Mic Drop #28: ViacomCBS wins with Sports, Kids and Pluto TV in Q1 2021

And a "mic check" correction to a previous estimate for Paramount+ ad revenues

Reposting my quote to Observer’s Brandon Katz from February:

“Sports plus breaking news plus kids plus Pluto is a business,” Rosen surmised. “Everything else they’re better off selling to Netflix.”

And putting it next to this quote from ViacomCBS’s Q1 2021 earnings press release:

On Paramount+, the biggest drivers of sign-ups were live sports and specials, including the Super Bowl, NCAA Tournament, UEFA Champions League, Oprah with Meghan and Harry and The Grammy Awards, as well as kids’ content, including programming from the SpongeBob universe and iCarly, and original programming, including The Stand and Star Trek: Discovery.

[…]

Globally, Nickelodeon programming was a significant driver of signups and engagement on Paramount+.”

To add, ViacomCBS shared that Pluto grew to 50MM users, and “revenue doubled year-over-year”.

So…

Now, there is one caveat to this “mic drop”. ViacomCBS CFO Naveen Chopra told investors that it will “further reduce the amount of content we license to third-party streamers, instead preserving more of these assets for our in-house streaming services.” CEO Bob Bakish committed to “a substantial ramping up of original movies next year, where we expect to begin averaging an original movie a week in 2022,”

Meaning, ViacomCBS management believes more original content on the Paramount+ service will help it to scale, and is using the proceeds of a recent $3B cash raise from $2 billion in Class B common stock and $1 billion in Series A Mandatory Convertible Preferred Stock to fun new movies and shows to do so.

I think that’s a tactical and strategic misallocation of funds.

I think the Paramount+ app, which is effectively a fresh coat of paint on the seven year-old CBS All-Access app, creates too much friction for users to discover and engage with content. It offers minimal personalization, which hurts its ability to scale, and for the content I come to the app to watch, the user experience makes that content unusually difficult to find.

I hated using it for watching The Masters for its final round on Sunday, where I found myself clicking on a tile for The Masters assuming it was the linear feed. But instead, that took me to feeds that The Master organization distributes digitally to both CBS and ESPN+. I had to deduce that the final round of The Masters was on the live CBS feed option in Paramount+ - two to three menu clicks away in Roku - after I figured out the tiles were sending me to the wrong feed.

That experience needs fixing more than Paramount+’s content library - people are coming for sports, live events, and kids content, and they will need to find what they are looking for. As a viewer who came for The Masters and could not find it, I left annoyed and don’t plan on using the Paramount+ app until I really truly need to again (which I did this week for the UEFA Champions League Semifinals).

Another better use of that $3B would be for improving marketing and improving product channel fit. ViacomCBS reported 6MM+ additional streaming subscribers for all of its streaming services, but did not break out how each service performed. That doesn’t mean Paramount+ grew by 6MM. Rather, it means that all ViacomCBS SVOD services (Paramount+, Showtime, BET+, Noggin, NickHits) grew, and its “Premium” service Showtime - grew the most.

In marketing terms, that reflects three challenges for Paramount+.

First, that growth of 6MM was distributed across four to five apps, and Showtime grew the most. I would be curious about how that growth was distributed across all apps, especially given the popularity of kids content in Q1.

Second, the big "hits” for Paramount+ were actually for CBS All-Access and therefore pre-rebranding, as this tweet from Decider’s Scott Porch sums up:

It is also worth mentioning that many of the Paramount+ sign-ups were free trials, and the trial offer ended not-so-coincidentally on March 31st, the end of the quarter. How many of those 6MM were free trial sign-ups? How many churned out? We won’t know until its annual shareholder meeting later this month, or Q2 earnings.

