Monday AM Briefing #71

*Need* to know stories and trends for this morning & the week ahead; A Short Essay on MLB’s, NBA’s & NHL’s Potential Streaming Solution for RSNs

Here is a link to the replay of my Fireside Chat with Hedgeye’s Communications Sector Head (Internet, Media and Telecom) and Partner Andrew Freedman (NOTE: email required to watch).

As usual, we had a good, wide-ranging, and in-depth conversation. Below is a time-stamped outline of the Fireside Chat:

Intro / Background

1:02 – My bio in

6:35 – Netflix's (NFLX) venture into video games

14:41 – Netflix's content moderation & potential effects of moderation

22:43 – Key takeaways from the Scarlett Johansson lawsuit

27:58 – Iger vs. Chapek

29:50 – Reflecting on management styles in Media

38:30 – The correct go to market strategy for Discovery-Warner Media (T) (DISCA)

51:36 – Sport's role in streaming (SBGI)

1:01:11 – The end game for ViacomCBS (VIAC)

1:09:35 – Redstone's mindset with ViacomCBS

A Short Essay on MLB’s, NBA’s & NHL’s Potential Streaming Solution for RSNs

This tweet from The Athletic’s Sean Shapiro popped up in my Twitter feed on Friday, prompting a bunch of chatter.

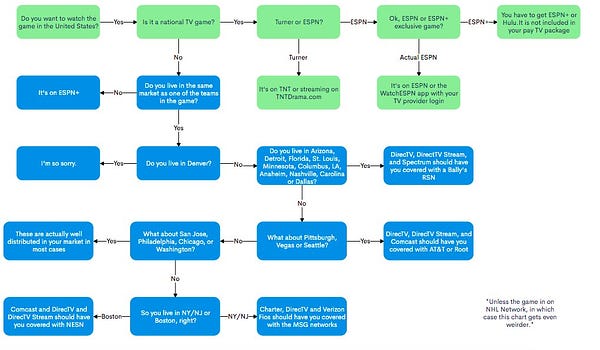

Shapiro breaks down in this tweet (and this article) why there is “a need for a viewers guide of how and where to watch hockey in the United States”.

We are now in the rare moment of the year when all four major sports are broadcasting on TV and via streaming. What makes this particular moment in 2021 notable is that the future of the Regional Sports Network (RSN) business model faces growing uncertainty.

I mean, there has been uncertainty during pandemic, but there is more uncertainty following Major League Baseball Commissioner Rob Manfred’s comments at the CAA World Congress of Sports two weeks ago:

Asked about Sinclair’s claim that it is close to obtaining the necessary rights to launch a direct-to-consumer RSN service, Manfred said the accurate statement would be that Sinclair does not have enough digital rights from enough clubs in order to have a viable direct-to-consumer product. Manfred: "The other set of rights they've talked a lot about is gambling rights, they don't have those either. We have been clear with Diamond from the very beginning, this was not a late starting issue. We've been very clear with them from the beginning that we see both those sets of rights as extraordinarily valuable to baseball, and we're not just going to throw them in to help Sinclair out.”

Notably, Manfred blamed Sinclair Broadcasting Group’s problems with RSNs for the negativity surrounding the RSN model:

“Fewer subs, it makes the business more difficult. I think that the negativity surrounding the RSNs has been increased exponentially as a result of the situation with the Sinclair (Broadcasting) subsidiary Diamond. Part of their problem is cord cutting. The other part of their problem is there's excessive leverage on that business." Manfred: "If you think about what they paid for it, how much debt they have on it, I mean, you think it's over 80%, it's a huge number. And that leverage has produced headlines that are more negative. There are RSNs out there that they're not thriving or growing, but they're going to survive. Look, look, there are RSNs, YES and NESN that have businesses that remain profitable, they're affected by cord cutting. But the fact of the matter is I think the negativity has been increased by the Diamond situation.”

