Mic Drop #34: Apple TV+ & Churn

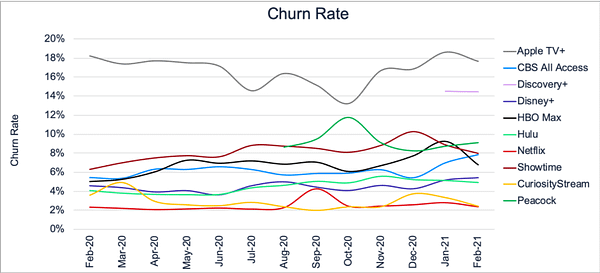

With churn rates estimated to be at 16%, why is Apple betting on a paywall for TV+ *now*?

Starting July 1st, the $4.99 paywall for Apple TV+ officially goes up for everyone except:

anyone who buys and activates an Apple device before June 30, 2021 qualifies for a free one-year trial, or

anyone who buys and activates an Apple device on July 1, 2021 or later will qualify for offers of 3 months free Apple TV+.

According to data from Antenna, Apple TV+ has the highest churn amongst the streaming services with scale at 16% per month.

So why is Apple betting on a paywall for TV+ now?

I made two predictions about Apple TV+ in PARQOR's "Learnings from OTT streaming in 2020, Predictions for 2021" presentation back in January.

Prediction #1: Apple extends its free trial offer in February

For the Curse of the Mogul framework, I predicted:

In February, Apple TV+ again will revisit its free trial offer. The service is not ready for monthly subscriptions, yet, and likely suffers from high churn and/or pause.

Apple hedges by adding a cheap Apple One tier with iCloud and Apple TV+, only, and extending the free trial for new device owners.

I already dropped the mic on this prediction back in January in Mic Drop #13: Apple Extends Its Free Trial for TV+.

My conclusion, then, was:

With TV+’s free trial being extended, it appears that Apple has not delivered a value proposition that users need with neither TV+ nor an Apple One bundle. Also, Apple shifting its attention to paywalled podcasts implies that it is looking at additional growth engines for both its Services business, which is expected, but also its Apple One bundle, which is a bit unexpected three months after launch.

This all reads a bit ominous for both TV+ and the Apple One bundle.

It’s hard to say five months on whether this conclusion was right. It reads like things have turned out more ominous for the Apple TV+ free trial than for the future of Apple TV+.

But, Apple launched paywalled podcasts about 10 days ago. which offers App Store-like means of monetizing content: 30% of a subscription fee for the first year, but if a subscriber remains active beyond 12 months, Apple switches to taking 15% of that fee.

With 1.6B devices worldwide and 620MM services subscribers across 170 countries worldwide, Apple subscriptions and channels offer a broader, multicultural and multilingual portfolio of content with which to monetize a broader distribution of audiences than the Apple TV+ can (all Apple TV+ productions are English-language, except for Tehran).

So, it does appear that Apple believes it can find more revenue growth for its services business with podcasts than by doubling down on Apple TV+. That is not “ominous”, per se”, but it is not a big vote of confidence in the TV+ revenue model, either.

Prediction #2: TV+ will be in high-profile, creative limbo in 2021

For the Visionary vs. Fiduciary executives framework, I predicted:

Jamie Elricht and Zack van Amburg of Apple TV have real critical and creative wins under their belt, but need scale. Apple’s culture for software and ecosystem development is too methodical and iterative for scaling a streaming business, leaving TV+ in high-profile limbo in 2021.

Apple TV+ continues to roll with real critical and creative wins - after the recent finish to its second season, For All Mankind has an 86% average tomatometer and 86% average audience score on Rotten Tomatoes, and 7.8 rating on IMDb.com from 21K reviews. TV+ has an even bigger success with second season of Mythic Quest: Raven’s Banquet, with 97% tomatometer and 85% average audience score Rotten Tomatoes, and 7.7 rating on IMDb.com from 13.4K reviews.

Apple TV+ has also lined up an exciting summer ahead of it, with soon-to-be-released second seasons of the popular Ted Lasso (July), the Emmy-winning The Morning Show (September), and the word-of-mouth success See.1 And, then, starting August, it has an exciting slate coming out, including:

Foundation: A series based on Isaac Asimov's award-winning novels premieres in September,

The Problem With Jon Stewart: Marking Stewart’s first return to TV since leaving The Daily Show, the series premieres in September, and

The Shrink Next Door: Starring Will Ferrell and Paul Rudd, the series premieres November 12.

Apple recently released a preview trailer with teasers of all of the above.

$4.99/mo vs. 16% churn rate

To bring us back to my prediction:

“Apple’s culture for software and ecosystem development is too methodical and iterative for scaling a streaming business, leaving TV+ in high-profile limbo in 2021”.

The value proposition of Apple TV+ as defined by Apple is no longer in limbo, though seemingly surviving with a passive vote of confidence from Apple management. It now has a price tag of $4.99, too.

But at 16% churn, the value proposition of Apple TV+ as consumers perceive it is in limbo. It’s also not great economics for Apple, limiting Lifetime Value (LTV) to $32 per user, or 6% of Netflix’s LTV of $570, according to Cross Screens Media. Because beyond the exciting titles, above, there is no broader library of content to keep users engaged month after month.

So what will reduce churn? Isaac Asimov’s Foundation? Season 2 of Ted Lasso? An Amazon-like move of acquiring a studio with a library like Lionsgate or Paramount?

It’s hard to say. The safest bet we can make with Apple TV+ is churn rates will continue to be high, and Apple is betting on an increased weekly release schedule to drive growth and minimize churn. Everything else seems speculative.

That may not leave TV+ in limbo at Apple, but it leaves TV+ in a weak, limbo-esque position with consumers as a nice-to-have on occasion, but not a must-have.

Notably, See does not have enough critical reviews to qualify for the Rotten Tomatoes tomatometer, but has a 7.6 rating from 46K reviews on IMDb.com.