Member Mailing #276: Hollywood-meets-Creator-Economy, YouTube, Spotify and OnlyFans

Stories about YouTube, Spotify and OnlyFans last week shed valuable new light on the moving pieces of the Hollywood-meets-Creator-Economy business models

Key Takeaways

Stories about YouTube, Spotify and OnlyFans last week shed new light on the moving pieces of Blackstone’s $900MM bet on Hello Sunshine.

They also shed valuable light on why Hollywood-meets-Creator-Economy models are unusually risky.

Surprisingly, Amazon is unusually well-positioned to solve for these unusual risks.

If you are Blackstone, Kevin Mayer and Tom Staggs, does anything change in strategy and operational roadmap after the past week?

That said, Hello Sunshine and its imitators may need to rely heavily on legacy production for revenues going forward.

I think the $900MM price tag for Reese Witherspoon’s Hello Sunshine has overshadowed the Hollywood-meets-Creator-Economy business logic behind the investment by Kevin Mayer and Tom Staggs.

I wrote about Hello Sunshine before in A Short Essay on Talent Trade-offs in Streaming vs. The Creator Economy. At the root of Hello Sunshine’s business model are four cornerstones that lie within the overlap between both marketplaces:

Production Business

Book Club

E-Commerce

Audio (Podcasts)

Meaning, Reese Witherspoon is both an A-List Hollywood talent with a traditional production studio, and she is also has a direct-to-consumer (DTC) brand with multiple channels and community for monetizing those DTC relationships.

That is, in essence, Hollywood-meets-Creator-Economy business logic.

There is an implicit plug-and-play logic to this point: back-end tools like Shopify and Stripe make it easier than ever for an A-list celebrity like Reese Witherspoon to launch e-commerce businesses that scale online. Gwyneth Paltrow’s GOOP has scaled off of similar technological trends and was last reported to be valued at $250MM in 2020.

But, as I asked in A Short Essay on Talent Trade-offs in Streaming vs. The Creator Economy when discussing Facebook Gaming Streamer Corinna Kopf’s $4.2MM earnings over one month on OnlyFans:

What are the trade-offs for Hollywood talent to achieve Corinna Kopf-levels of success in the creator economy? Do they offer outsized returns when compared to “safer” but decreasing streaming dollars?

To date, the answers to those questions have been more speculative than substantive, largely because there has been very little transparency in the Creator Economy.

But, last week we learned:

a big payday from Spotify may be quite costly to listener bases

“Creators are becoming storefronts for brands, whether it's their own brand or selling other people's products” on YouTube, and

OnlyFans founder Tim Stokely revealed that banks can be fickle and “unfair” partners if they disagree with the content on platforms.

These stories all shed led on the evolving dynamics of the Hollywood-meets-Creator-Economy models.

They also shed valuable light on why Hollywood-meets-Creator-Economy models are so risky that Hello Sunshine and its imitators may need to rely heavily on legacy production for revenues going forward.

Blackstone’s Bet on Hello Sunshine

The point of this essay is not to cast a bearish or bullish light on the Hello Sunshine business model, but to highlight how we now better understand its moving pieces.

The least risky cornerstone of the Hello Sunshine model is the production business revenues, which The Information reported as:

$65 million in revenue last year, a figure that is expected to double to around $125 million this year. That means Blackstone and its partners are paying about 7.2 times this year’s projected revenue to buy the firm.

It also reported Hello Sunshine is expected to more than double revenue next year, reaching $310 million in 2022.

The deal is structured so that $500MM in cash is allocated to purchasing shares from existing Hello Sunshine investors, and to fund operations. The additional $400MM+ is the “imputed” value of the equity Hello Sunshine will roll into the new, unnamed company that will be run by Kevin Mayer and Tom Staggs.

The company has $2B from Blackstone to spend on similar acquisitions.

So, Mayer’s and Staggs’ bet is that Reese Witherspoon can become a global “storefront” for her four cornerstones and other brands, as Mayer told Variety’s Cynthia Littleton:

“You should look to see us have multiple revenue streams beyond licensing and owning content. The great first step is to generate brands and franchises,” Mayer said. “We’re going to leverage that connection for other means” in line with the company’s stated focus on e-commerce transactions and building social communities around artists and brands.

