Mic Drop #42: Is Spotify Pivoting Away from Expensive Talent Deals?

Spotify may see more growth in podcasts with Anchor & the Creator Economy than with Hollywood talent & exclusive original content

Both The Verge and Business Insider have delivered a one-two punch of an unusual level of transparency into Spotify’s podcast business recently.

Ashley Carman of The Verge has a must-read piece on how “Joe Rogan, confined to Spotify, is losing influence”. It is “a data investigation” that lays out “the powerful podcaster’s influence has waned since he went behind Spotify’s wall.”

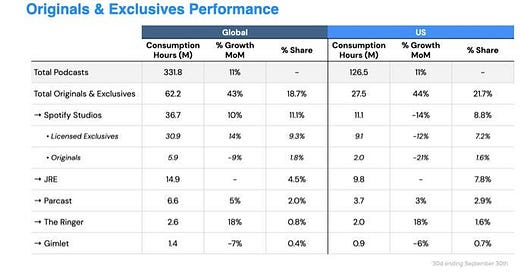

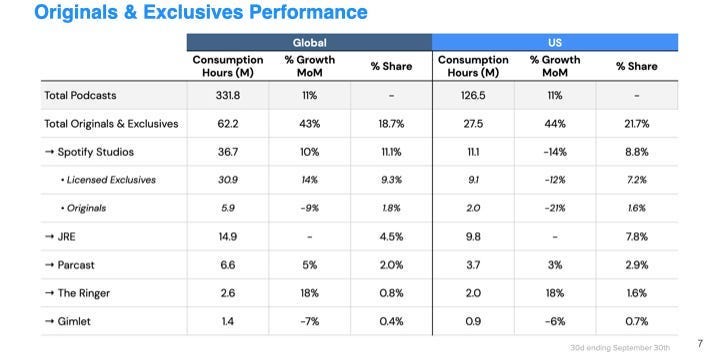

Separately, Natalie Jarvey and Steven Perlberg of Insider Intelligence got their hands on this “chart from a Spotify newsletter” and some internal data on how Gimlet Media “is struggling to find its place within Spotify's podcast universe” ($ - paywalled).

The “data investigation” from The Verge and Insider Intelligence’s piece both offer evidence of the same problem:

Joe Rogan may be reaping more value from his $100MM deal than Spotify and its shareholders; and,

Gimlet Media may be reaping more value from their $230MM deal than Spotify and its shareholders; and, therefore,

the projected growth rate, or “g”, of Spotify’s bet on exclusively-hosted, original podcasts isn’t as solid as they had assumed.

In other words, as I had predicted when Joe Rogan linked up his podcast business exclusively to the Spotify ecosystem last May, Spotify’s bet on Joe Rogan and exclusively-hosted podcasts are betraying symptoms of The Curse of the Mogul.

1. Joe Rogan may be reaping more value from his $100MM deal than Spotify & its shareholders

The data in the Insider Intelligence report reinforces a point I made when I wrote about Rogan last June:

With a $100MM bet on Joe Rogan, [Spotify] is making an enormous bet on a single podcaster to drive more Premium Subscribers and ad-supported monthly-active users, but with less data: listening data for Rogan is spread across multiple other platforms, including other podcasting apps (Apple is the dominant one), and YouTube (where Rogan gets up to 40MM views per month for podcasts and other content).

But, there is no guarantee those audiences will follow, en masse, with Rogan to Spotify. And, that is Spotify's bet, with the caveat the bet is based on an incomplete picture, seemingly relying on intangibles, and that makes it a bet which demands more questions with a Curse of the Mogul lens.

The Verge article sums up why Rogan’s influence across a wide variety of metrics has “waned” since he joined Spotify:

Rogan’s reach could be dipping for a number of reasons. The show used to benefit from posting full episodes to YouTube, which usually received millions of views each and often led to snippets going viral on other platforms, like Twitter. But the YouTube channel now just hosts clips, which don’t always break the million-view milestone. Rogan also used to have visibility in other podcasting apps, which is important because not everyone uses Spotify. It’s possible that social media algorithms, and YouTube’s in particular, also helped Rogan and his guests gain a following.

Putting the two points together, Spotify assumed loyal audiences across platforms would follow Rogan to Spotify. But, it turns out the algorithms of those platforms were doing a lot of work to drive audiences at scale, too, so those audiences were not as loyal as Spotify had originally assumed.

The latter has not translated to the former, and the “g” of The Joe Rogan Experience (“JRE” in the chart, above) from last September is 0%.

2. Gimlet Media may be reaping more value from their $230MM deal than Spotify and its shareholders

The chart, above, from the Insider Intelligence piece shows a -7% month-over-month decline in audience from last September. But, a Spotify spokeswoman told Insider Intelligence “Gimlet consumption has increased 25% since September, even with some popular shows publishing less frequently.”

