Member Mailing #269: Disney, Sinclair & The Sports Streaming Consumer

“Live sports will change to reflect consumer preferences" & ESPN+ seems to be the only sports streaming service that understands the consumer

Key Takeaways

"Live sports will change to reflect consumer preferences", but only Disney seems to understand that

Disney is solving for live sports streaming by being more immediately responsive to consumer feedback

Pricing and price-value relationship have been fundamental to Disney’s success in growing ESPN+, to date

Sinclair seems positioned to be unable to deliver on price and price-value relationship, or to adapt to rapidly evolving consumer preferences

It may not be unfair to conclude that while Sinclair is playing checkers, Disney is playing chess in sports streaming

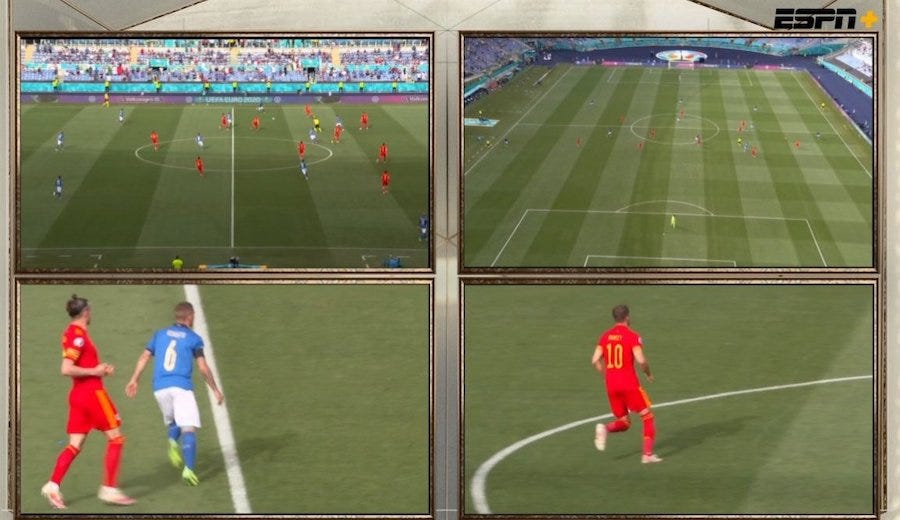

On Monday I watched France’s Kylan Mbappé miss a game-tying penalty kick from four multi-cam angles on my TV yesterday. I was watching the ESPN+ alternate feed of the Euro 2020 quarterfinal match of Switzerland vs. France on the Hulu app of my Roku.

In this sample screenshot, the match broadcast is in the upper left, an aerial view in the upper right, and player-centric cams on key players of each team are on the bottom left and right.

ESPN+ is streaming all 51 Euro 2020 matches live on ESPN+ in this multi-cam format. Those who have the Disney+ or have purchased the ESPN+ add-on within Hulu (at $5.99 per month) may watch the Euro 2020 matches, but only in this format.

It is an unusually innovative move from Disney, made possible only by its unusual focus on negotiating sports distribution rights deals specific to its Direct to Consumer (DTC) business. Those terms permit both multi-cam simulcasts on ESPN+, and those ESPN+ broadcasts to be distributed through Hulu.

Disney CEO Bob Chapek was asked about these deals, and its strategy of “flexibility”, at the JP Morgan Global Technology, Media and Communications Conference last month. He responded:

Well, as you know, we've got new deals with the NFL, with Major League Baseball, with NHL and La Liga. And that flexibility for us, as we need, to pivot towards a direct-to-consumer ESPN+ type platform, has been an important component that we insist upon for each one of these deals. So whether it's an exclusive right or a simulcast right, it's important that we go ahead and utilize our content that we have purchased the rights to in a way that we see fit, again given that distribution flexibility that we talked about so much at the onset of this conversation.

But the speed of how we do this is going to really depend on, I would say, a couple of factors: Number one is consumer behavior and where they want to watch. I watched some great golf matches on ESPN+, following individual golfers this weekend, which was really, I mean, fascinating. They're doing a great job with things like that. But at the same time, there's rights constraints that we have that might meter how fast or how slow we go. And then existing deals can do that as well. And then, of course, we'll only do it if it's accretive to our shareholders. So when the time is right to really stomp on the gas, and go even stronger into our direct-to- consumer platforms for sports, we'll do that.