Mayer and Staggs imply they value the production model most because the demand for “Category-defining content that commands a marketplace premium” is strong at streaming services:

“We want companies that are producing meaningful, category-defining content brands that resonate with their chosen audiences. We want to do that across multiple audience (sectors),” Mayer said. “There are a lot of those companies out there that would benefit from additional size and scale and to be linked up with like-minded media companies that have must-have content. We think there’s a big revenue lift that will come from tying some great companies together.”

So, the production model seems to be the least risky bet of the four cornerstones, and also currently makes up the majority of revenues for Hello Sunshine.

As for the other three cornerstones, Puck News’ Matt Belloni wrote:

The book club, and the branding work, and the podcasts, and the e-commerce on social media, and all the products that can be launched in the vein of Witherspoon’s Draper James fashion line (which is separate from this deal). Hello Sunshine might not be particularly dominant in all those categories now, but the foundation is there, Witherspoon and Harden are highly motivated, and with the expertise of two Disney guys and a sh*t-ton of money, the company can get really good at it and scale.

Mayer and Staggs are betting on grassroots growth of brands and franchises driven by “Category-defining content”, and built around talent-centered e-commerce, podcasts, and community (like book clubs) businesses.

That is their Hollywood-meets-Creator-Economy business logic, but with an unusual emphasis on grassroots.

The Costs of Joe Rogan’s Deal with Spotify

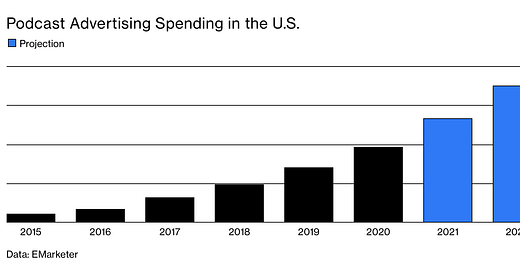

Podcasts may seem like a less risky bet given the size of deals Spotify has been offering to Hollywood talent. It has doled out enormous sums to land exclusive deals with Hollywood talent like Joe Rogan (~$100MM), Alex Cooper of Call Her Daddy ($20MM) and Dax Shepard of Armchair Expert (at least $50MM). It also purchased Gimlet Media for $230MM, and Bill Simmons’ The Ringer for $196MM.

Joe Rogan linked up his podcast business exclusively to the Spotify ecosystem last May. I wrote about the deal with the Curse of the Mogul framework last June:

Despite a 20% increase in Spotify's share price since the announcement on May 19, the move raises the question: is Joe Rogan reaping more value from this deal than Spotify shareholders in the long term?

To date, Spotify has leveraged data it has on music streaming to scale to an enormous global presence of 286MM monthly active users. With a $100MM bet on Joe Rogan, it is making an enormous bet on a single podcaster to drive more Premium Subscribers and ad-supported monthly-active users, but with less data: listening data for Rogan is spread across multiple other platforms, including other podcasting apps (Apple is the dominant one), and YouTube (where Rogan gets up to 40MM views per month for podcasts and other content).

But, there is no guarantee those audiences will follow, en masse, with Rogan to Spotify.

A recent piece by Ashely Carman at The Verge proved my writing to be prophetic:

…a new data investigation by The Verge finds that the powerful podcaster’s influence has waned since he went behind Spotify’s wall. His show has declined as a hype vehicle for guests, and Rogan’s presence as a mainstay in the news has plummeted….

Taken altogether, The Verge’s data findings suggest that Rogan has lost impact and relevance since going exclusive to Spotify. A sizable portion of his audience likely didn’t follow him when he made the jump.

Carman’s piece does an unusually good job of succinctly summing up the trade-off between payment and relevancy for Hollywood talent like Rogan:

Even still, Spotify has continued to secure exclusive deals with big names. Most recently, it signed Alex Cooper of Call Her Daddy and Dax Shepard of Armchair Expert, both of whom, if Rogan is any indicator, will likely see a drop in their listener base. For Spotify, however, the deals might be worth the tradeoff if people migrate to its app and it sells ads against these programs. For the podcasters who are receiving multimillion-dollar deals, the money exchanged might be enough to make up for lagging relevancy. At least until their contracts run out.

