Member Mailing #279: Roku & Google Bet on Programming Guides of FAST Channels

This is a major development with broad implications for linear, advertising, SVOD, and AVOD marketplaces

Programming guides of free ad-supported TV channels, or FASTs, have emerged as a default feature on OTT streaming devices from Google and Roku.

These are a major developments.

Janko Roettgers of Protocol reported last week:

Google is looking to make its Chromecast streaming device more appealing to cord cutters. The company has plans to add free TV channels to Google TV, the Android-based smart TV platform that powers Chromecast as well as select smart TVs from companies including Sony and TCL, Protocol has learned.

To achieve this, Google has held talks with companies distributing so-called FAST (free, ad-supported streaming television) channels, according to multiple industry insiders. These channels have the look and feel of traditional linear TV networks, complete with ad breaks and on-screen graphics. Free streaming channels could launch on Google TV as early as this fall, but the company may also wait to announce the initiative in conjunction with its smart TV partners in early 2022.

Roku joined the PR blitz on Monday:

With the Roku OS 10.5 update, Roku device owners will be able to access the live TV guide — which now boasts more than 200 channels to stream for free — faster by pinning it to their home screens alongside their other apps and channels. After updating, users just need to search for “Live TV on The Roku Channel” and will be able to install it as they would any other app or streaming service.

How significant are these developments?

According to Leichtman Research Group, about 43% of all TV sets in U.S. households are connected Smart TVs, and 60% of adults watch video via a connected TV device at least weekly.

Assuming 110MM broadband-connected households in the U.S., that’s at least 40MM connected Smart TVs, and at least 66MM connected TV devices.

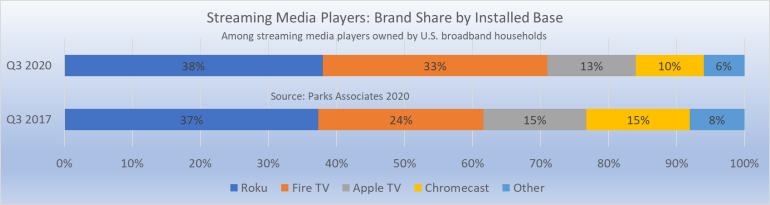

Also, as of Q3 2020, Google and Roku controlled almost 50% of the streaming media device market, combined, implying at least 33MM connected TV devices in the U.S.:

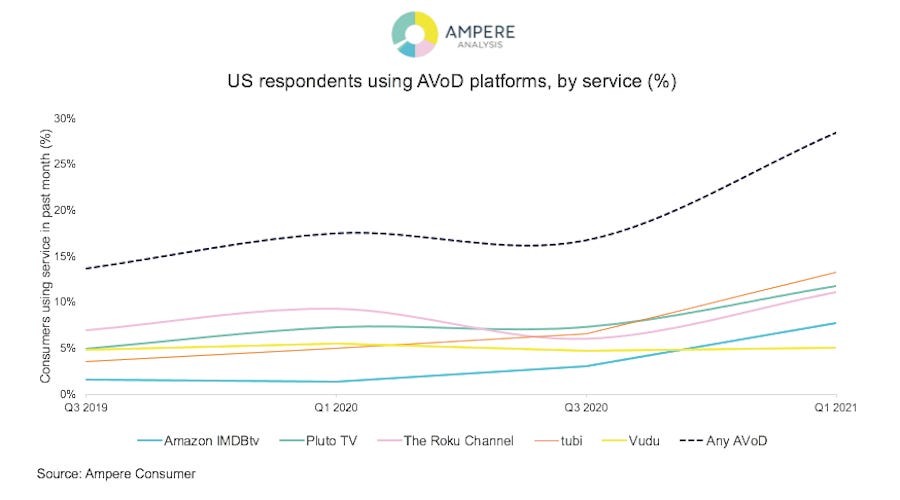

Moreover, there is growing demand for AVOD in the U.S., as per this chart from Ampere Analysis:

So, this development has a wide variety of implications for the linear, streaming, SVOD, and AVOD marketplaces. It also ties into a number of Member Mailings and themes from 2021, to date.

Given the breadth of these implications and my own time constraints, it is easier for me to send out a summary of past Member Mailings this development plugs into, and why.

To get full Member access these previous mailings. click on the button below to subscribe:

Member Mailing #264: Subscribers vs. Viewers in Sports Streaming

In terms of UX/UI, these programming guides drive a wedge between viewing audiences and subscriber audiences, a distinction I wrote about back in May around bundling streaming services:

Bundling as a solution is limited in two ways. First, bundling may aggregate subscriber audiences at scale, but that relationship is ephemeral. Secondly, personalized user experiences create a higher probability of viewing audiences at scale than bundling. Two perfect examples of this are Hulu and Amazon Prime Video.

As a user experience, programming guides of FAST channels seem to fit nicely between both use cases. The open question is whether it fits too nicely: meaning, does it risk creating enough friction between device owners and apps outside the programming guide to reduce viewership.

I think that is a real risk to apps that need subscriber audiences, or audiences that will pay for streaming content, when free content is immediately available on the connected TV device screen.

Member Mailing #271: AVOD after the 2021 Upfronts

For advertisers seeking more scale understand the post-Apple App Tracking Transparency (ATT) world, connected TV devices may offer better solutions for scale outside of legacy media.

These programming guides reflect just how important first-party data has become to both advertisers seeking scale outside of legacy media:

The reality of the advertising marketplace in summer 2021 is that advertiser demand has now been fundamentally changed more by Apple’s ATT than by the emergence of streaming ad inventory from legacy media companies. First-party data is more important than ever.