The business logic of Chapek’s response mirrors the business logic of a Twitter thread from Antenna CEO Rameez Tase, arguing “live sports will change to reflect consumer preferences".

The screengrab, above, comes from a blog post that complained about the initial version of ESPN+’s multi-cam experiment. Disney responded to this and other consumer complaints by changing the feed layout to a new, multi-cam view, above, one week later. This response is particularly notable for the unusual operational agility and speed.

Compare this to Sinclair’s recently filed 8-K with details on its upcoming DTC service. Sinclair is in the midst of building out a long-promised DTC service, scheduled to be released later this year at a price originally thought to be $23 but now TBD (I wrote about the $23 price point earlier this month in Monday AM Briefing #55).

Both Disney and Sinclair are solving similar problems: their linear businesses have been cash cows, but they need to act fast as cord-cutting increasingly drives audiences away from the linear consumption model. They will need to make up not only for lost revenues from cord-cutting, but lost profit margins (40%+). To do so, both believe that the live sports viewing experience will need to change to adapt to consumer preferences.

Where they diverge is they have two very different approaches to the product aspect of Product Channel Fit. Their key differences lie in pricing and price-value relationship, and in how each is defining what consumers need from a sports streaming product.

The comparison reveals Sinclair’s streaming objectives and read of the streaming marketplace to be problematic.

Disney, Sinclair & The Innovator’s Dilemma

Bernstein media analyst Todd Juenger recently offered a critique of the proposed Warner Bros. Discovery merger that is quite helpful for framing the distinctions between Disney’s and Sinclair’s strategies:

Juenger noted that all of the funds to support their streaming efforts come from traditional linear network affiliate fees and advertising revenue, both segments which are in sharp decline. And he added any unanticipated disruption to that side of the business -- accelerated cord cutting, a drop in ad revenue, a recession -- would put the entire streaming strategy at risk.

“Ironically, the more successful the streaming service becomes in the market – the more pressure is put on the linear networks,” Juenger wrote. “Which is the tyranny of the innovator's dilemma. (And also important to investor expectations about earnings and multiple. The more bullish one is on streaming, the more bearish one must be on legacy. And vice-versa). “

Adding to the potential injury is that both companies have networks with their own specific risks. Discovery’s networks, according to Juenger, have the highest operating margins in the industry (60%), but the risk is that any downturn in revenue would fall directly to the cash flow line at a very high rate.

Juenger’s perspectives also apply to both Sinclair and Disney, which took enormous hits to cash flow from pandemic-related interruptions to sports. But the impact on the cash flow line of each business was for different reasons: both MVPDs and vMVPDs were actively dropping Sinclair’s Regional Sports Networks (RSN) during the pandemic, but none were dropping ESPN networks. Rather, ESPN had fewer live sporting events to monetize.

Sinclair had $2.4B in operating losses in 2020, forcing it to reported an impairment loss on the RSNs of approximately $4.2 billion (reflecting the original $9.6B price tag for the 21 Fox RSNs). It also is on the hook for $420MM in rebates to distributors in 2020.

Disney raised $11B of new debt last May “to mitigate the impact to cash flow and liquidity” of a projected $4.4B negative free cash flow.

Both are now proceeding with their streaming bets fully aware that free cash flow from linear operations is on the decline. Sinclair is raising $600MM in part to fund its streaming service, an acknowledgement that current and projected cash flows will be insufficient to fund the pivot to DTC.

Whereas, Chapek told the JP Morgan conference that Disney is undergoing a “multiyear transition to a very strong DTC business” funded by the cash flows from linear:

To some extent, our linear businesses right now are just generating a ton of cash flow, which for a business that's emerging from a very tough year from a COVID standpoint where we took on some debt to give us a better cash position, pandemic-related, I think it's nice to have a strong cash flow business like those linear businesses. And frankly, they're also funding our DTC investments; that would be pretty difficult without that cash flow.

