Monday AM Briefing #57

The stories and trends in OTT streaming you *need* to know for this morning & the week ahead

A Short Essay on “the next Kubrick” & New Definitions of “movies” & “popular reception”

IAC Chairman Barry Diller went viral, again, for some comments on the state of streaming in an interview with NPR’s David Gura:

Diller acknowledged the recent success of streaming services and how indispensable they became during the pandemic, but he was less complimentary of their expensive efforts to create more original content.

"These streaming services have been making something that they call 'movies,' " he said. "They ain't movies. They are some weird algorithmic process that has created things that last 100 minutes or so."

For Diller, this is about seismic change and nostalgia, but it is also about semantics. The definition of "movie," he said, "is in such transition that it doesn't mean anything right now."

It mirrors a complaint by actor Stephen Dorff to the U.K.’s Independent last week:

“My business is becoming a big game show. You have actors that don’t have a clue what they’re doing. You have filmmakers that don’t have a clue what they’re doing. We’re all in these little boxes on these streamers. TV, film – it’s all one big clusterf**k of content now.”

They are effectively nostalgic for the same thing: whatever Hollywood used to be is not what Hollywood is becoming.

Stephen Dorff wants to “find that kid director that’s gonna be the next Kubrick and I’ll act for him instead”.

But, I imagine “the next Kubrick” is likely playing with the black-and-white filter on their iPhone than a handheld Arriflex 35 II C camera with black-and-white Kodak film. Whatever movie “the next Kubrick” is producing right now, the creative for that “movie” is not being driven by the same constraints around production budgets, technology or distribution that the original Kubrick faced.

If anything, streaming services have challenged how the success of a movie is defined in terms of the scale of its consumption and/or cultural impact. Diller told NPR:

"I used to be in the movie business where you made something really because you cared about it," he said, noting that popular reception mattered more than anything else.

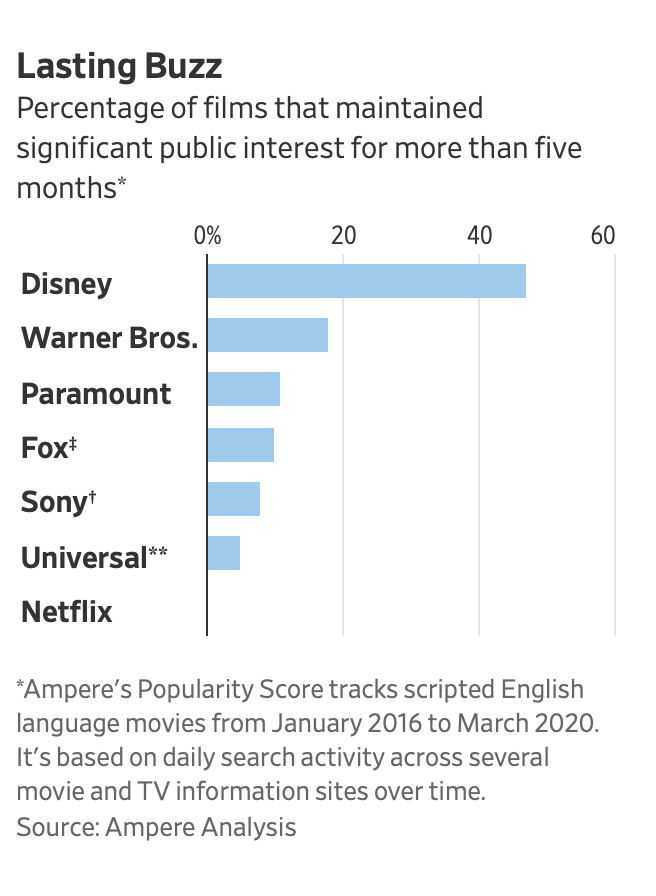

If Diller’s and Dorff’s complaints seem more intangible, the change in the definition of “popular reception” is tangible according to an Ampere Analysis chart in a recent WSJ article, In a Netflix World, Movie Studios Make More Movies Than Ever. Is That a Good Thing? ($ - paywalled):

Compare this new standard of “less than five months” to Stanley Kubrick’s best performing film, 2001: A Space Odyssey. According to Wikipedia, “The original release of 2001: A Space Odyssey in 70-millimetre Cinerama with six-track sound played continually for more than a year in several venues, and for 103 weeks in Los Angeles.”

So, it may not be that the definition of “movies” is changing, but rather that the definition of “popular reception” is changing. Nowhere has this been more evident than in a recently announced multi-year licensing deal between Amazon’s Prime Video and IMDb TV with Universal Filmed Entertainment Group (UFEG).

As a recent piece from Deadline breaks down, after 2022 the distribution of a “popular” movie from UFEG will play out like this:

NBCUniversal’s Peacock streaming service will exclusively have UFEG’s 2022 movies and beyond 120 days after their theatrical release for four months and also during the last four months of a title’s 18-month pay-one window.

Prime Video will exclusively stream UFEG’s 2022 and future live-action titles during the middle ten-month period of that 18-month window (months 5-14).

