Mic Drop #33: Prime Day Is a ”Massive Dry Run” Towards Amazon Channels Bundling

What Nielsen's new "The Gauge" tells us about the future of bundling

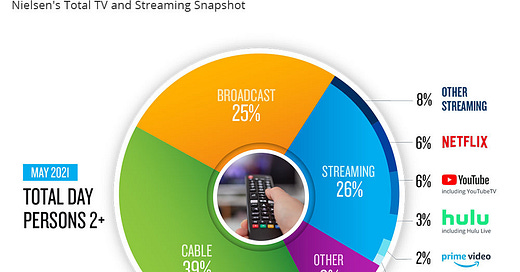

Nielsen released its “The Gauge” yesterday, and there is plenty of chatter about it (including from Netflix’s Co-CEO Reed Hastings, and WarnerMedia CEO Jason Kilar).1

I think the statistic that sticks out most is how 8% of Streaming behavior comes from Other Streaming, which Nielsen methodology defines as “any high bandwidth (video) streaming to the television not listed.” So, that reflects the consumption of other streaming services like HBO Max, AMC+, Apple TV+, Pluto TV, Tubi, Peacock, or Paramount+.

But there is also a longer tail of streaming apps that have succeeded at a smaller scale in the U.S. They also fall into that bucket, like AMC+, Shudder or CuriosityStream.

It is no surprise that the aggregated long-tail consumption of streaming apps is greater than the dominant streaming platforms like YouTube or Netflix: those platforms have scaled with models that serve the long-tail of consumption. Meaning, they offer enormous libraries of content (more than 500 hours of content are uploaded to YouTube every minute, and there are 13,000-15,000 titles on Netflix) which are algorithmically targeted to serve different niche consumption behaviors.

Rather, what is notable is how this 8% data point reflects the growing power of channels stores like Amazon Prime Video Channels, Roku, Comcast’s X1 software, Apple TV, Google Chromecast, and Samsung TV Plus.

It is worth focusing on Amazon Prime Video Channels, in particular, both because of the math of its reach (Amazon Prime reaches an estimated 150MM subscribers in the U.S., alone, and 50MM+ Fire TV owners), and because 18 months ago I wrote about how “Amazon quietly has its thumb on the OTT marketplace”.