Sinclair is solving for a precipitous decline in linear consumption of RSNs only from cord-cutting, while Disney is navigating a more steadily managed decline of cord-cutting that is funding its pivot to direct-to-consumer.

These economics, alone, may explain the difference in approaches to pricing and price-value. But there are other consumer-related considerations at play.

Disney’s DTC Solution: ESPN+

Disney’s approach to sports streaming has been more piecemeal than Sinclair: meaning it seems to be more focused on what it can deliver to consumers within the constraints of its business model and rights distribution agreements. It is pursuing complementary models in DTC with sports betting (with Draft Kings) and Pay-Per-View (with UFC), both of which are integrated into the app.

So, the focus of the execution is clear - streaming plus marginally valuable services - but the moving pieces of the business model are a bit more complex. In the JP Morgan Conference, alone, Chapek speaks to weighing various considerations like:

pricing

value (via bundles)

distribution channels

consumer behavior/preferences

rights agreements, and

shareholder value

ESPN+ is a streaming app, first, and it has Product Channel Fit as a streaming app. But, “price-value relationship” for a sports-streaming app is core to the ESPN+ value proposition. Every iterative decision they make is towards that objective, and with consumer behavior/preferences, rights agreements, and shareholder value in mind.

Consumers’ needs more from sports streaming are not static, they are evolving.1

Sinclair’s DTC Solution: TBD

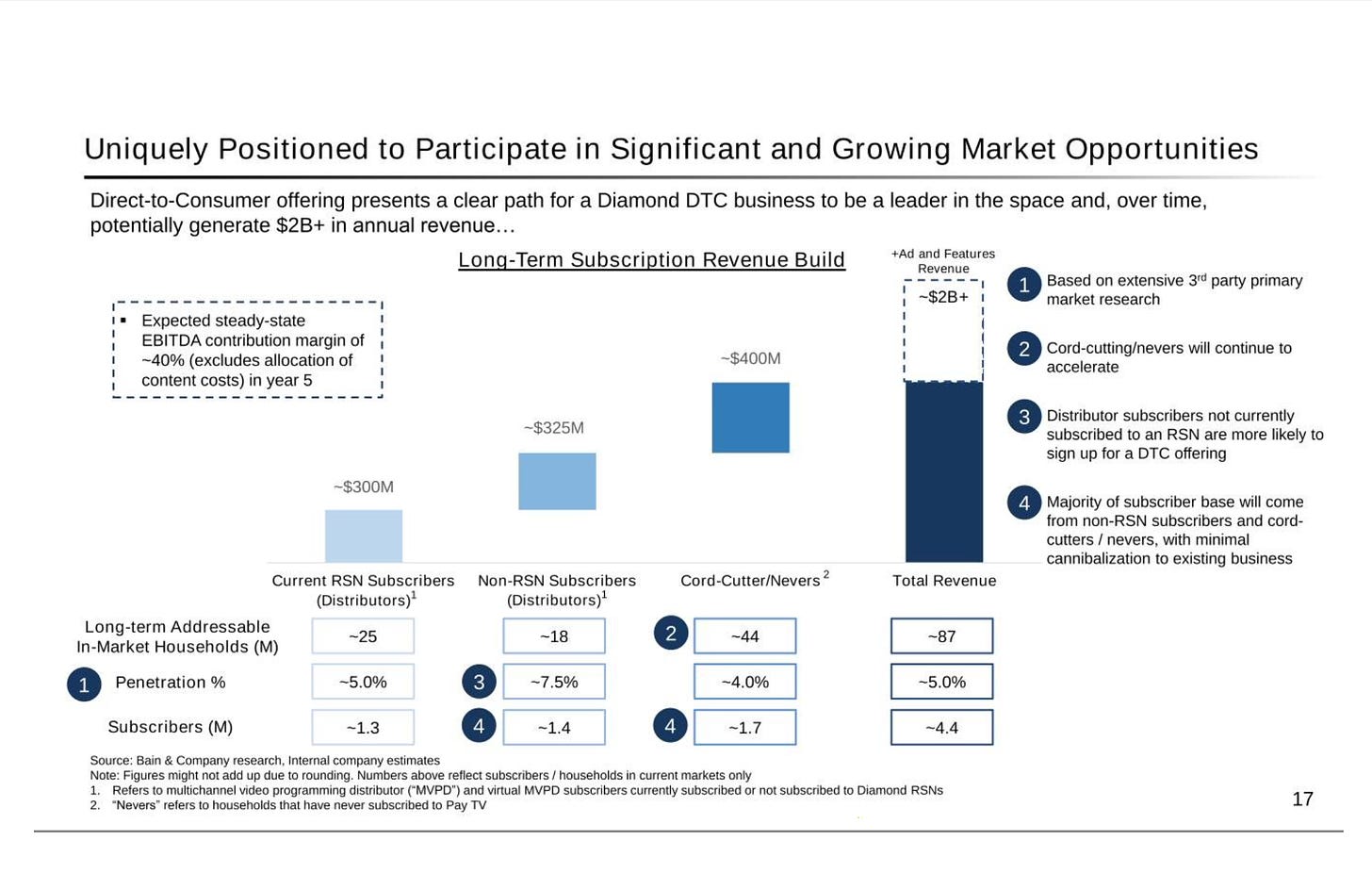

Sinclair’s recent 8-K offers details about its future streaming service, though it tells us more about what Sinclair’s research tells it about streaming consumers.

Price and price-value relationship are the challenges for Sinclair. Notably, the 8-K does not include a price for the future DTC service, which has been speculated to be $23/month. Sinclair CEO Chris Ripley recently told a reporter that the rumored price is not true, and Sinclair is conducting market research to determine a “fair price” for the DTC service.

Sinclair needs to propose a price that converts local fans and also solves for the lost economics of cancelled or postponed RSN distribution agreements. The average RSN charges about $3.53 per subscriber per month, and the Sinclair RSNs charge distributors between $2.42 and $7.52 per subscriber per month. As I wrote two weeks ago:

