Member Mailing #280: AMC Networks, MSG Entertainment Face New Friction with Linear AND Streaming Consumers

There is a common theme to recent, surprise executive resignations at AMC Networks & Comcast dropping MSG Networks from Comcast Xfinity

[Author’s Note: Last week I was unable to send a Member Mailing due to some other commitments, one of which you will be hearing about shortly.

I will make it up to Members at a later date.]

Key Takeaways

It was a rough week for two businesses owned by the Dolan family: AMC Networks and MSG Networks.

But what is the “writing on the wall” that the Dolans, AMC Networks and MSG Networks executives may be seeing?

As MSG’s standoff with Comcast highlights, it is not just disintermediation in the simplest sense, which is digital overtaking linear.

Rather it is a complex set of developments disintermediating the Dolan Family’s cable businesses and its target customers across linear and streaming

The Dolans are majority shareholders of both AMC Networks and MSG Entertainment, neither of which had a great week last week:

On September 28th, longtime AMC Networks COO Ed Carroll announced he would exit at the close of 2021 after 34 years at the company, a month after CEO Josh Sapan stepped down as AMC Networks president and CEO and transitioned to an executive vice chairman role.

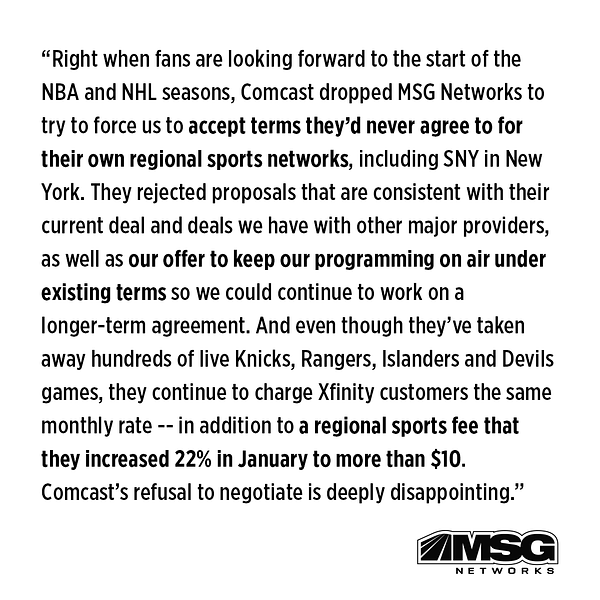

On October 1st, Comcast dropped MSG Networks from its Xfinity platform

The first is a question about the future of AMC Networks, and whether it can replace affiliate and advertising revenues with streaming revenues. The second question is an existential one for MSG Networks revenues, which is just under 50% of its revenues and almost all of its operating income.

I last wrote about the Dolan family in A Short Essay on The Dolan Family & AMC Networks CEO Josh Sapan's Resignation back in August.

The question then, and still now, is:

how the Dolan family — who were integral to the scaling and evolution of linear media with Cablevision (out of which AMC Networks originally was spun out as Rainbow Media) — may be thinking about the [cable] business.

The question seems more resonant now given the standoff with Comcast over MSG Networks, which will be blacked out of 1/3rd of residential cable households and another 3MM+ on Xfinity Flex for the foreseeable future as the NHL and NBA seasons kick off.

Longtime AMC Networks executives see the writing on the wall, and the future of MSG Networks now faces the writing on the wall.

But what is the “writing on the wall” that the Dolans, AMC Networks and MSG Networks executives may be seeing?

Given that the Dolans are notoriously private and secretive, the answer is not clear. But, there are four available lenses for thinking through answers to this question:

the outcome of 40MM-50MM post-cord-cutting linear households (AMC & MSG)

Regional Sports Networks (MSG)

AMC’s streaming efforts (AMC+ and a suite of six apps), and

The emerging power of Smart TVs and devices (AMC+ & AMC’s Walking Dead channel on Pluto TV)

The four lenses tell us the “writing on the wall” for the Dolans is not digital disruption in the purest sense.

Rather, it is something akin to death by 1,000 paper cuts: a complex set of developments disinter-mediating the Dolan Family’s cable businesses and its target customers.

1. Future 40MM-50MM Post-Cord-Cutting Households

I argued in A Short Essay on The Dolan Family & AMC Networks CEO Josh Sapan's Resignation:

Even if AMC Networks accomplishes its goal of 20MM to 25MM paid streaming subscribers by 2025, that still may be half the size of the linear cable market in 2025.