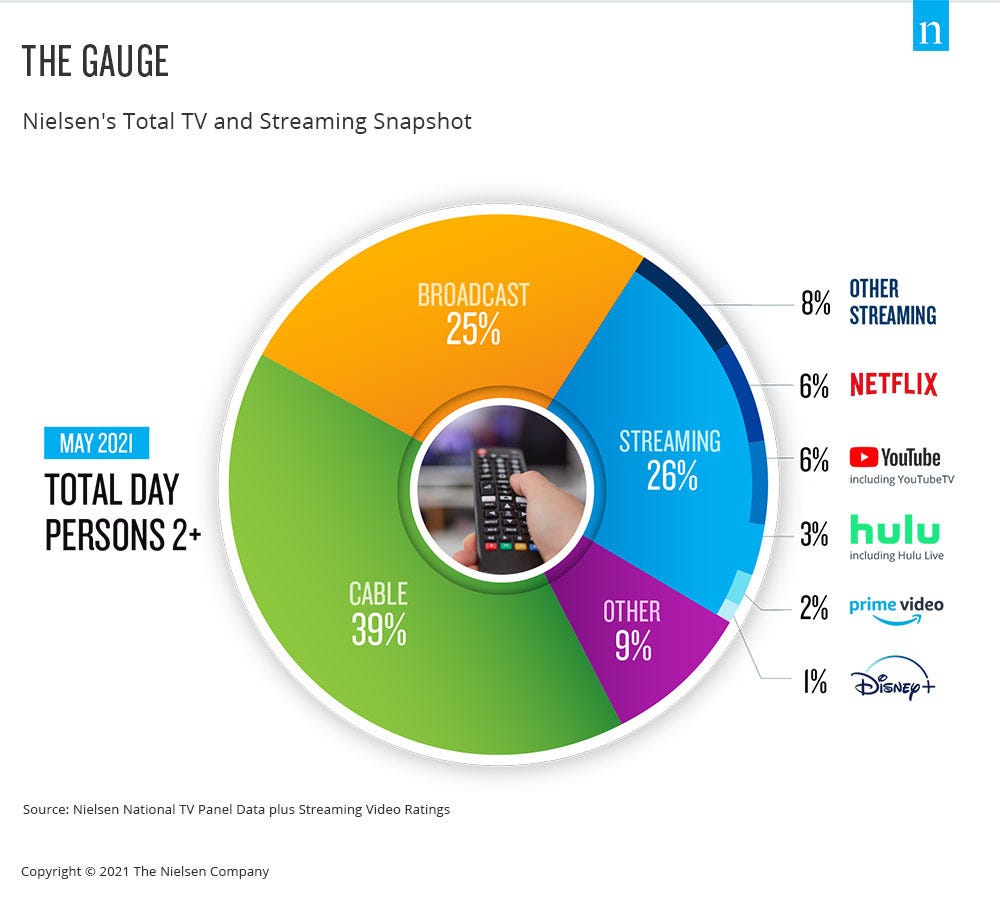

This week, Amazon is running a Prime Day promotion for Amazon Channels, offering 18 different channels for $0.99/month for up to two months. With a series of no more than three clicks, any Prime member can add each of these channels and their content libraries to their Amazon Prime Video interface.

Last night, I added two channels both at a near 90% discount: the Noggin app that normally costs $7.99/month (88% discount), and AMC+ that normally costs $8.99/month. For the next two months, I have effectively “bundled” these two apps with Amazon Prime Video. Meaning, I will be spending $14.97/month with Amazon for the next two months, until or if I churn out of either or both.

If I choose to add three more apps, I will be spending an additional $4.95 with Amazon, or five apps at effectively the cost of Paramount+’s new tier (and notably, Paramount+ is one of the apps offered at $0.99). In short, I can build my own bundle for the next two months via Amazon Prime, and the additional cost will be equivalent to the pricing of one app.

If we apply the logic that Prime Day is a “massive dry run” for the holiday season, I wonder if this pricing on Prime Day is also a “massive dry run” for Amazon to make a bigger move in bundling. Meaning, if Prime Day 2020 marked the two biggest days in sales for third-party sellers, I wonder if Prime Day 2021 will result in the two biggest days in new sign-ups and reactivations for some or all of these 18 streaming services.

Because if that happens, Amazon will be making a strong case for being a necessary condition for scaling a streaming service after the “pull-forward impact” of COVID.

This Week’s Mic Drop…

This all points to a question I asked last June: “There is inevitably a shift towards SVOD bundling coming, but what will be the catalyst?”

I wrote, then:

Amazon, broadly, and subscription channels like Comcast's Flex and Hulu specifically, offer value for tier two and tier three services to grow. There is a clear, win-win, and revenue-generating relationship. Better yet, for Starz and other tier two and tier three providers, they are able to offload the risk of churn.

It is harder to envision how bundles will work: the economic rationale for a revenue share from a discounted bundle are less clear.

By “tier two and tier three services”, I was referring to how Starz CEO Jeffrey Hirsch saw the marketplace in a compelling, must-watch/listen conversation on the Variety Strictly Business podcast.

I thought the bundling that he predicted was going to happen, and Channels services were most likely to drive those outcomes. I think we’re witnessing Amazon Prime Channels make as strong a case as any for that argument.

As for the catalyst, I think there are two.

The “pull-forward impact” of the COVID pandemic is the first. I think Amazon now realizes that the long tail of apps simply will not be able to scale without Amazon Prime Video Channels and the scale of Amazon Prime’s subscriber base. In other words, Product Channel Fit with Amazon will be a necessary condition for streaming scale.

Second, I think Prime Day will be an additional catalyst: ~150MM U.S. Prime Members are being educated that they can create incredibly cheap bundles through Amazon Prime Channels. They will be back for more.

Other Channels inevitably will take note and inevitably imitate Amazon (Roku already offers discounts), creating downward pricing pressure for longer tail apps. That could get ugly for smaller apps, which are not yet profitable and will need to justify higher pricing.

There is also an amusing misunderstanding from Variety about what Reed Hastings meant by “on the board”.