights to in a way that we see fit, again given that distribution flexibility that we talked about so much at the onset of this conversation.

But the speed of how we do this is going to really depend on, I would say, a couple of factors: Number one is consumer behavior and where they want to watch. I watched some great golf matches on ESPN+, following individual golfers this weekend, which was really, I mean, fascinating. They're doing a great job with things like that. But at the same time, there's rights constraints that we have that might meter how fast or how slow we go. And then existing deals can do that as well. And then, of course, we'll only do it if it's accretive to our shareholders. So when the time is right to really stomp on the gas, and go even stronger into our direct-to- consumer platforms for sports, we'll do that.

The business logic of Chapek’s response mirrors the business logic of a Twitter thread from Antenna CEO Rameez Tase, arguing “live sports will change to reflect consumer preferences".

The screengrab, above, comes from a blog post that complained about the initial version of ESPN+’s multi-cam experiment. Disney responded to this and other consumer complaints by changing the feed layout to a new, multi-cam view, above, one week later. This response is particularly notable for the unusual operational agility and speed.

Compare this to Sinclair’s recently filed 8-K with details on its upcoming DTC service. Sinclair is in the midst of building out a long-promised DTC service, scheduled to be released later this year at a price originally thought to be $23 but now TBD (I wrote about the $23 price point earlier this month in Monday AM Briefing #55).

Both Disney and Sinclair are solving similar problems: their linear businesses have been cash cows, but they need to act fast as cord-cutting increasingly drives audiences away from the linear consumption model. They will need to make up not only for lost revenues from cord-cutting, but lost profit margins (40%+). To do so, both believe that the live sports viewing experience will need to change to adapt to consumer preferences.

Where they diverge is how each solves for that change. They have two very different approaches to the product aspect of Product Channel Fit. Their key differences lie in pricing and price-value relationship, and in how each is defining what consumers need from a sports streaming product.

The comparison reveals Sinclair’s streaming objectives and read of the streaming marketplace to be problematic.

This has been a preview of this week’s Member Mailing.

Subscribe today to read the full article here!