Why would the Dolan family give up that larger market opportunity for higher subscriber fees because a more niche, “genre wars” strategy is working at lower ARPU (~$4/streaming subscriber, and without advertising) too?

It makes me wonder whether Sapan’s resignation was the result of the Dolan family doing the math and realizing that there will be more upside in pivoting back towards what they know best (linear) than in doubling down on what they know least (streaming) at a smaller scale.

The point of that essay was to argue why a sale of AMC Networks was unlikely.

I still think a sale of AMC Networks is unlikely, but I am less certain of this argument above after the MSG Networks dispute.

The 40MM to 50MM prediction came from former NBCU executive Salil Dalvi, who predicted what smaller cable packages for these audiences could look like:

It is not clear where the Dolans see AMC Networks or MSG Networks in this scenario. It is guesswork, at best.

But, starting from the default assumption that 40MM to 50MM is the most likely outcome, and the Dolans no longer own Cablevision (which is now Altice… which is struggling), which means they cannot build their own solution.

That leaves both AMC Networks — which relies heavily on The Walking Dead and does not own much of its library — and MSG Networks — which relies heavily on two underperforming sports teams — in tough pole positions for getting one of those 20-30 basic channel slots in a Total Addressable Market of 40MM to 50MM homes.

In fact, AMC Networks relies unusually heavily on The Walking Dead:

For 12 consecutive years, the series has remained the No. 1 series on basic cable among adults 25-34 in live+3 viewing. Per our source, the linear ratings are essentially flat with the last episode of “The Walking Dead” in April.

“The Walking Dead” was a monster rating success back when SVOD wasn’t dominating over traditional television viewership — during the show’s fifth season, its live+same day viewership peaked with a staggering average of 14.4 million viewers per episode; 7.4 million of those fell into the coveted adults 18-49 demographic. It was ranked the top cable show in the key demo for eight of the past nine years. The show’s 10th season averaged just 3.4 million viewers in live-plus-same-day, with 1.1 million in the key demo, but even now in its 11th season, it still holds the rank of cable’s #1 drama and AMC is home to three of the top 10 cable dramas among the key demo, which include “The Walking Dead,” “Fear the Walking Dead” and “The Walking Dead: World Beyond.”

I argued in Member Mailing #278: Can or Will Comcast Ever Innovate A Smaller Bundle & Set-Top Box?:

In a smaller bundle, AMC Networks faces the difficult choice of trying to achieve more scale while also navigating the “multidimensional” chess of evolving user behaviors. Given its bets on specific genres, it may meet that demand better on streaming than on linear.

The Walking Dead is less of a sure bet on linear for AMC Networks as cord-cutting progresses. In this light, streaming may simply be a better business model for AMC Networks, and the departures we are witnessing — longtime legacy media executives — implies different management is necessary for that business model.

2. MSG Networks & The Problem with RSNs

MSG Networks does not face as bright a future in linear nor streaming.

The challenge in streaming is that there is not a business model for RSNs in streaming, something I wrote about in Member Mailing #269: Disney, Sinclair & The Sports Streaming Consumer:

Price and price-value relationship are the challenges for Sinclair. Notably, the 8-K does not include a price for the future DTC service, which has been speculated to be $23/month. Sinclair CEO Chris Ripley recently told a reporter that the rumored price is not true, and Sinclair is conducting market research to determine a “fair price” for the DTC service.

Sinclair needs to propose a price that converts local fans and also solves for the lost economics of cancelled or postponed RSN distribution agreements. The average RSN charges about $3.53 per subscriber per month, and the Sinclair RSNs charge distributors between $2.42 and $7.52 per subscriber per month.

In this light, the prices MSG will need to charge on both Comcast and streaming will need to be a multiple of whatever they charge now.

But, Comcast needs to keep the price of its bundle lower, so Comcast is facing downward-facing price pressure. There is no middle ground between MSG and Comcast here.

The economics of streaming are shaping up to be punitive for fans of the Knicks and Rangers alike. Worse, the Comcast data reflects that audience demand in a third of linear homes in the U.S. is highly elastic.

MSG Networks has no pricing power outside of the tri-state area, if at all, and certainly not for streaming.

This Comcast revelation is brutal for the future of MSG Networks, and implicitly for other RSNs.

