Monday AM Briefing #54

The stories and trends in OTT streaming you *need* to know for this morning & the week ahead

A Short Essay on Churn & Q2 2021 Results

Lots of pieces and data about churn in streaming popping up in the closing weeks of Q2 2021:

The Hollywood Reporter highlighted decelerating growth for Disney and Netflix

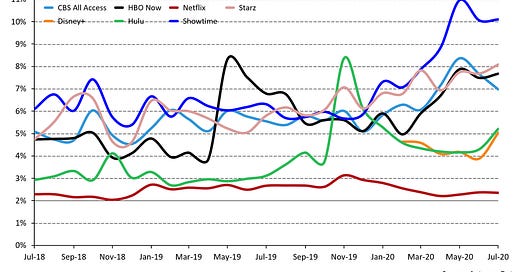

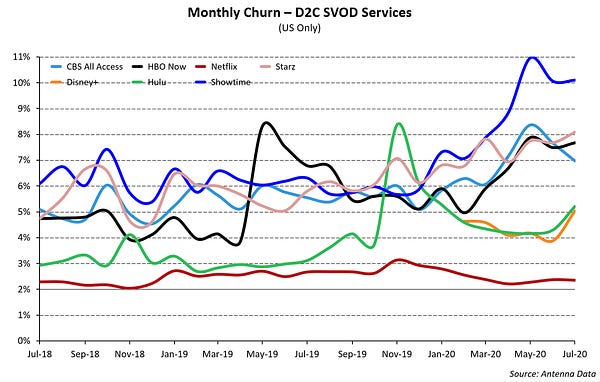

SVOD churn jumped to 20% from 15% in H2 2020

TV[REV] suggested this jump in churn is evidence of their “The Great Rebundling” hypothesis

The average number of video streaming services utilized per U.S. user has fallen for the first time, according to technology research firm Omdia

Antenna and MoffettNathanson Research shared analysis on churn data from Q4 2020,

Antenna CEO Rameez Tase tweeted about Netflix’s market-low churn rate of 2.5% in response to another Twitter thread on why understanding pricing and churn is “at least 75% of the $NFLX thesis”

This is the most important piece of the entire $NFLX thesis. Per @AntennaData the stock has shown almost no increase in long-term Churn over time as (a) they have increased prices and (b) they have attracted late adopters of the service. Data here:

This is the most important piece of the entire $NFLX thesis. Per @AntennaData the stock has shown almost no increase in long-term Churn over time as (a) they have increased prices and (b) they have attracted late adopters of the service. Data here: Understanding pricing and churn is at least 75% of the $NFLX thesis in my view. $NFLX reported gross churn of 2.5% (Q4 '20), which is an annual gross churn of 30%. Is this a sign of weakness? I conclude NO for the following reasons:

Understanding pricing and churn is at least 75% of the $NFLX thesis in my view. $NFLX reported gross churn of 2.5% (Q4 '20), which is an annual gross churn of 30%. Is this a sign of weakness? I conclude NO for the following reasons: Unusual Value @unusualvalue

Unusual Value @unusualvalueVariety VIP+ published a data-rich piece on streaming churn, including a recent study conducted by Maru Group for Variety Intelligence Platform ($ - paywalled)

I think the interesting question is, why we are hearing so much more about churn now?

Netflix streaming is almost 15 years old, Hulu has been around since 2008, and Paramount+ (née CBS All Access) has been around since 2014. It’s not a new metric.

Perhaps the reason is because “investors are increasingly looking to a tapestry of metrics to evaluate the long-term viability” of legacy media streaming “endeavors”, as Business Insider reported ($ - paywalled). And, “long-term viability” seems to be on everyone’s minds following the Warner Bros. Discovery merger.

I also wonder how much relates to the “pull-forward impact” of the pandemic on growth. It was something Netflix envisioned in its Q1 results last April:

Some of the lockdown growth will turn out to be pull-forward from the multi-year organic growth trend, resulting in slower growth after the lockdown is lifted country-by-country. Intuitively, the person who didn’t join Netflix during the entire confinement is not likely to join soon after the confinement.

That does not mean growth isn’t feasible: Paramount+ spiked to #1 in the iOS App Store on Friday following the release of a reboot of Nickelodeon hit iCarly (it has since dropped to #18).

But, the challenge with the pull-forward impact of the pandemic or from new hits like iCarly is whether that growth is lasting. Volatile churn may be an inevitable part of being a streaming service not named Netflix.

