Monday AM Briefing #58

The stories and trends in OTT streaming you *need* to know for this morning & the week ahead

Addendum to Last Friday’s Mic Drop

If there were two tweaks I would make my argument in Mic Drop #37: discovery+ vs. Creator Economy, they would be:

All sign-up experiences for Magnolia Network on Magnolia.com and on the Magnolia app require discovery+ accounts, and many put discovery+ sign-up one-click away (unlike the example I shared); and

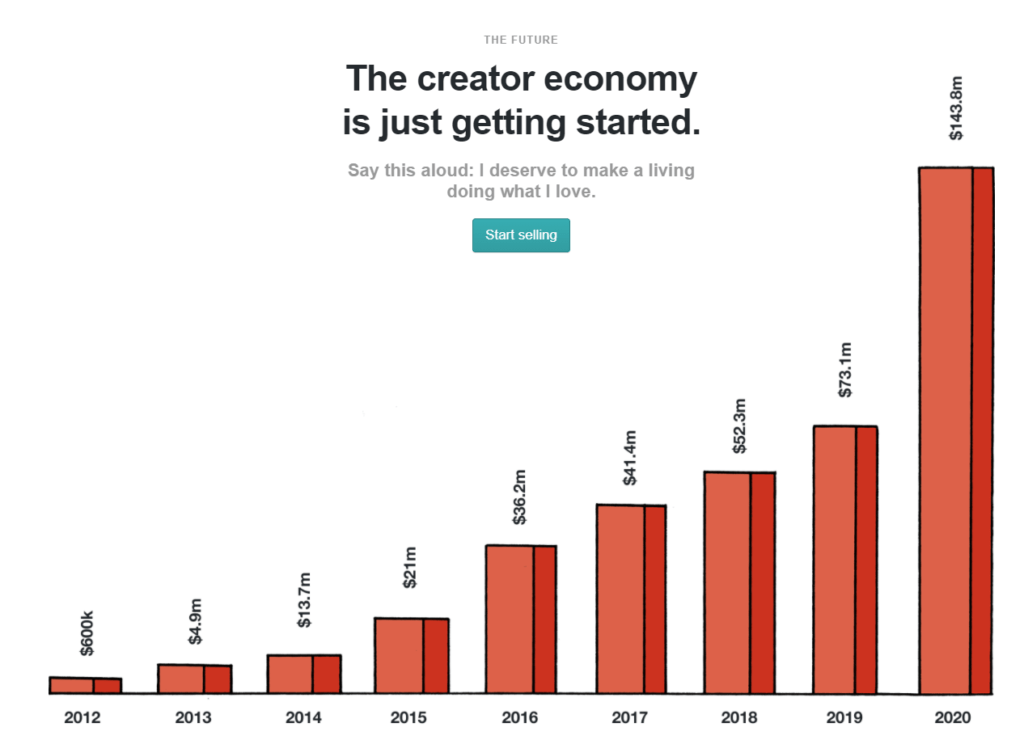

I realized a key advantage to the creator economy is how the consumer relationship requires membership, either via a free platform (YouTube, Facebook) or a paid membership platform (e.g, Substack, Gumroad, Patreon).

Both point to how Discovery is betting that a streaming utility (discovery+) can serve the role of an online membership platform for the Gaineses and Magnolia Network. But, the creator economy is about monetizing online membership in multiple ways on a platform, and discovery+ monetizes the Magnolia brand in only one way (streaming).

So if I were to tweak my argument in the Mic drop, it’s that discovery+ is a streaming utility performing the role of a Patreon or Gumroad to manage online consumer relationships for the Gaineses and Magnolia.

That may benefit discovery+ in the short-run with sign-ups, but the growth of the Creator Economy ($2B invested in the U.S., alone, and $1.3B in 2021, to date) suggests that fans of the Gaineses will be seeking more membership perks from Magnolia than only a streaming service. In other words, demand for Magnolia Network may have the unintended outcome of growing demand for the types of DTC relationships Discovery Chairman David Zaslav has been resisting, to date.

That’s a tension worth following closely.

A Short Essay on Netflix, Gaming, & The Fiduciary vs. Visionary Framework

After The Information reported back in May that Netflix was looking to hire an executive to oversee an expansion into videogames, it hired former Oculus and EA game development leader Mike Verdu as vice president of game development, reporting to Chief Operating Officer and Chief Product Officer Greg Peters.

VentureBeat describes Verdu as “a serious game leader whose career has focused on building entire portfolios of games for companies.”

What will he and his team be building? Bloomberg reports:

The idea is to offer video games on Netflix’s streaming platform within the next year, according to a person familiar with the situation. The games will appear alongside current fare as a new programming genre -- similar to what Netflix did with documentaries or stand-up specials. The company doesn’t currently plan to charge extra for the content, said the person, who asked not to be identified because the deliberations are private.

For as big a move as this, and with its FY 2021 Q2 earnings coming up on Tuesday, July 20th, there seem to be a lot of missing details.

The Fiduciary vs. Visionary Framework is helpful here for identifying and answering the bigger questions. Is Mike Verdu:

Incentivized to pursue his or her vision for the future of the business (Visionary)? Or,

Is he constrained by the priorities of the Board of Directors and senior management (Fiduciary)?

We can answer the second question, first: Greg Peters is the visionary, and Verdu is reporting to Peters. We know from Netflix’s Schedule 14C filing that Greg Peters is incentivized for:

his performance in developing and deploying our increasingly complex engineering systems to support our continued expansion into new jurisdictions and languages and new product offerings to enhance user experience, as well as the continued market demand for engineering talent.

