Member Mailing #273: MGM Resorts M life "Convergence" vs. "Metaverse" Convergence

MGM Resorts inspired the PARQOR Hypothesis & offers valuable precedent for understanding "Metaverse"-type online/offline convergence in media

Key Takeaways

A lack of transparency in OTT streaming may be a reason why the “Metaverse” is capturing the marketplace’s imagination about the future of media.

But, the “Metaverse” is a concept that has yet to substantively answer, “what will online/offline convergence look like operationally and strategically?”

I like The PARQOR Hypothesis and the IAC Q2 2020 Shareholder Letter as helpful baselines for answering this question.

IAC’s rationale for investing in MGM Resorts in August 2020 was to solve for convergence and Omni-Channel but not to build a “Metaverse”.

MGM’s success in solving for its pain points may not inspire the imagination like the “Metaverse”, but it is unusually valuable precedent.

A lack of transparency has become a feature, and not a bug, of the OTT streaming marketplace.

The more often Disney, WarnerMedia and Apple TV tell us that new series are setting new records but without any data, or when a Netflix executive casually dilutes a success story like 6 Underground in an interview with Variety, it becomes objectively less appealing to imagine where the OTT marketplace is headed. Each player seems like they have too much to hide.

Without transparency, how do we think about the future of media in the streaming marketplace?

There are few, if any, good answers.

I think this is one reason why the concept of the Metaverse is capturing more of the collective imagination about the future of media than streaming is.

But, the Metaverse is still a concept, or “a wide set of protocols, technology, tubes and languages, plus access devices and content and communication experiences atop them”, as essayist Matthew Ball has described it.

It was a vaguely defined, guiding concept for the Internet in 1992, and it is still a vaguely defined, guiding concept in 2021. That’s the point of Twitter CEO Jack Dorsey’s tweet, above.

There is now more of an overarching business logic to the concept in 2021 than in 1992 with both cloud computing and DTC business models driving the gaming industry towards “Metaverse”-type models (e.g., Epic Games). But, beyond gaming there is still not much business substance to it, especially in legacy media.

The appeal of the concept is convergence: how will gaming, music, streaming, Virtual Reality, Augmented Reality, and e-commerce drive the convergence of digital and physical worlds, private and public networks/experiences, and open and closed platforms?

More importantly, what will this convergence look like operationally and strategically?

I like The PARQOR Hypothesis and the IAC Q2 2020 Shareholder Letter as helpful baselines for answering this question. Because IAC’s rationale for investing in MGM Resorts in August 2020 was not to build a Metaverse.

Rather, the rationale was “to build great interactive businesses and compound capital for our shareholders", and MGM has a rare but clear opportunity to deliver on that promise.”

IAC’s Investment Rationale

Online gaming is core to IAC’s investment rationale in putting $1B into MGM Resorts.IAC management has been following online gaming “for awhile”.

To operate true sports betting and digital gaming, a provider is currently required to partner with a local casino operator. And while we believe that regulatory environments generally catch up with consumer demand, it’s taken quite a while in this category, so we found one of the leading players operating in 7 going on 11 states by the end of 2020: MGM, which pairs a strong physical presence and brand with talented online operators in a fast-growing joint venture in online gaming. Similar to Disney’s advantages over pure-play streaming companies with an iconic brand and multiple avenues to monetize the same intellectual property between streaming, theatrical releases, merchandise, and theme parks, we believe MGM also is an aspirational brand, which could be delivered with daily accessibility and offer gaming consumers (including the 34 million M-life Rewards members) a wider range of services, both physical and digital, than any competitor. And MGM, with its highly capable joint venture partner GVC, has only just barely begun to deliver these products.

Our history in driving off-line to on-line conversion gives us confidence in the path and, like other industries we’ve seen transform, a conviction that it will be assisted by natural tailwinds.

Above, IAC lays out how and why MGM’s online and offline businesses could be better integrated and offer a wider range of services, both physical and digital, for gaming consumers.1

IAC’s significant, $1B bet2 is that MGM will perform better in both delivering online services and “driving off-line to on-line conversion” with IAC than without IAC.

What makes IAC’s bet particularly notable is how it came one year after MGM Resorts announced MGM 2020:

a company-wide, business-optimization initiative aimed to leverage a more centralized organization to maximize profitability and, through key investments in technology, lay the groundwork for the Company's digital transformation to drive revenue growth.