One implication of this trade-off for the Hello Sunshine model is that a lucrative payday for a podcast can result in a negative impact on audience engagement on other platforms:

Rogan’s reach could be dipping for a number of reasons. The show used to benefit from posting full episodes to YouTube, which usually received millions of views each and often led to snippets going viral on other platforms, like Twitter. But the YouTube channel now just hosts clips, which don’t always break the million-view milestone. Rogan also used to have visibility in other podcasting apps, which is important because not everyone uses Spotify. It’s possible that social media algorithms, and YouTube’s in particular, also helped Rogan and his guests gain a following.

The lesson of Joe Rogan’s deal with Spotify appears to be: the best available payday for Hollywood talent may also be the worst outcome for Hollywood talent seeking to build DTC businesses across platforms.1

So, Hello Sunshine may want to avoid any deals with Spotify. But, those challenges may be limited to Spotify.

Opportunities with Amazon

Amazon.com bought exclusive rights to SmartLess, the podcast hosted by actors Will Arnett, Jason Bateman and Sean Hayes, for between $60 million and $80 million.

Unlike Spotify talent deals, which limit content to the Spotify platform, the exclusivity is more narrowly defined: starting on Aug. 1, new episodes of the show will appear on Amazon Music and Wondery+ one week before they are released on other outlets.

Like Spotify, Amazon is betting heavily on Hollywood talent offers valuable inventory for advertisers in an ad marketplace slated to generate almost $2B in 2022.

Amazon seems to be a natural partner for Hello Sunshine:

Production Business ↔ Amazon Prime Video

Book Club ↔ Amazon Kindle

E-Commerce ↔ Amazon Prime

Audio ↔ Amazon Music

After the Smartless deal, Amazon seems optimally positioned to create win-win outcomes with Hello Sunshine. Whereas, a lucrative deal with Spotify may create too many off-platform risks for the rest of that model.

The implication is Amazon may be optimally positioned more broadly for owning the Hollywood-meets-Creator-Economy than Spotify.

YouTube & Creators

Chief Business Officer Robert Kyncl’s recent interview with The Information’s Kaya Yurieff offered evidence that YouTube could be an optimal home for Reese Witherspoon’s Hello Sunshine brand (she has a YouTube Channel):

This decade is really about disruption of retail. It’s obvious from everything that’s happening in the world and the rise of e-commerce. What will happen is that there will be many more places to buy from than ever before. And that’s because of platforms like YouTube, Instagram, and many others … building effectively retail into their products. The reason everybody is working on it is because—when we spoke about creators—just like they build their brands, they have captive audiences that they know how to monetize their audiences and commerce is just yet another tool in the toolbox to allow them to do that.

Creators are becoming storefronts for brands, whether it's their own brand or selling other people's products. You have democratization of music, democratization of video, and you have democratization of retail. That will be a very significant contributor to creators earnings over the next decade.

YouTube is becoming increasingly valuable for e-commerce because it enables it by allowing in-video and test hyperlinks back to an e-commerce site. It also enables 10 different money-making opportunities:

Shorts Fund (a monetization model for Shorts on YouTube)

Ads (55% rev share)

YouTube Premium (paid subscription option where the majority of subscription revenue goes to YouTube partners)

Channel Memberships (exclusive perks and content to monthly paying members)

Super Chat (a highlighted message in the chat stream to get the creator’s attention)

Super Thanks (users can express their gratitude and show support with an animated GIF and get a distinct, colorful comment to highlight their purchase, which creators can respond to)

Super Stickers (allows fans to purchase a fun sticker that stands out during livestreams and Premieres)

Merchandise (showcasing official branded merchandise from 30 different retailers globally)

Ticketing (learn about upcoming concert listings and click directly to YouTube ticketing partners’ sites)

YouTube BrandConnect (making it easier for creators and brands to create branded content that is both authentic and effective)

YouTube announced last week that it has over 2MM creators in its YouTube Partner Program, and has paid more than $30B to creators, artists, and media companies over the past three years, alone.