In other words, he is being paid to build the technical side of Netflix’s vision. Co-CEO Reed Hastings tapped Peters to answer Nidhi Gupta’s question about gaming in this year’s Q1 earnings call (along with Chief Financial Officer Spence Neumann)

'll -- I'll just take one more sort of point at it which is that, you know, Nidhi, we're -- we're in the business of creating these amazing deep universes and compelling characters and, you know, people come to love those universes and they want to immerse themselves more deeply and get to know the characters better and their backstories, all that stuff. And so you know, we're really -- we're trying to figure out what are all these different ways that we can increase those points of connection, we can deepen that -- that fandom and certainly, you know, games are a really interesting component of that. So whether it's, you know, game of flying some of the linear storytelling redoing like interactive Bandersnatch and the kids' interactive programs, that's been super interesting. We're going to continue working in that space for sure.

So, Peters and his team have laid the groundwork for gaming to integrate into Netflix.

What makes this move so interesting now is that with gaming to appear “alongside current fare as a new programming genre”, Peters and Verdu are going to have influence over content in the Netflix interface. To date, that has been dictated only by both Co-CEOs Reed Hastings and Ted Sarandos.

This is an incremental move with enormous implications not just for the future of Netflix, but for how/whether Sarandos and Hastings loosen their control over Netflix’s available portfolio content.

Must-Read Monday AM Articles

Two other details about Netflix’s gaming emerged this week. First, Insider reported a Netflix job listing suggests “the goal with Netflix's gaming division is to, ‘create new types of stories and new product experiences’”. Second, What’s on Netflix highlighted comments from Head of Interactive Games Chris Lee at E3 2019 that video games reflect an opportunity to “extend the universe of these shows and these films into other mediums”.

The Verge’s Steve Moser tweeted some additional background on the video games service, including a potential partnership with Sony Playstation. What’s on Netflix also has a list of all video games produced by Netflix, to date.

The Hollywood Reporter’s Lesley Goldberg reports that Netflix’s new deal with Shonda Rhimes reflects its plans for additional live events for its franchises, including the upcoming London-set Bridgerton ball scheduled to launch in November.

Netflix promoted executives Kira Goldberg and Ori Marmur to head up a team autonomous from but with the same responsibilities as their previous team under Tendo Nagenda because “Netflix is ramping up its [film] output dramatically”.

Co-CEO Ted Sarandos took the unusual step of posting on LinkedIn to explain why three marketing executives were fired last week.

Netflix has ordered three seasons and four specials of “Cocomelon” spinoff “Cocomelon Lane,” which will be the first-ever narrative series featuring the “Cocomelon” characters in an actual story arc.

Both The New York Times and IndieWire dove into the mechanics of the success of the Fear Street Trilogy, released on a weekly basis.

Disney’s Black Widow saw its second weekend at the domestic B.O., down -67% at $26.25M. The results are raising real questions about the future of the day-and-date model, and theater owners are blaming Disney+. Forbes’ Scott Mendelson offered a more bullish take on Black Widow’s results.

Is Loki a hit for Marvel? Observer’s Brandon Katz dove into third-party data, and The Entertainment Strategy Guy dove into Nielsen to show how Loki had the highest Week 1+2 Viewership per Hour of any series in the Nielsen dataset.

NBCU says Peacock has secured $500 million in up-front commitments to Peacock, on top of the $100 million in commitments Peacock secured last year ahead of its launch. Also, it said has already sold 85% of its inventory in the football extravaganza, with media buyers acknowledging the Super Bowl market heated up earlier than many had anticipated.

Bally’s announced on Tuesday that they have acquired the Association of Volleyball Professionals, or AVP, with plans to show events and content across the Bally Sports branded Sinclair regional networks.

Variety VIP+’s Gavin Bridge has an unusually good, data-and-chart filled breakdown of why IMDb TV is “set to be the free streaming service to beat”. ($ - paywalled)

Roku Brand Studio is releasing a six-episode comedy talk show, The Show Next Door hosted by Randall Park, made in partnership with Maker’s Mark. It is the second show created by the branded content studio, formed in March.

Professional Bull Riders and ViacomCBS will merge PBR RidePass into Pluto TV, effective July 20, PBR RidePass (which brands itself as “the Netflix for western sports”) will be free, after launching in 2018 with a $7.99 per month price point.

ViacomCBS’s Kids and Family chief Brian Robbins gave The Hollywood Reporter his first interview since gaining global and streaming oversight of Nickelodeon. It sheds some interesting details of ViacomCBS’s streaming strategy.

IndieWire highlights how machine learning and AI are being used “to discover talent, identify business opportunities, and navigate a landscape dominated by streamers that keep a tight lid on their own insights.”

Questionable valuations being floated in the entertainment marketplace after Amazon’s acquisition of MGM, including A24 for $3B. Bloomberg’s Lucas Shaw reported Apple has had talks with A24, and that Chris Lindahl of IndieWire dove into why the independent studio may be worth that much.

Chicago Tribune’s Nina Metz asked, “Why are sitcoms at an all time low?” It’s also worth reading this rabbit hole of a Twitter conversation on the topic with Nina, me, and Meet Cute’s Web Barr.

AMC Networks reached a $200 million settlement deal with Frank Darabont and CAA in the long-running profit participation lawsuit over “The Walking Dead.” The deal essentially wipes out the company’s free cash flow for 2021.

PricewaterhouseCoopers projects OTT video revenues to reach $94 billion by the end of 2025, up 60 percent. That includes spending on subscription (more than $81 billion) and transactional (nearly $13 billion) video on demand.