PARQOR Monday AM Briefing #47

The stories and trends in OTT streaming you *need* to know for this morning & the week ahead

First, a reminder that you are receiving this week’s Monday AM Briefing from Substack (and not Mailchimp) because I will be sending all PARQOR mailings from this Substack - parqor.substack.com - through May 16.

Second, I created a coupon 90DAYS on both Substack and Memberful that will give a 33% discount for one year or $33.50/month, to any subscribers wanting to upgrade to Member Mailings.

The 90-day window for the offer expires in two weeks on May 16 (!). Click below for discounted access to last week’s Member Mailing, “Evaluating the Televisa-Univision Merger Announcement”, and all educational resources on the Five Frameworks.

A Short Essay: Roku and Google’s YouTube TV Standoff is not Co-opetition

On Friday, Roku’s third ugly public standoff since 2020 began after it followed through on its threat to remove streaming bundle YouTube TV from its platform.

The outcome seems surprising given the relative seamlessness of Roku’s recent deals with Amazon for The Roku Channel on Fire TV, and IMDb TV on the Roku Channel. I wrote about both in February in Member Mailing #252: Coopetition and Original Content Strategies in Streaming:

If there is any indication of how powerful Roku’s and Amazon’s positions are in the connected TV ad marketplace, it is how the announcements of The Roku Channel’s distribution on Amazon Fire TV last October, and IMDb TV’s distribution on Roku last month, emerged with little drama or fanfare.

In other words, if there was complexity within the negotiations - and there presumably was given that the IMDb TV announcement came three months after The Roku Channel announcement- that complexity was not enough for either party to default to public stand-offs around non-negotiable items like inventory sharing or third-party licensing. These two deals are true outcomes of Coopetition.

Coopetition or Co-opetition (the latter spelling better reflects the pronunciation) is a portmanteau of competition and cooperation, and is defined as “collaboration between business competitors, in the hope of mutually beneficial results”.

That Member Mailing highlighted how easy it was for Amazon and Roku to reach a deal despite being head-to-head competitors in the free AVOD space (Amazon’s IMDb TV vs. The Roku Channel), in the Connected TV ad space (Amazon Advertising vs. Roku Advertising) and in the TV device and OS space (Fire TV devices. Roku devices).

It has been comparatively difficult for both WarnerMedia and NBCU to reach deals with Roku and Amazon for their ad-supported apps (WarnerMedia’s HBO Max, NBCU’s Peacock) - both deals took ~8 months to reach - and NBCU remains in a standoff with Amazon over distributing Peacock.

Last week, Google and Roku each publicly told the marketplace that cooperation was not an option, and rather accused each other of being “anticompetitive” and of “bad faith”. Google told the marketplace in a YouTube blog post:

Despite our best efforts to come to an agreement in the best interests of our mutual users, Roku terminated our deal in bad faith amidst our negotiation. Unfortunately, Roku has often engaged in this tactic with other streaming providers.

And Roku shared in a statement to Deadline:

It is well past time for Google to embrace the principles that have made streaming so popular for millions of users by giving consumers control of their streaming experience, by embracing fair competition and by ceasing anticompetitive practices. We believe consumers stand to benefit from Google and Roku reaching a fair agreement that preserves these principles and we remain committed to trying to achieve that goal.

There are multiple moving pieces to the negotiations, and you can get a thorough picture from these three pieces:

Deadline’s Dade Hayes, “Roku Removes YouTube TV From Channel Store Over “Anti-Competitive Practices”; YouTube Decries “Bad-Faith Termination” Of Deal – Update”

Axios’ Sara Fischer, “Roku says it may lose YouTube TV app after Google made anti-competitive demands”

Protocol’s Janko Roetggers, “What Roku and Google are fighting about: Video codecs, voice search and millions of eyeballs”

It is worth revisiting the Co-opetition framework as a helpful, additional lens here. Roku “has characterized [the dispute] as more about principle than dollars.” But I don’t think that’s entirely accurate: co-opetition is about two competitors both realizing that there are more incentives to cooperate than to compete. The problem here is neither company is incentivized to cooperate.