UFEG’s animation slate for 2022 and beyond, which includes Minions: The Rise of Gru and DWA’s Puss in Boots: The Last Wish and The Bad Guys, will be on Netflix during the ten months of the 18-month window when they’re not on Peacock.

Looking at this deal, the “movies” are the same, but the path for a movie to “popular reception” has become a lot more complicated:

Most theatrical releases from Universal now have less than a 10% chance of maintaining public interest for five months;

After 17 days, Universal movies lose their theatrical exclusivity and can go “premium video on-demand” (PVOD)

The releases go to a Peacock 120 days after their theatrical release for four months to 14 million Monthly Active Users (MAUs), and only about 20% who pay for it;

Then, for months 5-14, the releases go to Amazon Prime Video, where they will compete with Amazon’s own content library and MGM acquisitions;

Then, the releases go back to Peacock for the last four months of a title’s 18-month pay-one window.

So, if Stephen Dorff’s “the next Kubrick” distributes via Universal, they have 17 days to maintain public interest before they lose their audiences to a months-long complex dance between PVOD providers and competing streaming services. In other words, they have ~10% of the time Stanley Kubrick had to capture the imaginations of audiences at scale.

The new economics of distribution in the Amazon-UFEG deal suggests “popular reception” seems near impossible for “the next Kubrick” to achieve. As for how they find “popular reception” that lasts longer than five months, “the next Kubrick” may be better off finding a single channel outside of Netflix, perhaps even Disney, to achieve that objective.

Must-Read Monday AM Articles

Another must-read on this topic is a New York Times piece on the management of recent Amazon acquisition MGM Studios under Chairman Michael De Luca and his deputy Pamela Abdy.

The Verge asks, “Does Amazon even know what it’s buying with the MGM acquisition?”

Brandon Katz of The Observer leverageD my “genre wars” lens to compare two different series on the Los Angeles Lakers from HBO Max and Netflix. https://observer.com/2021/07/netflix-hbo-los-angeles-lakers-series/

Travis Clark from Business Insider wrote about the two challenges still facing the box office: Strong openings alone can't save the box office, and Sequels are (still) carrying the box office ($ - paywalled).

Lots of Netflix headlines last week. Kate Knibbs argues in Wired, “Netflix Is Losing Its Cool”, and “Netflix may be inching ever closer to occupying the role that CBS did during the heyday of broadcast television”.

After new FCC Chair Lina Khan ordered a review of the proposed Amazon-MGM merger. This piece from Eriq Gardner of The Hollywood Reporter argues The Biden Administration is “doing quite a lot to ensure” that Netflix maintains its competitive advantages over aspiring competitors.

Netflix is opening three promotional pop-up video stores in London, Brighton, and Newcastle, England to mark the release of Fear Street Part 1: 1994, the first installment of Leigh Janiak's Fear Street trilogy, based on R.L. Stine's beloved horror books.

Deadline interviewed Netflix’s VP of Original Series for EMEA Larry Tanz about “the evolution” of Netflix’s creative efforts “from a little townhouse, making and commissioning shows out of LA, to specific country teams and offices commissioning local shows locally”.

Netflix and Shondaland announced they have expanded their deal to exclusively produce, stream and distribute feature films in addition to potential gaming and virtual reality content. The WSJ has a good breakdown of the deal ($ - paywalled)".

Netflix hired former Apple executive N’Jeri Eaton to oversee its podcasting business, and will be part of the company’s editorial and publishing team.

The Entertainment Strategy Guy dives into Nielsen data and finds, “Netflix hasn’t had a hit sitcom since March of 2020.”

Lionsgate and MarVista Entertainment are remaking a number of classic made-for-television movies from the Hearst library. MarVista has identified over 100 titles to reimagine.

NFL Quarterback Tom Brady, Good Morning America co-host Michael Strahan and filmmaker Gotham Chopra are cofounders of the media company Religion of Sports, which is betting that there is pent-up demand for access to top athletes.

Disney issued a press release that Marvel Studios’ Black Widow debuted to an estimated total of more than $215M globally this weekend, including $80M in domestic box office, $78M in international box office, and over $60M in Disney+ Premier Access revenue from consumer viewership.

That puts its domestic box office on the lowest end of this boxofficepro three-day forecast.

Kidoodle.TV is bringing data transparency to the generally opaque kids-streaming space with a web-based dashboard aloows content providers view lifetime plays on the Kidoodle.TV service for all of their series or individual titles.

“Silver streamers”, or viewers over the age of 55, have become some of the most engaged binge watchers.

US virtual MVPD subscribers are projected to increase to more than 23 million households by 2024, up from an estimated 12-13MM. Here is a good interview with the CEO of one of those virtual MVPDs, Philo’s Andrew McCollum.

Last. in light of my “aggregator 2.0” Mic Drop last Friday, Sara Fischer of Axios has a good breakdown of Grocers, Delivery Companies, Pharmacies, Retail and Delivery companies emerging as logical advertising partners to audiences at scale.