Friday Mailing #47: RSNs & Disaggregation

If MSG Networks can't reach a deal with Comcast, will it be better off disaggregating its content and betting on streaming?

First, a quick note to fine-tune a point I made in Wednesday’s Member Mailing on AMC Networks and MSG Entertainment:

Comcast Xfinity reaches 18MM+ residential video customers, and 21MM+ Xfinity customers when including Xfinity Flex, but MSG Networks is not in 18MM+/21MM+ homes nationally

Rather, it is in “a healthy six-figure number” in New Jersey and Connecticut, and a long-tail number more outside of NYC

Unlike on virtual MVPD Fubo TV, where it is available nationally, MSG Networks is only available regionally on Comcast.

That means it has lost access to a highly targeted user base within Comcast’s customer base, and not access to a larger, more national audience of 18MM+.

I regret the error.

I avoided diving deeper into the question of the future of MSG Networks as a Regional Sports Networks (RSN) because it’s a hornet’s nest of issues.

But, it’s also a story surfacing more in the headlines recently: we are increasingly hearing about more distributors dropping RSNs and/or more standoffs between RSNs and distributors.

AT&T SportsNet and Root Sports RSNs were removed from the Dish Network service last Thursday, and Dish has previously stopped carrying other RSNS, including the Bally Sports networks owned by Sinclair Broadcast Group.

The problem is the economics: RSNs make large rights payments to leagues for games and in turn demand high rights fees from distributors.

As cord-cutting increases, high rights fees push bundle prices higher at a time where distributors need lower prices to retain subscribers.

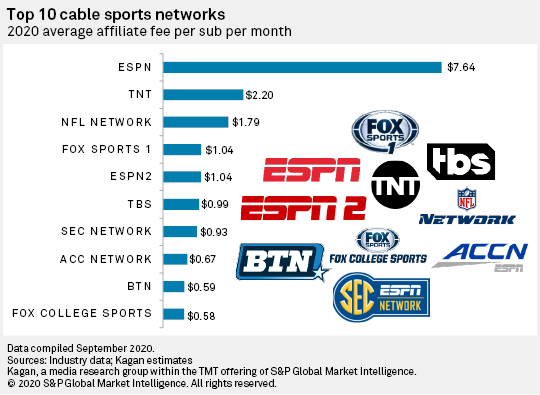

MSG Networks is one of the most expensive RSNs, having charged distributors in 2019 an average rate of $4.65 per sub per month and was projected to be $5.42 in 2020. This puts it closer to ESPN than any other RSN in pricing, though Comcast’s NBC Sports Philadelphia is projected to be $5.53 per sub per month in 2022.

Dish has been pushing an à la carte model, “similar to premium subscription channels”, as a solution to higher prices like MSG Networks’ affiliate fees.

No RSN has yet to agree to it.

Disaggregation & RSNs

I predicted in March 2020 and again in November 2020 that the fundamental value proposition of RSNs - effectively, live sports, replays, and nostalgia - will be disaggregated by streaming.

In the March essay, “The sports broadcast market after COVID-19”1, I wrote:

…RSNs' programming bundles live broadcasts alongside nostalgia. OTT enables the disaggregation of nostalgia from livestreaming, and can deliver it in an experience more tailored to passionate fans. Fox, NBCU, and ViacomCBS all building nostalgia-driven channels for their original content on their AVOD services. Peacock will offer channels like Pluto TV, and also hubs for its content with specially curated channels (e.g., sketches on SNL with Kristen Wiig in the SNL hub), which will be a deeper experience than what Pluto offers.

NBCU, Fox and ViacomCBS arguably are in a place to monetize sports nostalgia content over OTT better than RSNs or the teams who own the livestreaming rights. They have a better understanding of what advertisers want, are able to sell both national and programmatically targeted campaigns, which in turn results in higher CPMs, and with their AVOD services will be able to reach U.S. audiences at scale immediately. So, there is good reason to believe that as RSNs get phased out, their nostalgia programming will be aggregated and bundled into OTT services.

That leaves RSNs stuck with an old, expensive model that is on the brink of being disaggregated.