This would imply that we will see investors grow more skeptical about legacy media bets in streaming, and the famed “streaming multiple” will play out in reverse. Investors will lose confidence in legacy media streaming bets across the board (which I wrote about for Members last November).

I think this is an inevitable outcome, likely to be muted or diminished by three factors.

First, legacy media companies have been managing the story around churn for years. My favorite tactic is the concept of “pause” (which I wrote about back in December 2019), where streaming services accept that their target demographics are loyal to the content, first, but are not loyal to the streaming service. So, users have not “churned out” but have simply have paused their accounts until the next installment of a series arrives.

Second, earnings guidance has become a game of under-promising and over-delivering. Or as IAC Chairman Barry Diller puts it:

“Companies spend too much time massaging the process, getting the model right, so that they can always beat, not miss expectations, and the markets are always reactionary on that wildly short-term, dumbness of what happened in the next quarter,” Diller said, adding the models are “based on a phony premise.”

Both factors point to a third factor: we may be seeing more stories about churn now because investor relations teams are getting ahead of the story for Q2. Meaning, Q2 earnings are likely to show elevated churn from the “pull-forward impact” and other factors like the post-pandemic economy kicking back into gear.

Investors wising up to streaming churn are going to open up a Pandora’s Box of questions for legacy media executives. We are witnessing the optics being managed, aggressively, by legacy media companies in real-time.

Must-Read Monday AM Articles

The must-read of the week is “How Roku used the Netflix playbook to beat bigger players and rule streaming video” from CNBC’s Alex Sherman. It’s a smaller case study on how Netflix’s and Roku’s histories are intertwined.

Scott Mendelson of Forbes writes, “If we don't have trustworthy VOD revenue figures and/or streaming viewership data, the only way to determine whether a project is successful is to get a follow-up.” The Wall Street Journal writes about how “Many Hollywood insiders worry about the pressure studios are putting on themselves to maintain quality amid the huge jump in production.” ($ - paywalled)

Netflix expanded and reshuffled its creative leadership team across Asia in acknowledgement of the region’s importance to its growth.

Disney vet Emily Horgan wrote about Netflix’s kids strategy on YouTube, and asks “Could this help them finally unlock a major kids franchise hit for themselves?”

Brightcove disclosed in its Q1 report that 30.8% of all domestic OTT subscription revenue will go to Netflix, and Disney+ (which includes ESPN+ and Hulu) will account for 25.9% of SVOD revenue.

MoffettNathanson is bullish on AVOD, seeing it grow to $20B in 2025, but are bearish on the prospects of Peacock and ViacomCBS to scale.

NBCU CEO Jeff Shell spoke to a Credit Suisse investor conference and told them that Peacock “is misunderstood sometimes as being a separate business “, and that his company is “pretty comfortable” with Peacock’s current distribution.

Discovery CEO David Zaslav acknowledged at the same Credit Suisse conference that he still has “work to do to win hearts and minds” of the WarnerMedia team. I wondered on Twitter “whether Zaslav is learning that the scope of what he is taking on is different than what he assumed he was signing up for”.

Disney CEO Bob Chapek told the same Credit Suisse conference that the real test of Disney’s recent reorg will be “how the studio’s current five-year plan plays out.” He also told a Q&A call between Disney and Morgan Stanley that “over 50% of our global marketplace don’t have kids, [over half of] our subscribers don’t have kids.”

In a surprising move, the British government has asked streaming services, including Netflix and Amazon, to disclose viewing data for shows originated by UK public service broadcasters.

In Member Mailing #266: Netflix & Verizon Test Bundling Streaming with Gaming, I asked “Can bundles of gaming apps with streaming video services capture growth that streaming services cannot reach?” Polygon wrote a deeper dive into how “Disney took over video games after closing all of its studios”.

I wrote last September that Google TV is “an extraordinarily powerful hack of content aggregation”. But it has not played out that way, yet, and Google’s VP and GM of TV Platforms Shalini Govil-Pai offered some background as to why in an interview.

Canal+ is now threatening to entirely pull out of covering Ligue 1 in light of the rights award to Amazon. Politico wrote about “Why Amazon’s move into European sports is unstoppable”.

A group of nine European soccer leagues, including the top domestic leagues in Denmark, Switzerland and Norway, are pooling their international media rights in the hopes that selling a larger centralized package will bring more eyeballs and more revenue.

Disney closed a fast-paced upfront that saw more than 40% of total dollars committed to the company go to streaming and interactive venues.

NBCU is talking to potential advertisers about a price tag of $6 million for a 30-second spot in the event. The bet is on a renewed wave of enthusiasm from Madison Avenue for live sports.