Mic Drop #24: In one week, momentum changes for STARZ in the "Genre Wars"

What happens to STARZ after both the Netflix deal for Knives Out and the Netflix deal for Sony films?

Some of the lockdown growth will turn out to be pull-forward from the multi-year organic growth trend, resulting in slower growth after the lockdown is lifted country-by-country. Intuitively, the person who didn’t join Netflix during the entire confinement is not likely to join soon after the confinement.

The quote, above, from last April, was from Netflix warning shareholders that the pandemic lockdown was going to have a “pull-forward” impact on user growth. It did, with new subscriptions slowing down in Q3 and Q4.

The fun question is, what else can happen in the marketplace after a pull-forward impact on user growth? What are other consequences of a pull-forward impact?

Over the past two weeks, we saw STARZ’s future impacted with a one-two punch from Netflix, which:

secured the rights to the sequels to Knives Out, which Lionsgate originally distributed (it streamed on Amazon Prime in the U.S. but on STARZPLAY internationally); and,

a five-year deal with Sony that will give Netflix the exclusive U.S. rights to Sony’s films once they leave theaters and premium video-on-demand services

Notably, these were both victories at the expense of Lionsgate and its streaming service, STARZ: Lionsgate distributed the first Knives Out, and the Sony deal with Netflix replaced Sony’s previous five-year deal with STARZ.

These two wins reminded me of something I wrote in Mic Drop #15: STARZ's finds wins in the "Genre Wars” about how Netflix “does and doesn’t compete with STARZ”:

…Netflix’s bets on genre and target audiences are more complex than a head-to-head battle in a “genre war”. This allows the smaller services like STARZ and AMC and Shudder [to] find strategic and financial wins by being genre- and target-audience-focused. Notably, neither of the smaller services is betting on the Romance genre.

Netflix and STARZ are not engaged in “streaming wars”, they are engaged in infrequent “genre wars”. STARZ is proving genre to defensible territory and a good business to be in within the streaming marketplace.

Evidently, Netflix and Lionsgate/STARZ have been competing behind-the-scenes, and Netflix has won resoundingly both times.

This leaves two obvious questions:

what does this mean for the “genre wars”?

what does this mean for the future of STARZ?

The first question has an easy answer: the “genre wars” will continue because, for the foreseeable future, there are still wins to be found for services like STARZ and AMC’s suite of streaming apps continue to focus on distributing content for target audiences. In the last week alone:

Starz announced new shows target black female audiences (the trailer for Run The World), and broader female audiences (announcing Samantha Morton as Catherine de Medici in The Serpent Queen)

AMC Networks’ announced its British programming-focused streamer Acorn TV has acquired exclusive SVOD and U.S. premiere rights to the new season of Midsomer Murders

There is a longer discussion to be had around the future of the “genre wars” as digital marketing undergoes a fundamental transformation with Apple’s and Google’s changes to IDFA and ad tracking, and the rise of Connected TV. But, we won’t be diving into that today.

As for the future of STARZ?

There is both an obvious answer and a less obvious answer to what these developments mean for the future of STARZ.

The obvious answer is the loss of Sony’s pay-one movies is a painful loss. STARZ has now lost future installments of the Spiderman, Venom, and Jumanji franchises, and the upcoming Morbius starring Jared Leto, and Uncharted starring Tom Holland in an adaptation of a Playstation game. As we are seeing on other services like Amazon Prime, HBO Max, and even Netflix, blockbuster movies matter for driving traffic, and retaining subscribers.

If you want to be cynical about the future of STARZ as a stand-alone service, you would not be unreasonable in thinking so.

STARZ CEO Jeffrey Hirsch has been stoking some of that cynicism by openly discussing STARZ in bundles for over a year now. When he spoke to Variety’s Andrew Wallenstein on the Strictly Business podcast last June, he predicted, “I think you’ll see a day when a Netflix/Starz bundle will show up as well at some point.”1 Even last June, the implication was that stand-alone, as a model, had less runway than before.

Which leads to a logical question: given the “pull-forward” impact of the pandemic, how much more runway does STARZ have as a stand-alone app after these deals?

That is where the less obvious answer is helpful: STARZ has pursued a strategy of pause, to date. “Pause” as a strategy reflects an organizational acceptance that their target demographics are loyal to the content, first, but are not loyal to the streaming service. The strategy embraces churn as a tactic, which reads counterintuitive.