The question is whether legacy media companies will look “outside of the box” at gaming or e-commerce platforms for “aggregator 2.0” mergers or partnerships to meet this demand. Or, whether they simply will pursue mergers with other media companies.

There is real power being aggregated across Smart TV providers who are also offering robust post-ATT advertising solutions.

Member Mailing #272: After Sun Valley, Co-opetition or Competition in Connected TV?

I asked in this Member Mailing:

Are traditional media CEOs better off bundling to solve for the last mile in Connected TV because that’s where the ad dollars are going? Or solving for something else?

The Roku and Google programming guides offer one answer: they can bundle their FAST channels into programming guides to solve the last mile, and bet on free driving scale.

But, if sports and legacy media SVOD content is not available in the last mile, then there is still friction between users and content. I highlighted this problem in that mailing, too:

…the subtext of this year’s Olympics is there is a competitive dynamic at play with these and other Connected TV platforms.

There is also a Co-opetition dynamic at play, first reported by Variety’s Cynthia Littleton out of Sun Valley two weeks ago:

Now that traditional media giants are all investing big in streaming platforms, there’s an obsessive focus on bundling services and how consumers will navigate so many direct-to-consumer options. Traditional media executives are worried that Apple or Google or Roku or some other third-party player will become the new cable operator — the distribution go-between — by finding a way to bundle rival services to make it easier for subscribers to search for content and pay bills.

“It’s still too hard for people to find stuff,” the CEO source said. “People think this will get solved by rebundling or by technology.”

The implication is traditional media streaming services realize that these platforms own the last mile to the consumer, and in Connected TVs, Roku owns the largest share of it (40%) and Amazon just behind it (29%). Moreover, YouTube is dominating Connected TV usage: 120MM homes streamed YouTube or YouTube TV on their TV screens last December in the U.S.

According to this logic, Peacock and Pluto TV are vulnerable to friction created by Google’s and Roku’s programming guides.

Meaning, Pluto TV’s and Peacock’s value propositions as aggregators of FAST channels become narrower with other FAST channels now more immediately available in Connected TV programming guides.

Google and Roku now offer marginally more value to users with the immediate accessibility of their programming guides.

Member Mailing #278: Can or Will Comcast Ever Innovate A Smaller Bundle & Set-Top Box?

Last week it was announced that Comcast struck a partnership with Chinese TV manufacturer Hisense to sell two smart TV models under the XClass TV brand, and powered by a version of Comcast's X1 operating system.

Google offers a real competitive challenge to Comcast, in particular, as reported in Mediapost’s DigitalNewsDaily:

"Google is smart to FAST-follow the market," comments Michael Zacharski, CEO of Engine Media Exchange. "Because Google owns the hardware in Chromecast, as well as SSP and DSP assets, it can quickly move to compete with end-to-end players like Roku and the OEMs for CTV ad dollars." The move could prove "both an obvious play to connect the dots for advertisers looking to fulfill omnichannel media solutions, and an opportunity to gain maximum advantage in the data targeting and measurement space, as Apple and Google continue their work to scuttle the current cookie based ad economy," he adds.

Comcast has a large TAM for its Xfinity software (and today it announced an international version, a global streaming device called the XiOne):

This question about growth in linear vs. streaming highlights the core tension in distribution during cord-cutting: as the U.S. streaming marketplace slows, investors will be looking for growth, and streaming services like Peacock may not offer that growth.

Moreover, 40MM-50MM linear homes may offer more scale than streaming services like AMC Networks and Peacock may ever be able to attain via OTT distribution.

So, there may be more exciting possibilities for Xfinity X1 STB software at 40MM-50MM STBs than for Peacock (and for 110MM broadband homes in the U.S.). When taking an initial stab at that scenario, some notable implications for Warner Bros. Discovery and AMC Networks emerge.

Roku’s and Google’s programming guides offer three competitive threats to Comcast:

they offer a competitive alternative to Peacock within almost 50% of the Smart TV device marketplace in the U.S.

they offer a competitive alternative to ad buyers

NBCU’s FAST channels will also need distribution via Connected TV programming guides outside of Peacock, which in turn will force disaggregation of Peacock.

Conclusion

There is lots of food for thought here, and it feels like I have just begun skimming the surface.

The most fascinating angle here is how the advertising market shapes up as linear dollars start moving increasingly to Connected TV. I also wrote in Member Mailing #272: After Sun Valley, Co-opetition or Competition in Connected TV?:

With Roku and Amazon offering ad-supported streaming services - and Amazon’s recent moving into sports streaming with the NFL deal - traditional media streamers face growing competition in Connected TV (CTV) ad sales as linear dollars shift over to digital. They need scale, but in order to scale, they need Co-opetition-type relationships with their emerging competitors in order to ensure discoverability.

Meaning, legacy media companies increasingly relies on Roku, Amazon, and Google for CTV distribution of its FAST content and SVOD apps. That means it will also rely on them increasingly for end-to-end ad sales solutions.

I wrote in Member Mailing #256: Amazon, NBCU, The NFL, & Addressable Advertising that this dynamic “gets dicey” when:

…we imagine a Sunday Night Football game broadcast on Peacock that is watched via Amazon Prime Video and/or a Fire TV device. If NBCU is giving up 30% of its inventory to distribute Peacock within the Amazon ecosystem, from whom is the advertiser better off buying ads to reach Sunday Night Football viewers? Peacock or Amazon?

With programming guides of FAST channels, established scale in broadband households, and rapidly scaling and improving end-to-end advertising solutions, the Connected TV inventory controlled by Roku, Amazon, and Google objectively seems increasingly appealing to ad buyers.