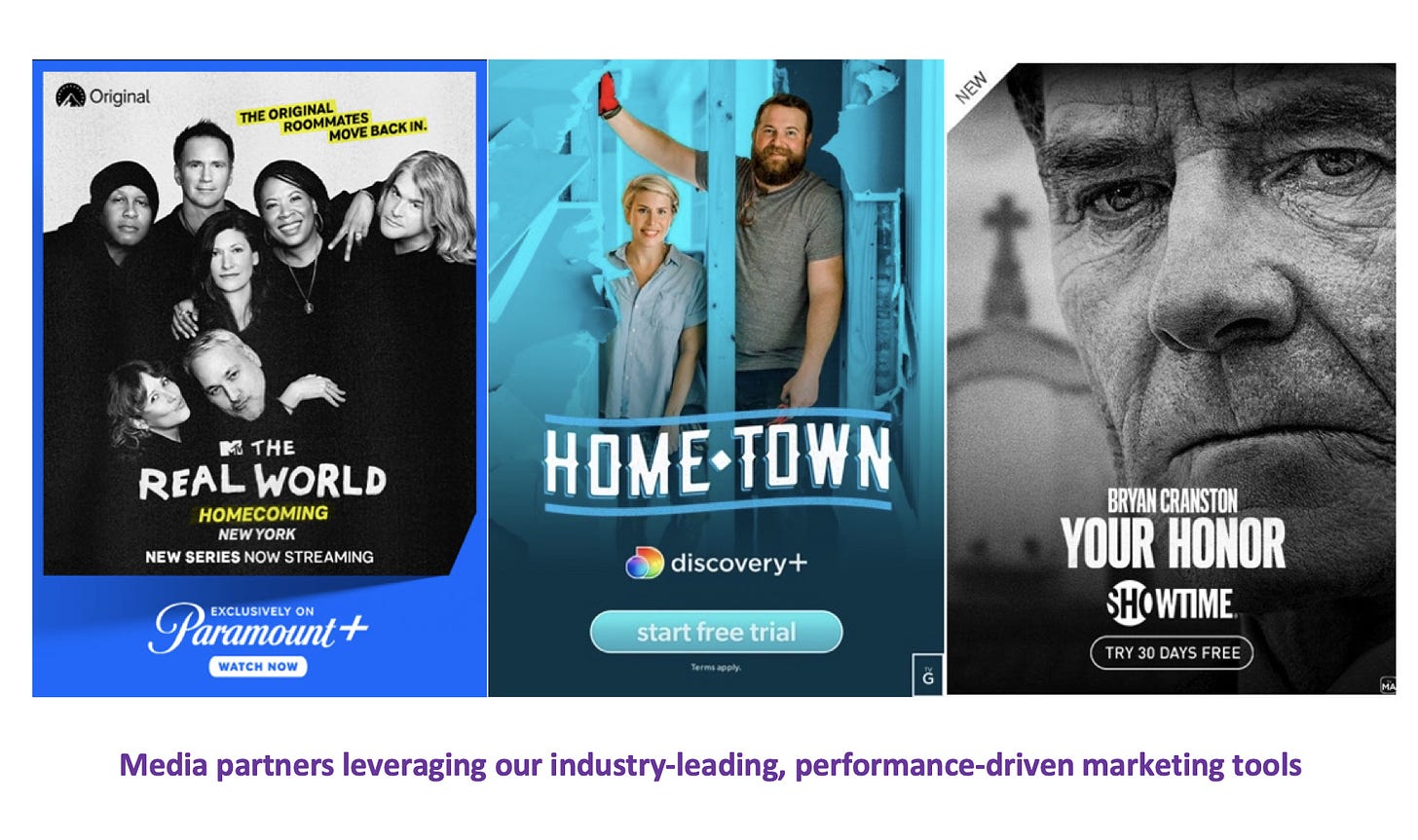

Third, Paramount+’s marketing efforts got some love from Roku’s Q1 2021 Shareholder Letter, with ad campaigns for The SpongeBob Movie, The Real World reunion, and Your Honor.

Typically Roku highlights success stories in these letters, so the implication is that ViacomCBS has found product channel fit in the Roku ecosystem, and Roku wants to sell their story. In other words, the success stories ViacomCBS has highlighted for shareholders had Roku to thank for their success.

But does ViacomCBS have anyone other channel partners to thank for its 6MM new subs? How reliant on Roku must they be going forward, especially with one movie per week?

That question has some interesting implications for tin foil hat M&A speculators wondering about how Roku and ViacomCBS each evolve from here.