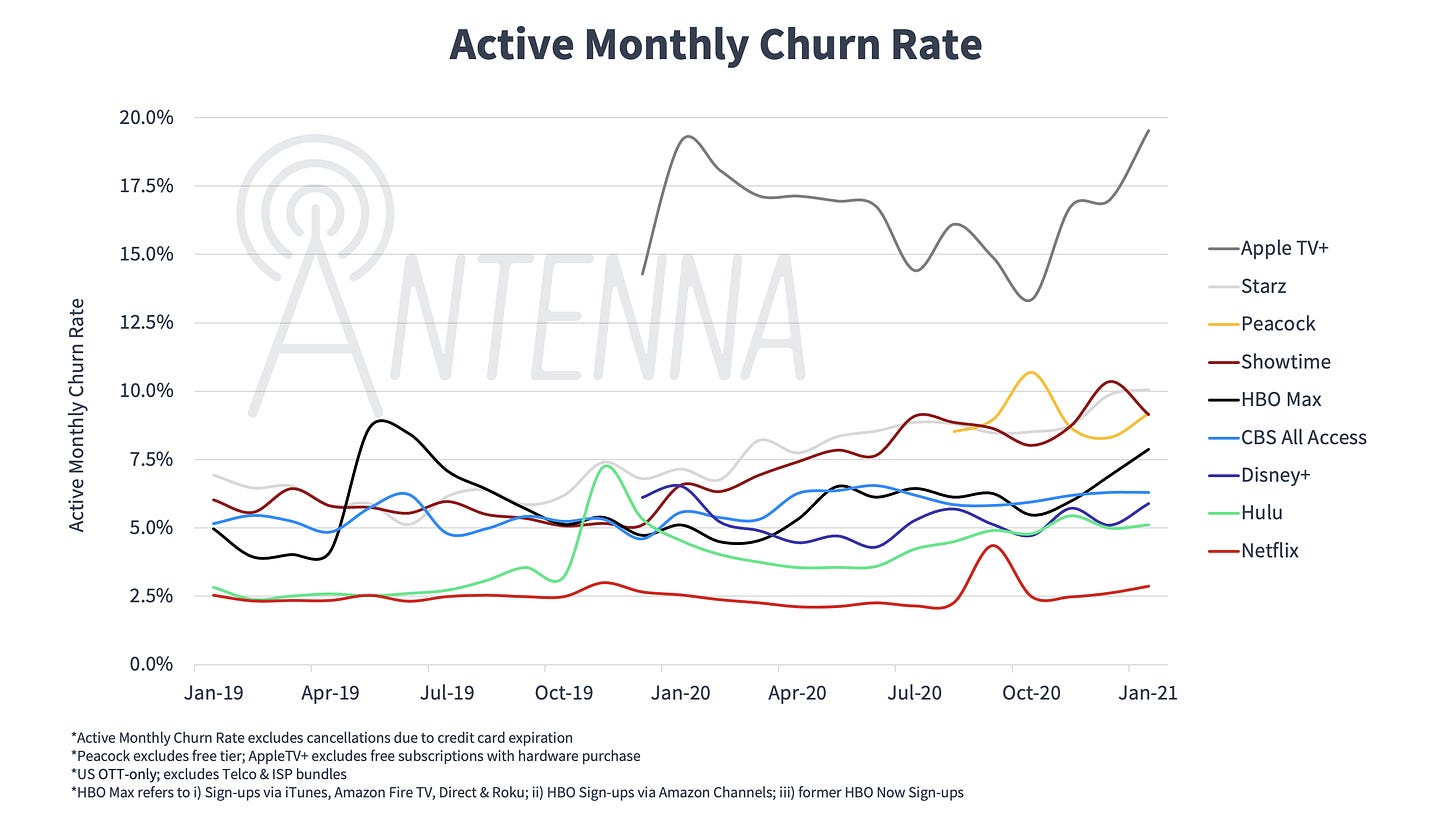

But some slides from ANTENNA Data on marketplace churn - shared in Member Mailing #253: AMC Networks, Starz & "Genre Wars" Strategies - tells us the story of pause for STARZ is:

steady annual churn rates with minor fluctuations;

most churned subscribers returning after a year; and

retention of churned subscribers typically between more than to six months, most within more than one to three months.

One slide told a story about fluctuating churn best:

What’s notable is how the dips in churn correlate to seasons of STARZ original series:

March 2, 2019 through April 28, 2019, American Gods (Season 2)

May 5, 2019 through June 23, 2019: The Spanish Princess

July 12, 2020 through September 6, 2020: P-Valley

July 14, 2019 through August 18, 2019: Sweetbitter (Season 2)

August 25, 2019 through February 9, 2020: Power (Season 6)

September 6, 2020 to January 3, 2021: Power Book II: Ghost

After Power Book II: Ghost, churn jumped to its highest level in 2021.

So, through the lens of series dates alone, the strategy of “pause” built around original series seems to work for STARZ. It suggests content consumption on STARZ will be variable with original series offerings, with or without Sony Pay 1 movies.

And, as CEO Jeffrey Hirsch told the Morgan Stanley Tech, Media, & Telecom Conference in March, STARZ is doubling down on that strategy:

“Growth, however, is mainly driven by original series. How many? Sixteen, he said. “We will have 12 this year, rising to 16 next year.”

But, he also told the same conference “mid-budget films play better on our service than anything else,” and:

“Movies are important to our service. Big box office movies drive a lot of acquisitions and conversions”.

The loss of the Sony deal is a real loss for STARZ. It reads like an emphasis on more original series has proven to be a better strategy for the service, generally, because there is little brand loyalty to the service itself.

The “pull-forward” effect of recent developments on STARZ may best be summed up as forcing it to have an unusually heightened focus on marketing its original series. That has proven to work, to date, but without big box office films, for how much longer?

And in a darkly funny way, that is effectively what happened in the Netflix-Sony deal… but without the bundle.