The two business objectives announced were:

Organizational changes to improve operating efficiencies, and

Investing in the Company's digital transformation to drive revenue growth

For #2, the specific objective was:

to reallocate a portion of [MGM’s] annual capital expenditure budget to specific technology advancements that will increase revenues and grow market share by innovating and elevating the guest experience through data, pricing, digital and loyalty capabilities and optimizing business mix. Through the Company's digital transformation, the Company expects to realize $100 million of annualized Adjusted EBITDA uplift by year end 2021.

IAC’s $1B bet honed in on the weaknesses of MGM’s ability to execute this objective. IAC never sought to build a “Metaverse” but rather a better consumer loyalty program.

MGM Resorts, M life, BetMGM & Omni-Channel

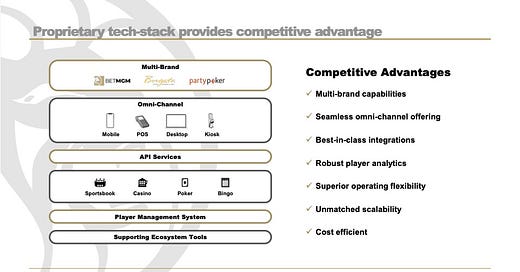

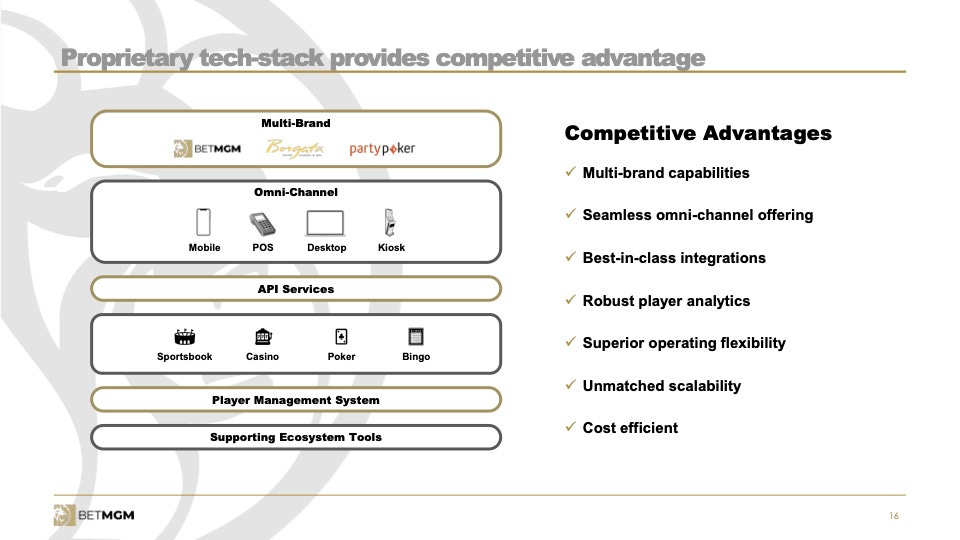

It is notable the key term IAC uses above is “Omni-channel”, which is a type of retail that integrates the different methods of shopping available to consumers. It is not the “Metaverse”, but it is still a business model built around online and offline convergence, as seen below.