Nostalgia content is replays of old games — which emerged as a necessary strategy during the pandemic — and interviews with old and new stars. MSG Networks offers a wide variety of these types of shows.

This points to a logical question: if RSNs offer an “old, expensive model”, is MSG Networks “on the brink of being disaggregated”, where its live broadcasts of games are better off being distributed in streaming and its nostalgia content is better off being distributed on AVODs?

Two arguments come to mind as answers to this question.

The first argument is MSG Networks is not about to be disaggregated:

“There’s the narrative out there that RSNs are dying. RSNs are not dying so much as they’re in the first phase of painfully evolving. RSNs exist for a perfectly good reason and it’s not going to change. All of this local inventory has to be monetized. This is the only way to do it, even in an era of streaming,” media consultant Pat Crakes told CFX. “These RSNs aren’t going to go away, but at the same time, they have a lot of problems. This value chain kind of relationship between distributor, channel and team isn’t going to get broken. The way out is to keep that intact. The problem is, what does that look like?”

Crakes likened RSNs to hothouse flowers. They appeal to 10-15% of an MVPD’s sub base, and are going to be the last to make the jump from linear to digital. He believes the path forward is to find that distribution model that keeps the distributor-channel-team value chain in place. That could take the form of a DTC product that cuts the distributor in—ie, charge $20 a sub and the operator takes a cut. “I wouldn’t be shocked if out of these conversations, a couple of these don’t involve some ideas like that,” he said.

The one thing RSNs do unusually well is to sell higher CPM, targeted local ad inventory. That is less of a focus for algorithmically targeted OTT advertising solutions.

So as in legacy media, there is a “co-dependent” relationship between supply and advertiser demand in the RSN marketplace. Marketplace disaggregation is unlikely, and “evolution” more likely, because local advertisers demand it.

The second argument is reflected in something I wrote about Ozy Media on Monday:

At its best — and this may be generous — Ozy Media was trying to scale a media business built around doing a “better” job on untold stories of American heroes that we often see on the nightly news or cable news as filler content.

In other words, what Ozy Media was building was an emotionally compelling, progressive/”woke” version of filler content that is an afterthought for cable news networks, and at a time when cable news networks are losing audiences precipitously.

Sports nostalgia content is “filler content” on network television. If Ozy Media is precedent — excluding the evidence of fraud — there is little to no audience demand for what RSNs treat as “filler content” beyond the RSN.

A move from Sinclair last November reflected that:

Whereas I had predicted sports nostalgia would be monetized better on OTT, in a fun twist on my prediction Sinclair is now disaggregating content from its sports verticals to help its RSNs: “…we are utilizing content from Stadium and Tennis Channel to provide incremental live and recorded sports programming to the RSNs.” Although not exactly my prediction of “nostalgia programming will be aggregated and bundled into OTT services”, it certainly mirrors the business logic and a step towards that model.

Disaggregated “filler content” isn’t a viable business model in part because local advertisers seem to prefer the broadcast model and is associated with the sports team rather than the sports content.

So, neither MSG Networks nor any RSN is likely on the brink of being disaggregated.

But, all will need distribution going forward, and more importantly local advertisers both want and need RSNs to continue to have distributions because streaming does not offer a compelling alternative to local advertising (yet?).

So, odds are MSG Networks will reach a deal with Comcast because it needs to reach a deal with Comcast (and it reached a deal with Verizon Fios after a short standoff).

An “à la carte” premium subscription outcome is unlikely now, but it does seem inevitable as more MSG Networks target customers cut the cord.

Postscript

I plan on using the term/title “Mic Drop” less.

Why?

The title originated as the seed of a fun experiment.

But, when you see “Mic Drop” juxtaposed next to a number like “48”, the term loses its meaning. It implies that, if I were referring an actual working microphone, it has been dropped on a stage at least 48+ times. It’s easy to imagine that microphone would be in physically terrible shape by now.

So, going forward, I’ll use it occasionally.

NOTE: you can see how much the PARQOR newsletter has evolved in 18 months