Sinclair is attempting to replace a guaranteed $3/month across 52MM RSN subscribers, or just under $2B per year, with a $23/month fee across a bucket of different, seasonal consumption patterns over the year, and different target consumers within those buckets. To gross the same amount of revenue annually, it would need to average just under 7MM subscribers per month at $23, or 13.5% of those 52MM subscribers.

The problem is, the $23/month price estimate may be too low and too complicated to attain:

In a March podcast with the Minneapolis Star-Tribune, The Streamable co-founder Jason Gurwin estimated that Sinclair would have to charge as much as $40 per month for the standalone service, less if there is a heavy sports betting component.

“So if they need to charge the consumer $40 a month in order to break even on rights fees, I could imagine a world where they're like 'Hey, if you are gambling $100 a month through our service, we'll give you the RSNs for free.' But obviously online sports betting is not legal yet in Minnesota," Gurwin said in the podcast.

Meaning, Sinclair could solve for lower prices where online sports betting is legal, but it will require other solutions where online sports betting is not yet legal (Action Network has a good map and summary of online sports betting in the U.S.).2

ESPN+ has been able to scale moderately at a price point well beneath its affiliate fee of $7.64 to $9. Sinclair is betting it can scale with the mirror opposite strategy with a price point that will need to be as high as 12.5x its current monthly revenue per subscriber.

Despite that, Sinclair believes it will reach as many as 4.4MM subscribers.3

This all points to Sinclair having two problems around the price-value relationship:

it may not be able to set a compelling price for users. and

a lower price point seems contingent on the feasibility of its sports betting and gaming price-value proposition

To achieve the type of scale it seeks for a streaming app, Sinclair is going to need help in solving for price-value relationship. That will require bundling in some form.

Unlike Disney, it is not cynical enough about what sports fans need from DTC streaming.4

Understanding The Streaming Consumer

Returning to ESPN+’s multi-cam execution, I also think it is worth noting the fundamental differences in Disney’s relationship with consumers, and Sinclair’s relationship with consumers.