According to a separate post from April, fans and creators “increasingly” turned to Paid Digital Goods. In 2020, over 10M viewers bought their first Paid Digital Good (Super Chat, Super Sticker, or channel membership) on YouTube.

This all reads promising for Hello Sunshine, and other Hollywood-meets-Creator-Economy business models seeking to better monetize audiences on YouTube beyond ads. There are now multiple tools for driving e-commerce sales via YouTube, and fans of Reese Witherspoon can pay to get her attention.

Yesterday Hello Sunshine announced it had partnered with Baileys Irish Cream Liqueur and dating app Bumble for an opportunity in branded content.

Hello Sunshine will release and host three short films inspired by first-time meetings (aka “Meet Cutes”) from the Bumble app which can be viewed on the Reese Witherspoon x Hello Sunshine YouTube channel and will live in a branded content hub on The Roku Channel nationwide this fall.

But, there is one challenge: the Reese Witherspoon x Hello Sunshine YouTube channel has no subscribers, and only 13.76MM views since June 2016. By comparison, Corinna Kopf has 1.77MM subscribers and 79MM views since June 2016. Also, Will Smith has 9.5MM subscribers and just over 651MM views since December 2017.

So, the Hello Sunshine brand seems positioned well far behind comparable channels, if not the broader YouTube creator ecosystem. This ecosystem is growing exponentially and seems like an optimal channel for the Community and original content cornerstones of the Hello Sunshine model.

But, the ecosystem also includes more established creators who are already taking their fair share of a $30B over three years. How will Hello Sunshine and other Hollywood-meets-Creator-Economy models compete with those creators with more established audiences, and more comfort with the existing monetization tools on YouTube?

The Baileys and Bumble deal may be a first step in that direction. Or, it simply may be a layup of a monetization opportunity.

It falls very much in line with the risk-averse production strategy “category-defining content that commands a marketplace premium”.

YouTube & The Back-end Risks

The Hello Sunshine deal with Bumble and Baileys Irish Cream is also interesting because, in one sense, it is a partnership around “brand-safe” content.

A lack of “brand-safe” content had been an “Achilles heel” for YouTube until last February, when YouTube became the first digital platform to receive accreditation for content level brand safety from the Media Rating Council (MRC).

P&G Chief Brand Officer Marc Pritchard told Bloomberg in June:

I actually have to say YouTube has made dramatic improvements over the years that have made them a very, very worthwhile partner. You remember a few years ago we had some brand safety issues. They’ve done a remarkable job of cleaning that up and figuring out a way that you can reach a clear audience, do it in a way that’s brand safe and make sure that it’s even got relevant content.

But, the hesitation from linear TV advertisers to shift connected TV spend to YouTube, where it is seeing 120MM monthly Connected TV viewers in the U.S. alone, reflects how the platform still has many to win over:

At the heart of the issue, according to a number of brands and media buyers interviewed on a condition of anonymity, is that YouTube’s ecosystem is missing core components that TV buyers need. YouTube and Google’s CTV ecosystem, which includes YouTube TV, a live TV subscription offering, does not have adequate tools to manage frequency, which brands use to control how often they show ads to the same person. Advertisers also say they can’t use traditional ways of measuring TV inside of YouTube, making it incompatible with the rest of their ad campaigns.

So, both Reese Witherspoon and advertisers accustomed to buying against Reese Witherspoon content on TV may see opportunity in YouTube’s 120MM monthly Connected TV viewers. But, advertisers still have very good reasons not to buy Connected TV inventory on YouTube from either Hello Sunshine or YouTube.

That creates a risk of sub-optimal monetization on one of the most important channels for Hollywood-meets-Creator-Economy models to reach audiences.

OnlyFans & The Back-end Risks

The OnlyFans struggles with porn also reflected the vulnerability of creators on platforms to the values of Key Partners. OnlyFans announced plans to ban porn from its platform due to pressure from its banking partners, and then subsequently reversed that decision last week.

I wrote earlier this month that under very narrow circumstances, OnlyFans could be another channel for the Hello Sunshine model given Corinna Kopf’s success. However:

the OnlyFans model seems to fall outside of the types of female empowerment Reese Witherspoon has been pursuing with Hello Sunshine, to date. But, Blackstone is betting $2.5B on the business logic that Corinna Kopf-levels of success are attainable for Hollywood talent in the creator economy, too.