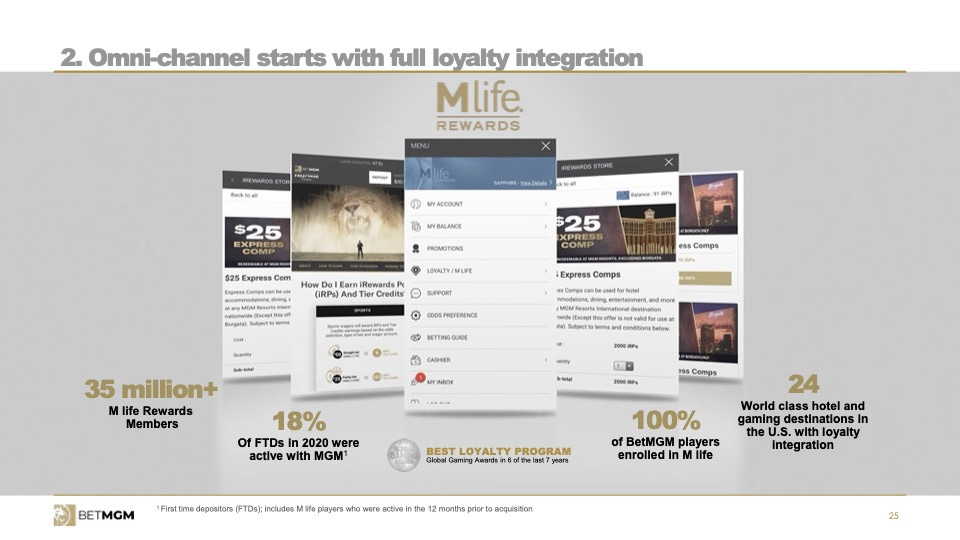

M life Rewards seem to be key to the Omni-Channel model.

MGM fleshed out Omni-Channel at its Investor Day Presentation in April:

In one slide, we can see how convergence works for MGM Resorts: it starts with loyalty integration, and builds online and offline access around it.

That does not make a CDP focused on loyalty integration or Omni-Channel models necessary conditions for operational and strategic convergence, or for a plug-and-play solution. But, it reflects how functional technological solutions offer immediate, less exciting solutions for convergence.

MGM Resorts CEO and President Bill Hornbuckle fleshed out how M life Rewards are essential to omni-channel sales on the Q1 2021 earnings call:

One of BetMGM's key competitive advantages is its ability to lever MGM's destinations, our broad-based offerings, and our M life loyalty program as efficient and affect customer acquisition and retention tools. MGM also benefited from its relationship not only our new customers being introduced to M life, but through BetMGM, we're also reigniting relationships with customers that had gone dormant. In the first quarter, 10% of BetMGM's new players came from MGM, and 44% of the new M Life sign-ups have come from BetMGM. Putting this together, we see significant value in this opportunity over time, and that's why both partners remain committed to ensuing and ensuring BetMGM's leadership in this space.

M life is now “Metaverse”-like in how it has become both “gateway to most digital experiences” and “a key component of all physical ones”. Notably, the “Metaverse” was not business objective pre-IAC investment and it has not become one after the investment.

MGM Resorts & the Amperity Customer Data Platform (CDP)

It is worth briefly diving into Hornbuckle’s claim that “through BetMGM, we're also reigniting relationships with [M life] customers that had gone dormant.”

Meaning, the technology driving MGM’s customer relationships has fundamentally changed since MGM 2020 was announced in 2019, and since the IAC investment in August 2020.

One key change was MGM Resorts partnering with Amperity’s Customer Data Platform (announced in November 2020):

Being able to trust our data and have access to it in less than an hour has been a complete game-changer," said Prakash Ranjan, VP of Engineering, Marketing Technology & Digital Ventures at MGM. "We had teams across the enterprise debating the accuracy and validity of their customer data models, but with Amperity, we're no longer wasting time figuring out who our customers truly are. Each one of those teams can now do something more productive and in the best interest of our guests."

With Amperity's CDP, MGM has now achieved:

A single universal Customer 360 database replacing multiple separate team databases

Significant deduplication of records for greater accuracy in reaching customers

The ability to create flexible predictive modeling accounting for customer experiences beyond gaming

In other words, MGM sought to leverage a fundamentally different software technology (CDP) to manage and build out its customer relationships across platforms. But, it expressly did not seek to build out a “Metaverse”.

A statistic like “44% of the new M Life sign-ups have come from BetMGM” is significant because it reflects how the growth of M life was limited to casinos.

M life now has 1MM new sign-ups since August 2020. But for a more robust technological back-end, MGM would not have found ~440K new additions to its customer database.

MGM’s move into online gaming has nothing to do with the “Metaverse”, but it delivers “Metaverse”-like results in a highly technical and unflashy way.

That is important.

What about legacy media?

As IAC memo highlights, Disney is the closest analogue to MGM Resorts’ model.