There is no clear-cut, clean way of describing the problems facing RSNs (I wrote about the problem of RSNs being disaggregated in Friday Mailing #47 two-and-a-half weeks ago). But, it has been a messy puzzle of moving pieces, and Manfred’s comments now solve for a big piece of the puzzle.

After Sinclair’s promises to investors of a DTC app — about which I wrote skeptically in Member Mailing #269: Disney, Sinclair & The Sports Streaming Consumer back in June — Manfred seems to have ensured those promises are DOA in the quotes above.

The solution, instead, would be the MLB launching “a nationwide video-streaming service that would enable fans to watch their teams’ hometown games without a cable-TV subscription” in 2023, as the New York Post reported last week.

The most eye-opening paragraph in the article is this one:

The National Basketball Association and the National Hockey League are also considering partnering with MLB on the new streaming service, sources said. Insiders say subscription rates would vary by geographic market and could be between $10 and $20 a month — well below the monthly cost of most cable-TV packages, which can easily stretch past $100.

In other words, the MLB solving for its RSN pain point can also solve for the NBA’s and NHL’s RSN pain points.

Returning to Sean Shapiro’s piece, there may be a single solution looming for that messy flow chart, above, and that single solution circumvents RSNs.

Ergo, the increasingly uncertain future that RSNs face.

Local Advertising Still Matters

There are RSNs out there that they're not thriving or growing, but they're going to survive. Look, look, there are RSNs, YES and NESN that have businesses that remain profitable, they're affected by cord cutting.

This prediction from Manfred, above, is worth revisiting because it reveals that, even in solving for its RSN pain point, the MLB could end up with a flowchart like the NHL’s outside of regions where the RSN model is working.

Obviously, that is an outcome they make seek to avoid, and for which a negotiated outcome is still feasible. That is the implication of this line in the NY Post article:

In exchange for Sinclair backing its streaming plans, MLB is open to a proposal from Sinclair in which the league would cut the roughly $1 billion in annual fees Sinclair pays teams for cable broadcast rights, giving its Diamond unit more breathing room to refinance its loans before they mature in 2026, sources said.

With Sinclair owning the digital broadcast rights for 14 MLB teams, that is $14B in annual payments Sinclair would no longer owe MLB.

That raises the question of what Sinclair’s business model would look like in 40MM to 50MM households, without the burden of rights payments, but with reduced affiliate fees and with lower advertising.

Operating Expenses get reduced significantly (~$1B of $2.4B in Sinclair’s OPEX 2020 is somewhere ~40%) but what will bring fans to watch Sinclair RSNs instead of streaming?

One answer to this question lies in my point about disaggregation, and how streaming “disaggregates” the value proposition of the RSN aggregating live broadcasts with replays of old games — which emerged as a necessary strategy during the pandemic — and interviews with old and new stars.

The broader value proposition of RSNs may still capture inelastic demand with this value proposition. That said, it will be sub-scale, like MSG Entertainment’s “healthy six-figure number” audience in New Jersey and Connecticut.

Another answer lies in another point about disaggregation: as in legacy media, there is a “co-dependent” relationship between supply and local advertiser demand in the RSN marketplace. Marketplace disaggregation is unlikely, and “evolution” more likely, because local advertisers would rather spend on what works than what may work.

So, the big open question remains how the demands of local advertisers will be met given that demand for advertising inventory on an MLB, NBA and NHL streaming service will always be targeted and sub-scale.

Perhaps OTT ad-serving and targeting technology will be more standardized by then. But local advertising is a business model that works ($196MM for Sinclair in 2020, though 10% of affiliate revenues), and will not instantly transfer to a centralized streaming service.

How MLB, NHL, and NBA leadership will set about solving for that is anyone’s guess. This also adds to the uncertainty of the future of RSNs.

Must-Read Monday AM Articles

Awful Announcing’s Jay Rigdon has a good take on why MLB’s proposeed service, “especially with the potential to be a joint effort with two other major American sports leagues, would be a massive undertaking, and it really could upend a lot of current standards.”