But needless to say, these three challenges reflect some obvious flaws in its marketing story that merit more attention than spend on content

Otherwise, it was an impressively positive story for ViacomCBS in Q1.

Mic Check: A Correction

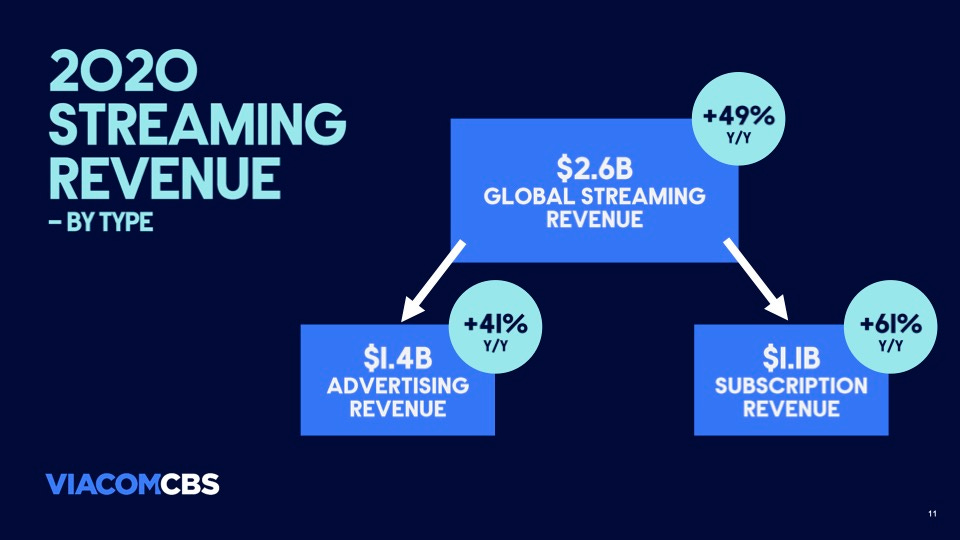

I absolutely hate when I make a mistake. In the case of mapping eMarketer projections for Pluto TV data to ViacomCBS earnings to estimate annual ad revenues for Paramount+, I misread a slide about Streaming Ad revenues in the ViacomCBS Streaming Event presentation from February as reflecting 2020 Annual Revenues, when it was for Q4 2020 revenues.

Which means the math that I have shared in both Member Mailing #259: An Evolving Tension Between Data and Context in AVOD (*Updated*) and Mic Drop #25: Who *is* the target customer for AVOD? is wrong. Here is the paragraph that requires a correction:

Notably, Paramount+ is also an older, more established AVOD by six to seven years. According to ViacomCBS’s presentation at its Streaming Event in February, it earned $845M in domestic U.S. advertising revenues in 2020. Going off of eMarketer’s estimates, above, if Pluto TV made $440MM in 2020 that means CBS All Access was responsible for a large percentage of $405MM. In other words, six to seven years after launch, Paramount+’s earlier iteration of CBS All Access was closer to Tubi TV’s $300MM in revenues than Pluto TV’s revenues.

ViacomCBS reported that it had $845MM in domestic streaming and digital advertising revenues in Q4 2020, but annually it generated $1.4B in global advertising revenues in streaming.

Needless to say, some details are getting obfuscated in the presentation. The math is slightly different:

The difference between Global and Domestic streaming revenues is just under 90MM ($2.56B vs. $2.46B), so that allows us to do some rounding

Going off of eMarketer’s estimates, if Pluto TV made $440MM in ad revenues then the rest of ViacomCBS’s streaming apps made just under $1B. But we can round that up to $1B using 50% of the $90MM in international streaming revenues and allocate the rest to subscription revenues: if there are $1.1B in international subscription revenues, then we can estimate $1.05B in domestic subscription revenues.

If Paramount+ was responsible for the majority of the remainder of that $1B in ad revenues, we’re looking at a working estimate of ~$750MM in revenues for Paramount+ in 2020, which is more than 2x Tubi’s revenues and closer to 2x Pluto TV’s revenues

I will update the numbers in these two past posts accordingly.