So, it is worth adding how Disney CEO Bob Chapek described its CDP strategy at the JP Morgan Global Technology, Media and Communications Conference in May:

And then just again, the shifts in consumer behavior where people, if they want to stay home and watch a movie, they want to stay home and watch a movie and they don't want to be coerced into doing something that they don't want. I think you've got all those things. Plus our - sort of our secret weapon, which is we've not had Disney+ operating in any sense in a full robust way while our parks have been operating, right? Because as soon as Disney+ kind of got really going, our parks shut down because of the pandemic. And so for the very first time, we've got the opportunity to take our original direct-to-consumer business, which is our park business, and use it for our newest direct-to-consumer business. And we've got tremendous amount of information on our consumers from our parks business and what would happen if we married that and actually mine that data to help people subscribe to Disney+ knowing what we know.

And I think it really gives us a big opportunity to take a leap forward on our direct-to-consumer business. But I think it's also important to note that we're not really managing our platforms for quarter-to-quarter growth. We're really managing it for the long-term. We're still essentially in a launch phase. We've been ramping up in content and it's really content-dependent.

It is an important quote for three reasons. First, we have it frames how important the overlap between Disney+ and theme parks customer data is to the future of its DTC efforts.

Second, Chapek frames the objective as longer term as “we're not really managing our platforms for quarter-to-quarter growth”. Like MGM 2020, there is a longer plan for transforming the consumer relationship to primarily DTC.

Third, and most importantly, Chapek does not use the term “Metaverse”, once. The business objectives are concrete, and they make the complex exercise of marrying theme parks data with streaming data seem less abstract, seamless, and feasible.

But “Metaverse” is still a term that Disney is using, as an interview with Disney Parks Chairman Josh D’Amaro from April highlights:

In the last year, streaming has become the primary focus for Disney. In many ways, Disney is very much a tech company now. How do the parks fit into that new focus?

I think they fit perfectly. Clearly, Disney+ has been phenomenally successful at the Disney company. We have the benefit of having these unbelievably powerful assets in the ground and the combination of a company that’s got such a strong and growing digital footprint, with the physical footprint, I think gives us opportunity to fuse those two things together like no other company can.

I’m sure you’ve heard this word before: “metaverse.” An opportunity to essentially bring these assets into a digital framework. It provides us with unending opportunities at these theme parks. It can bring Main Street alive in ways that you’ve never seen it before, never thought about it before. You can have the whole theme park participate in a game that culminates in a celebration at the hub at the top of Main Street. The possibilities are endless and I think that’s where we’re incredibly unique at the Disney company. This combination of a very forward-looking digital footprint with our legacy assets that we have in place, and making them incredibly relevant today.

In contrast to Chapek, D’Amaro’s description of bringing real estate assets into a digital framework is far more obtuse and uses language in broad brushstrokes. It is also more abstract than MGM Resorts’ ongoing project to build out the online component of M life.

That seems significant, suggesting Chapek’s ambitions are more concrete than the “Metaverse”.

Conclusion

MGM now expects revenues from BetMGM operations to reach over $1 billion in 2022, and projects long-term U.S. market share to be between 20% and 25% range and long-term EBITDA margins in the 30% to 35% range.

MGM’s broader objective in online is “to build great interactive businesses and compound capital for our shareholders”, and MGM has a rare but clear opportunity to deliver on that promise.”

The business logic of BetMGM is clear: it levers MGM's destinations, broad-based offerings, and the M life loyalty program as efficient and effective customer acquisition and retention tools.

A sentence like that does not have the same creative flair as descriptions of the conceptual “Metaverse” do. It is also more concrete. Sadly, that means it is unlikely to inspire much of the same Twitter chatter and blog posts imagining what it means for “Metaverses” to exist in the media marketplace.

But, it cleanly frames a “Metaverse”-type outcome of online and offline convergence, and what it looks like operationally and strategically. If there is any takeaway, a key pillar of that approach in 2021 is identifying the right Customer Data Platform solution.

Whether it is Amperity or another CDP, the point is that MGM Resorts has taken a highly technical, AI-driven solution and re-imagined its online and offline consumer relationships. It did not go big picture or abstract in the pursuit of conceptual objectives.

MGM Resorts’ initial success in solving for its pain points may not inspire the marketplace’s imagination like the “Metaverse”, but it is valuable precedent.

It also lays out the basic attributes for the BEADS acronym for The PARQOR Hypothesis (in its Disney comparison):

an Aspirational Brand

Existing user base at scale

Multiple Avenues to monetizing the same IP, and

Daily value proposition (something new for fans to consume daily)

Sales Channels: Online (digital) and offline (physical) commerce