3. AMC’s streaming efforts

“Genre Wars”

AMC Networks currently has 6 million aggregate subscribers across AMC+, Acorn TV, Shudder, Sundance Now, and ALLBLK streaming services. It projects it is on track for 9MM aggregate subscribers by end of 2021.

I asked in A Short Essay on The Dolan Family & AMC Networks CEO Josh Sapan's Resignation:

Even if AMC Networks accomplishes its goal of 20MM to 25MM paid streaming subscribers by 2025, that still may be half the size of the linear cable market in 2025.

Why would the Dolan family give up that larger market opportunity for higher subscriber fees because a more niche, “genre wars” strategy is working at lower ARPU (~$4/streaming subscriber, and without advertising) too?

I think we now have an answer to this question, above: AMC Networks will be increasingly unlikely to reach their target audiences through linear, even if linear remains at a greater scale than its 2025 objective of 20MM to 25MM households.

Streaming will be the better option because of AMC Networks’ “genre wars” strategy, which I wrote about in Member Mailing #253: AMC Networks, Starz & "Genre Wars" Strategies back in March:

..AMC’s priority in the “genre wars” is to focus on producing highly specific content within genres that have passionate audiences, like horror (Shudder) or fans of British TV (Acorn).

Linear offers guaranteed scale but, as above, is less reliable for ratings. Streaming offers more scale, in theory, but more friction in the path between the streaming app and converting subscribers: there is more competition for eyeballs and wallets, despite more available household spend from cord-cutting.

In streaming, too, AMC Networks relies unusually heavily on The Walking Dead:

The Season 11 premiere was available on AMC Plus one week ahead of its linear debut and grabbed the top launch viewership ever for the premium cabler’s streaming platform. Per an inside source with knowledge of the company, it drove the biggest week of new sign-ups for the streamer in 2021 and the episode has also been the top title on AMC Plus across all devices. Notably, the second episode of the season, which became available on AMC Plus last Sunday on the same day the first was being aired on TV, is pacing ahead of the premiere episode and is on track to break its viewership record.

There is no sense of scale in this data-less data point, here. But, there is a sense of “genre wars” engaging and converting passionate audiences.

Aggregator 2.0

The other promising sign about AMC’s streaming efforts is a recent “aggregator bundle 2.0” deal with Verizon:

Verizon is providing one free year of AMC+, the streaming service that offers “The Walking Dead,” “Mad Men,” and other AMC Networks series and films, to certain new and existing Fios and wireless subscribers, the company announced Thursday. The promotion begins immediately and runs until Feb. 10.

New or existing Verizon customers who purchase a 5G phone with a device payment plan will get 12 months of AMC+ included for no extra charge, Verizon said. New Verizon Fios customers who sign up for one of Verizon’s Mix & Match home internet plans also get the promotion. In addition, Verizon is giving away six months of AMC+ to customers on its “Start Unlimited” plan, its cheapest unlimited plan that includes 4G data instead of 5G. After the Verizon promotions end, AMC+ will cost the standard $8.99 per month.

This puts AMC+ in a bundle with Apple Arcade, Apple Music, discovery+ and Disney+. As I wrote in Member Mailing #270: First-Party vs. Third Party "Aggregator 2.0" Bundles:

…for Verizon, the economics are all marginal revenues contingent on their ability to market these deals. The marginal costs of marketing these services to an existing base of 90.2MM postpaid subscribers and 13.3MM Fios connections are effectively zero.

The advantages for AMC+ are obvious: Verizon can super-charge AMC+’s growth numbers with awareness and easy sign-up conversion over 100MM subscriptions across the U.S.

Also, the deal launches at around the same time as AMC Networks’ most important quarter in streaming: FY Q4 2021. As I wrote in Member Mailing #253: AMC Networks, Starz & "Genre Wars" Strategies:

[AMC Networks’] $300 million run rate at the end of 2020 is annualized, which led analyst Michael Nathanson to ask about “the quarterly volatility in subscription fees”. That is effectively a question about churn.

Meaning, if Disney is precedent (discovery+ numbers are still lumped with other Discovery OTT services), AMC+ could see as much as 7MM new sign-ups in Q4, or almost a 100% boost in its subscriber base. But, odds are it will likely be closer to 1MM to 2MM.

Verizon’s scale can deliver impact for AMC+’s growth, but it may be marginal.

4. Smart TVs

With more market activity in the Smart TV space, it is worth briefly considering whether those are factoring into the Dolans’ worldview.