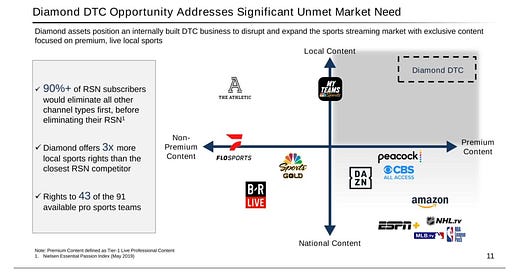

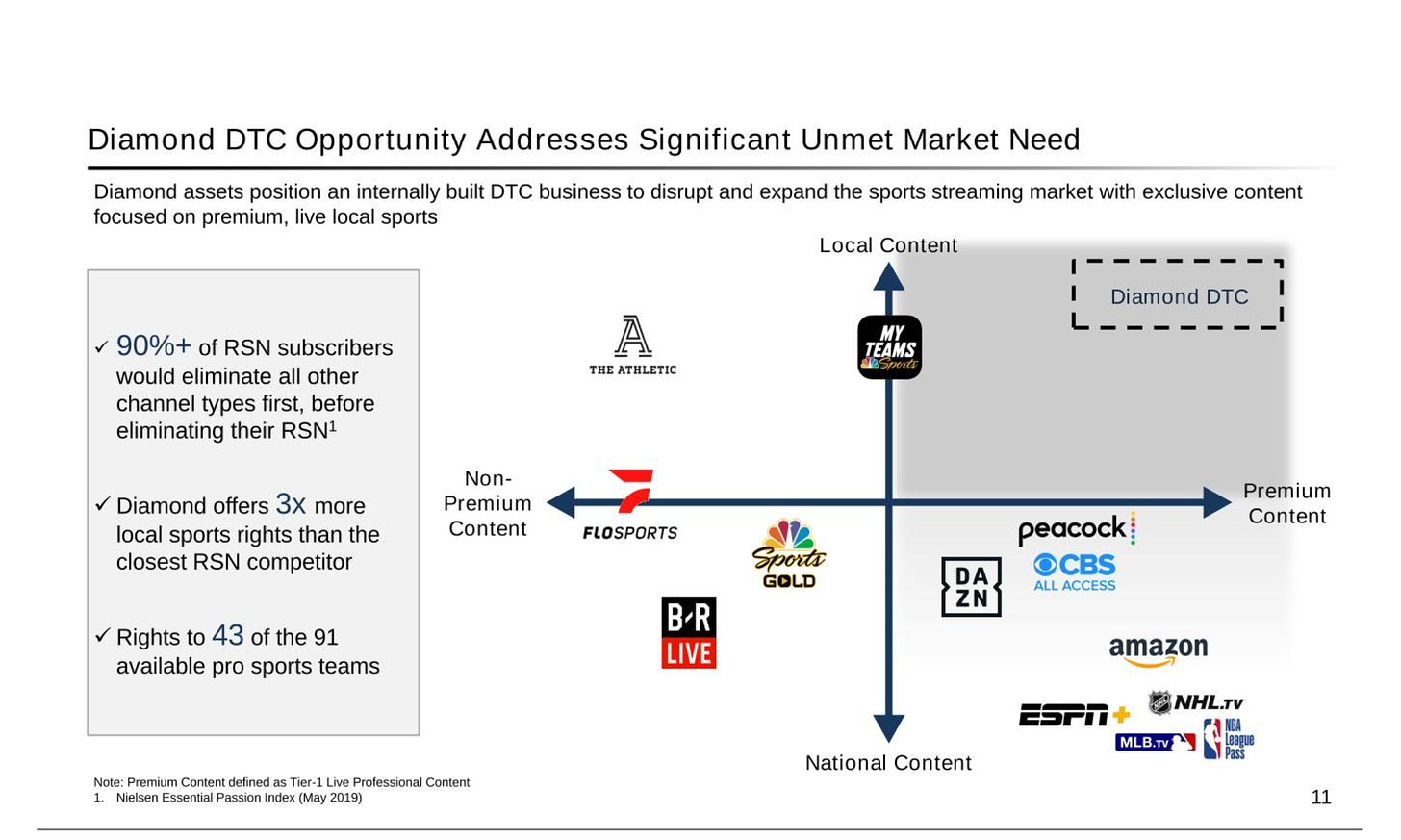

Sinclair frames its market opportunity as meeting a quadrant of “unmet market demand” for a mix of local content and premium content. It divides streaming demand based on content preferences, not interface. It seems to present a near-certain understanding of streaming consumers based on its research.