OnlyFans launched OFTV about a week after I wrote the above. It describes OFTV as featuring:

free, original content by OnlyFans creators spanning a wide variety of genres including fitness, cooking, comedy, music, and more. Creators are able to share both short- and long-form video content for their fans to watch from the convenience of their phones, tablets, and smart TVs.

Moreover, an interview of OnlyFans’ founder Tim Stokely by the Patricia Nilsson of the Financial Times reflected just how precarious its relationship with financial institutions as key partners has been:

Stokely said the change came in response to an increased level of obstacles from banks, which would “cite reputational risk and refuse our business”.

“We pay over one million creators over $300m every month, and making sure that these funds get to creators involves using the banking sector,” he said, singling out Bank of New York Mellon as having “flagged and rejected” every wire connected to the company, “making it difficult to pay our creators”.BNY Mellon’s role, in this case, was as an intermediary bank, helping with transfers between OnlyFans’ bank and the bank accounts of its creators.

Stokely also said UK-based Metro Bank had closed OnlyFans’ corporate account in 2019 with short notice and highlighted how many sex workers, including OnlyFans creators, were struggling to access basic financial services.

“JPMorgan Chase is particularly aggressive in closing accounts of sex workers or . . . any business that supports sex workers,” he said.

The implication is that there seems to be a trade-off between morality and scale on both YouTube and OnlyFans. Even if Hello Sunshine does not invest in OnlyFans, there is an enormous audience at scale there.

There is also a “constant” challenge for creators on OnlyFans:

“There’s constant insecurity for these creators because they have no stake in the platform’s actions. They have no say.”

How can Hello Sunshine solve for these types of problems across platforms while also investing in “category-defining content that commands a marketplace premium”?

There are no easy answers.

It is no surprise Blackstone is treating production as the more risk-averse business.

Conclusion

We are very much in the early days of the emerging, Hollywood-meets-Creator-Economy Venn Diagram overlap. Blackstone, Kevin Mayer and Tom Staggs are making a big, $2.5B bet in that territory.

But if you are Blackstone, Kevin Mayer and/or Tom Staggs, does anything change in strategy and operational roadmap after the past week?

The good news is there are $310MM of revenues expected from production in two years.

For podcasts, there are certainly eight-to-nine figure paydays to be had via Spotify and Amazon. But, Amazon offers more paths to monetizing an audience with e-commerce than Spotify, and Spotify’s recent challenges with Joe Rogan has highlighted how for Hollywood-meets-Creator-Economy bets, exclusivity to a platform can be costly.

YouTube offers opportunities for e-commerce models built around community and content. So YouTube seems promising. But, it is also highly competitive with 2MM creators sharing $10B per year in the Paid Partner program, and 10M viewers buying Paid Digital Goods with creators not-named-Reese-Witherspoon.

The Hello Sunshine x Reese Witherspoon channel is starting with a noticeably less-engaged YouTube base.

So, I think one immediate priority for Blackstone, Mayer and Staggs is solving for YouTube. It is an obvious pain point, it seems to be increasingly integral to the Creator Economy, and it maps elegantly to their bet on the “creator as storefront” model.

But, on the flip side, it also means that the optimal Hollywood-meets-Creator-Economy models will need to produce content that will scale on those platforms while also ensuring brand safety for advertising partners.

There is neither a bull or bear case for the future of Hello Sunshine and other aspiring Hollywood-meets-Creator-Economy models. But, the past week has shed valuable light on their execution risks beyond their production models, and notably, why Amazon is unusually well-positioned to solve for them.

Another potential payday would be something like Spotify’s $230MM acquisition of Gimlet, or $200MM of Bill Simmons’ The Ringer. But, Hello Sunshine alone is now worth 5x those prices, and the $2B Mayer and Staggs have for a roll-up of talent along the lines of Gimlet and the Ringer’s model is 10x that price. So it seems like the least likely outcome.

Business Insider dove into leaked data reflecting Gimlet’s struggles in podcasting.