The first is something I highlighted in Member Mailing #278: Can or Will Comcast Ever Innovate A Smaller Bundle & Set-Top Box?:

Only yesterday we learned Comcast struck a partnership with Chinese TV manufacturer Hisense to sell two smart TV models under the XClass TV brand, and powered by a version of Comcast's X1 operating system. This is after rumors of progress in Smart TVs emerged in June in a Wall Street Journal piece on Comcast.

Currently, 1/3 of all residential video customers are using Comcast’s Xfinity software (18MM out of 55MM). Xfinity Flex also has 3.8MM devices deployed across Comcast and Cox, as of May 2021.

Combining both user bases, Comcast’s Xfinity platform gets to 40% of Roku’s active user base of 55.1MM Monthly Active Users. It is a competitor to market leaders Roku and Amazon.

Meaning, it is particularly notable that MSG Networks is being dropped from Xfinity because that is the foundation of Comcast’s software products, including Smart TVs. Losing access to Xfinity means losing access to Comcast’s future in linear and broadband, and potentially beyond.

The second is something I highlighted in Member Mailing #279: Roku & Google Bet on Programming Guides of FAST Channels:

Programming guides of free ad-supported TV channels, or FASTs, have emerged as a default feature on OTT streaming devices from Google and Roku….

According to Leichtman Research Group, about 43% of all TV sets in U.S. households are connected Smart TVs, and 60% of adults watch video via a connected TV device at least weekly.

Assuming 110MM broadband-connected households in the U.S., that’s at least 40MM connected Smart TVs, and at least 66MM connected TV devices.

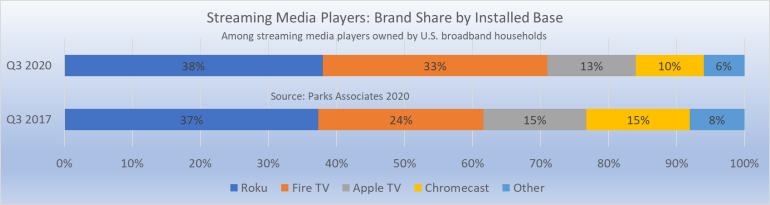

Also, as of Q3 2020, Google and Roku controlled almost 50% of the streaming media device market, combined, implying at least 33MM connected TV devices in the U.S.:

Meaning, the deeper issue for AMC Networks in the Smart TV space is competition from free ad-supported services (FASTs). It has addressed this competition with a Walking Dead channel on Pluto TV.

But, as I wrote in that essay:

Peacock and Pluto TV are vulnerable to friction created by Google’s and Roku’s programming guides.

Meaning, Pluto TV’s and Peacock’s value propositions as aggregators of FAST channels become narrower with other FAST channels now more immediately available in Connected TV programming guides.

Google and Roku now offer marginally more value to users with the immediate accessibility of their programming guides.

Meaning, even if streaming is the more promising path ahead for AMC Networks, and Comcast can be circumvented via Roku, Amazon and Google to reach 110MM+ homes, there are numerous areas of friction between the consumer and AMC+.

Conclusion

Returning to the original question: what is the “writing on the wall” that the Dolans may be seeing?

The most obvious takeaway is disintermediation. But, as the Comcast standoff highlights it is not just disintermediation in the simplest sense, which is digital overtaking linear.

Rather it is disintermediation playing out in highly complicated and various ways between the Dolan Family and target customers across linear and streaming:

AMC Networks faces a limited future in 40MM-50MM post-cord-cutting homes

MSG Networks facing brutal choices around the economics of its RSN business, both in linear and in streaming, after losing 1/3rd of U.S. residential homes (Comcast)

AMC+ needing an “aggregator bundle 2.0” with Verizon to scale, and

AMC+ and AMC’s Pluto TV channels being vulnerable to friction created by Google’s and Roku’s programming guides.

In short, the “writing on the wall” for the Dolans is the iterative emergence of various forms of friction between AMC Networks, MSG Networks, and their target audiences.

The “36,000 foot view” suggests AMC Networks seems better positioned than MSG Networks with just under a $2B market cap and $443MM of Operating Income in FY 2020 (AMC Networks). MSG Networks has just over a $2B market cap but facing is pandemic-related operating losses of $450MM in FY 2021 (MSG Entertainment excluding MSG Networks)

But, there is a complexity and an unpredictability to the friction: that may be why we are seeing so many surprising moves from the Dolan family as of late.