Roku is particularly unhappy that Google has been leveraging the negotiations to force an upgrade to the AV1 codec, an open-source video codec that promises better-looking 4K videos at lower bitrates (basically, more efficient streaming). Roku is telling the marketplace that it is not incentivized to pass on to consumers the additional costs that AV1 codec would require, but it would be more incentivized to do so if Google would agree to change the terms of its separate YouTube deal with Roku.

Google is saying it is not incentivized to revisit those terms.

There is a big competitive reason why: YouTube is the second most popular app on most smart TV platforms, reaching 120MM people in the U.S. per month who watch it on their TV screens. That is more than 2x the size of The Roku Channel, which has 51.2MM monthly active users, the majority of which are in the U.S. Back-of-the-napkin math tells us almost 100% of Roku Monthly Active Users use the YouTube app.

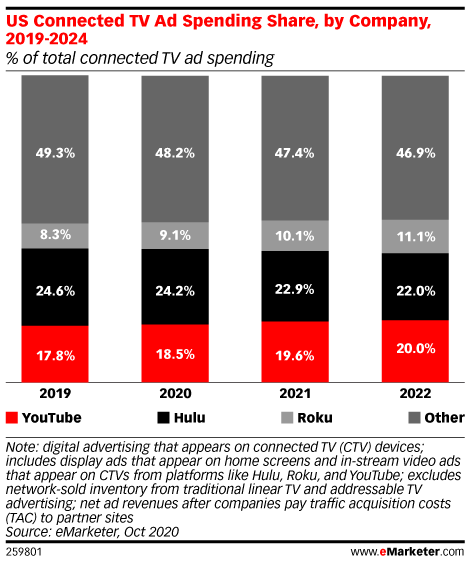

YouTube’s connected TV ad-serving software also competes with Roku’s emerging and growing connected TV ad-tech platform.

YouTube TV is the only exception: it is a vMVPD with 3MM+ subscribers, and Roku does not offer a vMVPD. So, there is no competition in the vMVPD space. So, in theory there should be a deal for YouTube TV already - there are no incentives to compete in vMVPD and therefore plenty of opportunities for both Roku and Google to cooperate here.

Instead, what makes this standoff interesting is how Google is leveraging these negotiations to exploit Roku’s win-win business logic, as Roku SVP Scott Rosenberg told CNBC’s Alex Sherman last July ($ - paywalled):

So the best, winning recipe is a model, an economic relationship between the parties where we’re both winning, we’re both earning as we drive the success of these apps. That’s what we seek and ultimately, in some cases, it takes us a little longer to get there with the parties

It is a jiu-jitsu-type move, leveraging YouTube’s scale as a means of breaking Roku via Roku’s “win-win” business terms. So, in this light, Google is saying “the success of YouTube apps on Roku needs the AV1 codec, and YouTube users need a better user experience on Roku ”. Roku finds both requests problematic, but both requests are necessary for the YouTube apps succeeding within the Roku ecosystem (Roku “commanded 37% of big screen viewing time in Q1 2021”, according to Conviva’s State of Streaming Q1 2021 report).

This ends up being a funhouse mirror version of co-opetition: Google is working within Roku’s “win-win” parameters of the partnership but its definition of “success” for YouTube and YouTube is costly for Roku. For Roku to also benefit from its partnership with Google, it is being asked to make costly decisions given those are the decisions that YouTube requires at its greater scale.

That puts Roku in an unenviable but logical position, given how its business relies on the success of its partners. Through the lens of co-opetition, the problem between Google and Roku simply may be that what YouTube needs to succeed is costly to Roku because that’s what a win-win outcome requires.

I don’t know if that is “anti-competitive” or “bad faith”. I do wonder if Roku’s “win-win” business logic may not be the best model for working with tech giants in streaming (excluding Netflix which Roku spun out of in 2007).

Must-Read Monday AM Articles

Alison Levin, Roku’s VP of global ad revenue and marketing solutions, gave CNBC a preview of Roku’s Newfronts pitch, which takes place today.