By contrast, Disney’s multi-cam viewing experience and iterative, evolutionary approach to product development, above, seems more circumspect, if not unusually sensitive to, what sports consumers want.

It is no accident that ESPN+ finds itself in the same quadrant as consumer-obsessed services Amazon, MLB.tv, NHL.tv, and NBA League Pass. Because, all five of those services are consumer-obsessed, and Sinclair is implying that approach is a negative.

So I think Sinclair may not realize that its four quadrant chart is actually an argument against its proposed streaming strategy. I think the reality of sports streaming is closer to Disney’s perspective: an iterative, evolving relationship that benefits from a close relationship with consumers, and unusually fast product development.

Conclusion

I continue to be impressed that Disney responded to consumer complaints about its ESPN+ multi-cam and made a change within a week’s time. It is both unusual for a legacy media company in streaming, and seems especially unusual when compared to the product development inertia at both Peacock and Paramount+.

It is powerful evidence of Antenna CEO Rameez Tase’s prediction that "live sports will change to reflect consumer preferences". It also reflects the implicit logic of Tase’s point: to succeed live sports streaming must understand and adapt to consumer demand as uncertain and evolving.

In this light, Disney’s strategy is nuanced: it effectively concedes that it does not fully understand the sports streaming consumer’s preferences, because those preferences are evolving in real-time. So its approach is to learn, iterate, and adapt.

Sinclair’s is less nuanced: it believes there is “unmet demand” from sports streaming consumers seeking premium, live local sports, and it is narrowly focused on meeting that demand with streaming, sports betting and gaming.

To be fair to Sinclair, it is solving for an extraordinary pain point: $9.6B spent on Fox’s RSNs without the foresight of a once-in-a-century pandemic accelerating cord-cutting trends. A Disney+-like bundle may be the best solution, but it is no position to build one, so the open question is where it will be able to find one.

Sinclair may have a solution for price-value relationship with its bet on gaming: it offers a logical inroad for a partnership for a bundle. But, ironically, as I argued in Member Mailing #266: Netflix & Verizon Test Bundling Streaming with Gaming:

The only market participant with a clear vision of how gaming fits into their bundling plans is Disney, and their clear vision is to pass on the risk to Verizon to test the bundle model.

Even Disney understands that the value of gaming in a bundle is better served by third-parties. It may not be unfair to conclude that while Sinclair is playing checkers, Disney is playing chess.

There are legitimate questions to be asked whether this methodical dance with consumers is the right approach given that ESPN+ has a fraction of the subscribers of either Hulu or Disney+ with 12.1MM. That said, the obvious answers - ESPN+’s near 4x growth from 3.1MM subs since the launch of the Disney+ bundle, the quick turnaround of a new streaming interface in response to fan complaints - are compelling.

Also, Sinclair CEO Chris Ripley recently told a reporter that the rumored price is not true, and Sinclair is conducting market research to determine a “fair price” for the DTC service.

4.4MM subscribers is well below the 7MM I projected in Monday AM Briefing #53:

Sinclair is attempting to replace a guaranteed $3/month across 52MM RSN subscribers, or just under $2B per year, with a $23/month fee across a bucket of different, seasonal consumption patterns over the year, and different target consumers within those buckets. To gross the same amount of revenue annually, it would need to average just under 7MM subscribers per month at $23, or 13.5% of those 52MM subscribers.

I also think a third challenge exists for Sinclair around marketing, as I highlighted two weeks ago: I am skeptical Sinclair understands the sophisticated marketing required to drive both streaming and sports betting subscribers to the same app, whatever the price.

Its deal with Bally’s to rename the Fox RSNs as Bally Sports RSNs, guarantees Sinclair $88MM over 10 years. But that relationship solves more for leveraging sports betting to drive local engagement with local fans.