Emerging "Metaverse"-type convergence strategies

N/A this week

Aggregator 2.0

Anyone is now able to apply for access to video uploading features in Anchor, Spotify’s free self-publishing podcast division, which will distribute the episodes directly on Spotify.

Scopely, one of the largest privately held mobile-first video game companies, and Sony Pictures Entertainment announced an agreement for Scopely to acquire GSN Games, a division of Game Show Network, LLC

Sports & Streaming

Matt Slater and Felipe Cardenas of The Athletic reported that “A $3 billion (£2.2 billion) deal over nine years is possible” for the U.S. TV rights to the Premier League

In the gaming marketplace, the New York Times reported the unthinkable may occur, and EA Sports is planning for a FIFA without FIFA.

FIFA announced it will adopt “a new commercial positioning in gaming and eSports to ensure that it is best placed to make decisions that benefit all football stakeholders.”

Creative Talent & Transparency in Streaming

In a week where it was leaked that Pinterest may be acquired by PayPal, Pinterest announced a bundle of new features in its first big push to pay creators, including a $20 million investment through 2022 that will fund "Creator Rewards."

The Information reported on how YouTube is copying TikTok’s growth playbook by paying professionals to produce original short videos for its Shorts offering. ($ - paywalled)

A list of the YouTube creators nominated for Webbys.

In a fascinating new model, Creator-focused financial startup Spotter has partnered with BBTV to buy $125 million of back-catalog content from the YouTubers in its network. Creators only give up rights to certain videos, and are free to do what they want with their lump sums. Spotter, monetizes the content it bought and collects 100% of revenue earned.

Original Content & “Genre Wars”

WarnerMedia’s top leadership spoke to Variety in Burbank in “an open-ended conversation” about where the company is headed pre-merger. CEO Jason Kilar also spoke to Bloomberg’s Lucas Shaw to shed more light on the AT&T quarterly subscriber figures for HBO Max.

Superna Kalle, president of international networks at Starz, gave Deadline an overview of the original content strategy for Starzplay,

Discovery made $35 million in production cancellations, cutting back on its more expensive productions

AdAge dove into how Squid Game is winning attention from brands ($ - registration required)

‘CoComelon’ Owner Moonbug is seeking a valuation of $3B and is seeking either an acquisition (Blackstone, Kevin Mayer and Tom Staggs) or IPO

Comcast’s & ViacomCBS’s Struggles in Streaming

Comcast announced the launch of its XClass TV, a new smart TV model being marketed direct to consumers in the U.S. The new smart TV will allow consumers to have access to Comcast’s digital platform without an Xfinity subscription, both inside and outside of Comcast’s service areas.

AVOD & Connected TV Marketplace

Kirby Grines lays out a really good argument why the Monthly Active Users metric is problematic: first, it’s a metric that “gives an overegged sense of user interaction to companies and their shareholders”; and second, “it has no standardized rubric to compare MAU measurements”.

Spotz.ai promises a more nuanced understanding of what an ad break opportunity looks like in streaming with the help of Artificial Intelligence

Roku and YouTube still have not reached agreement on their complex dispute which threatens distribution of UYouTube and Youtube TV on 55MM Roku devices. Some helpful data from A&E Networks executive Ethan Illfeder

Other

The Hollywood Reporter reported only 2 percent of moviegoers turning up to see Ridley Scott’s A-list The Last Duel on opening weekend were 17 or younger, while just 17 percent were between the ages 18 and 24. Conversely, more than 80 percent of ticket buyers were 25 years old and up.

Former Disney exec Emily Horgan wrote about the new services which are popping up to threaten YouTube's foothold in kids entertainment for Observer

Last week Amazon’s news app on Fire TV expanded live and on-demand local news from 88 to 158 major cities across the U.S..

Streaming services may pay up to 30 percent more to production workers as part of the International Alliance of Theatrical Stage Employees’ (IATSE) deal with major Hollywood studios to avert a strike.

Nearly half of millennials (47%) and 34% of Gen Z in the U.S. canceled and then resubscribed to the same streaming video service within the following 12 months, according to Deloitte’s latest “Digital Media Trends” study.