Google recently announced it was building custom silicon in an effort to boost performance and efficiency for YouTube “now that Moore’s Law no longer provides rapid improvements for everyone." TechSpot has an article diving into Google’s efforts, and why the company hired former Intel head of Core & Client Development Group Uri Frank to lead a server chip design team in Israel.

Jennifer Elias of CNBC reports, “If its current growth trajectory continues, YouTube will book between $29 billion and $30 billion in revenue this year”. This is expected to surpass Netflix’s projected revenue of $29.7B in 2021.

I wrote about market signals on sports streaming’s future “Mic Drop #27: NBCU & WarnerMedia Seem Skeptical About Sports Streaming's Future”. Brian Steinberg’s Variety piece has some helpful charts on total audience for NHL on NBC.

There were a few other interesting signals: Sportico reported an SEC filing from Sinclair in 2021 that said it is on the hook for $1.82 billion in rights fees but without distribution. An executive quoted said “Gambling can’t happen soon enough.” RSNs are playing with screen size to get more advertising dollars, at the expense of the fan viewing experience.

Jabari Young of CNBC reported: “MLB said live games on its over-the-top service, MLB.TV, garnered more than 1.3 billion minutes of streams from opening day, April 1, through April 18. That’s a 12% increase compared with the first 18 days of the shortened 2020 season and up 43% compared with the same time frame for the 2019 season, the league said in a release.”

In the UK, BT has confirmed that discussions are underway about selling a partial stake in its TV offering. According to the Daily Telegraph, DAZN, Disney, Amazon, and an unnamed British broadcaster are in the running as BT refocuses on upgrading its broadband network.

On to Netflix: Joe Adalian of Vulture has a must-read piece diving into Netflix’s product development process.

Netflix has movie releases planned for every week this summer. Lots of upcoming original IP, too, including Ryan Murphy’s Halston and Jupiter’s Legacy, its first production to come out of its 2017 Millarworld acquisition. Borys Kit of The Hollywood Reporter has a good interview with Millar.

Two paywalled articles about Netflix worth reading: Variety VIP’s Andrew Wallenstein writes about how Reed Hastings doesn’t appear to be “sweating the competition” despite a weaker-than-expected quarter. The Information’s Jessica Toonkel and Mark Di Stefano write in How Netflix Fumbled India, about which Hastings told investors “We’re still figuring things out.” ($ - paywalled)

Other streaming executives are worried about an uptick in churn as the pandemic comes to an end and people leave their houses. Niche services face the most interesting questions, as this article in The Drum argues. On that topic, AMC Networks CEO Josh Sapan discussed AMC’s strategy in a podcast interview with Recode Media’s Peter Kafka.

Terry Nguyen writes on Vox about how subscriptions like Patreon and Substack can be emotional purchases, but other subscriptions can feel more like utilities.

The Walt Disney Company announced it has chosen Amazon Web Services (AWS) to leverage the global rollout of its streaming service Disney+.

Comcast mentioned in its Q1 earnings call this week that it had plans to expand Peacock internationally. NBCUniversal announced it hired Jim Denney, a TiVo veteran who most recently was at Hulu, as executive VP and chief product officer of direct-to-consumer, overseeing Peacock’s global product strategy.

AT&T announced a $9.99 monthly price for its AVOD launching in June, which I think is high. Scott Porch wrote about HBO Max’s Year two strategy of “winning weekends” in Decider. AT&T CEO John Stankey spoke glowingly about HBO Max and WarnerMedia at Friday’s annual shareholder meeting. WarnerMedia CEO Jason Kilar is making $52MM per year, and his day-and-date “movie gamble” paid off at the box office, but AT&T Inc. shareholders voted against the executive compensation packages for AT&T management.

Discovery held its Q1 earnings call, where it reported Discovery DTC subs had gone up to 15MM subscribers from 11MM in late February. The Wall Street Journal has a helpful breakdown of the metrics it shared ($ - paywalled).

Advisory firm Strategy Analytics projects US viewers will spend more on streaming video than pay-TV for the first time in 2024. Samba TV reported in Q1 there was a 10 percent quarter-over-quarter decline in the daily average number of TV-viewing US households consuming linear, along with a 14 percent decline in total minutes viewed.