So, if there is any “Curse of the Mogul”-type critique to be made of Spotify’s acquisition of Gimlet, it’s that Spotify, as a platform, does not deliver significant growth. Also, it is not ideal for exclusive distribution of Gimlet podcasts:

…Spotify has a finite number of promotional spots on its highly trafficked homepage. "They brought on a ton of podcasting companies at once and they can't promote all of them super aggressively," said one Gimlet staffer. "There's never going to be as big an audience for bespoke narrative shows as there is for Joe Rogan."

Meaning, there are inherent limitations to Spotify, both as a user interface and as a distribution platform, that interfere with Gimlet being a growth engine that the $230MM price tag implies.

3. “The g” of Spotify’s bet on exclusively-hosted original podcasts isn’t as strong as they had assumed

The Podcast business is growing at Spotify: “Podcast revenue was up over 627% year-over-year, or nearly 200% on an organic basis”, according to CEO Daniel Ek on the FY 2021 Q2 earnings call. Ad-supported revenues have gone up 110% to €275MM from €131M.

But, the point about “the g” (as explained by The Entertainment Strategy Guy), is that Spotify’s model assumes its bet on podcasts will drive high growth, and in turn that will drive higher stock price targets.

In Spotify’s case, Ben Thompson described this as:

“controlling the value chain such that suppliers come on to your platform on your terms because you monetize them better than anyone else, even as you capture the excess value.”

Thompson identified three prongs to the strategy:

Anchor provides a way to capture new podcasters, leading them either to Spotify advertising or, in the case of rising stars, to Spotify exclusives.

Spotify Advertising makes a strong play to be the dominant provider for the entire podcasting industry; and

Gimlet Media becomes an umbrella brand for a growing stable of Spotify exclusive podcasts

The data on The Joe Rogan Experience and Gimlet Media suggest that one of only three prongs of Spotify’s podcast strategy is driving “g” (Advertising).

As a result, content creators have indeed reaped more value than Spotify shareholders.

Spotify’s Pivot

One obvious takeaway from the above is that Spotify management now has good reason to reconsider its podcast growth strategy.

I think all signs point to them actively doing so.

CEO Daniel Ek said as much on the FY 2021 Q2 earnings call when asked whether the podcast strategy had changed:

Yeah. I don't think really anything has kind of changed. I think we have been experimenting with windowing. We have been experimenting with exclusives and we've said for quite a long time that, obviously, we want more and more of the listening to happen only on Spotify. So it's been kind of more of a natural evolution to drive it toward that end. I do think, again, from a strategy perspective, we are very much aiming to be a very open platform all along, and the most important job for us is to be a great partner to all the creators that we have in the ecosystem. So, I don't think it rolls out and say that we would only do exclusives hard on. I think you're going to see us do many different types of deals, but where possible, we would obviously opt to take it fully exclusive, but we're going to be very opportunistic about that going forward.

For what it’s worth, I think Ek purposefully downplays exclusive deals in this answer, despite recent deals with Alex Cooper of Call Her Daddy ($20MM) and Dax Shepard of Armchair Expert (at least $50MM). He sounds less sold on that prong.

Ek speaks more to being “a great partner to all the creators that we have in the ecosystem”. Spotify is doing so by actively doubling down on the Anchor prong of their podcast strategy.

Last week that Spotify announced it will let all US-based Anchor podcasters sell subscriptions (the service launched in April 2021 with 12 independent shows on Anchor and NPR). International users will be able to sell subscriptions in the future.

That approach shares elements in common with YouTube’s Premium Partner strategy, which has paid $30B over the past three years to its creators.

But, whereas YouTube takes 45% of revenues, podcasters won’t have to pay Spotify anything for the first two years. In 2023, Spotify will begin taking a 5% cut of total subscription revenue. Creators will have to cover the cost of transaction fees through Spotify’s payment partner Stripe.

Conclusion

So, Spotify seems to be replacing the exclusive podcasts prong of its strategy with a more Creator Economy-focused business model. Even if Spotify may have the appearance of Hollywood-Meets-Creator-Economy model, the Anchor model demonstrably has a greater Total Addressable Market than Hollywood talent.

Why? Because 365MM Spotify MAUs and 165MM Premium Subscribers all will be able to offer paid subscription podcasts (in addition to being consumers of them). Also, Anchor powers 70 percent of Spotify’s total podcast catalog, or around 1.3 million out of over 1.9 million shows.

Spotify already has both supply and demand already locked into its ecosystem.

There will be no splitting the “g” in this Anchor model with Joe Rogan or the staff of Gimlet or The Ringer.

Instead, with this move Spotify has repositioned itself into a win-win-win model with creators and shareholders where it will capture 5% of the revenue of the supply side and 100% of the (exponentially growing) advertising and subscription revenue of the demand side.

To date, shareholders have punished the stock with indifference to Spotify’s Hollywood and original content-oriented podcast strategy, with today’s price (~$250) below where it was on June 1st, 2020 ($253), and down 20% from its high of $315 in December 2020.

Spotify may just self-diagnosed its Curse of the Mogul symptoms, and instituted a Creator Economy-based remedy via Anchor.

First, wow.

Second, I think this Anchor paid subscriptions move will shift investor indifference back to bullishness.