Member Mailing #270: First-Party vs. Third Party "Aggregator 2.0" Bundles

The recent Outside+ bundle from active lifestyle publisher Outside highlights some real challenges for streaming services offering first-party “aggregator 2.0” bundles

Key Takeaways

With the Amazon Fire-Peacock distribution deal, every legacy media streaming service has now signed a Co-opetition agreement

But, instead we are seeing more chatter about an “aggregator 2.0” bundles, which bundle streaming with gaming, music, shopping, etc.

There are two types of “aggregator 2.0” bundles: those that offer first-party services (Apple) and those that offer third-party services (Verizon)

Third-party bundles (Verizon) may be better positioned than first-party bundles to help streaming services scale

Three bets on bundling emerged in the marketplace in H1 2021:

Streaming bundled with gaming, music, shopping, etc. (Netflix, Amazon, Apple and Verizon)

Streaming bundled with other services with economics dictated by platform Channels models like Amazon and Roku (Mic Drop #33: Prime Day Is a ”Massive Dry Run” Towards Amazon Channels Bundling), and

Streaming bundling through traditional linear cable B2B bundling (Member Mailing #263: The AT&T-Discovery Merger's Questionable Bet on Rebundling)

Bet #2 is an example of Co-opetition, which highlights tensions between tech platforms and legacy media companies in the streaming marketplace. Back in February I wrote about why Co-opetition outcomes are best for SVODs and Amazon and Roku, but offer inherent disadvantages to emerging legacy media AVODs.

Bet #3 is also an example of Co-opetition, but where a bundle of Warner Bros. Discovery streaming apps get more reach and less churn via Amazon and Roku.

But, Bet #1 is not Co-opetition. Rather, it is an “aggregator 2.0” bundle, which offers “the ability to personalize offerings like never before, mixing and matching television, news, e-commerce, gaming, health, and any other service that charges a monthly or annual subscription rate.”

Now that Comcast/NBCU’s Peacock and Amazon have finally reached agreement for distribution on over 50MM Fire TVs and Fire tablets, every legacy media streaming service has now signed onto some form of a Co-opetition agreement.

But the “aggregator 2.0” bundle is still new. It is, in some ways, a digital offering reflecting the PARQOR Hypothesis, bundling various first-party services. So, it is notable that all legacy media companies excluding Disney are unable to offer this type of bundle (and Disney has opted to allow Verizon bundle Disney+ with third-party gaming services).

When a legacy media company does offer a bundle that makes streaming a value-add - like the recent Outside+ bundle from active lifestyle publisher Outside - we learn that the first-party “aggregator 2.0” bundle faces some real challenges.

“Aggregator 2.0”

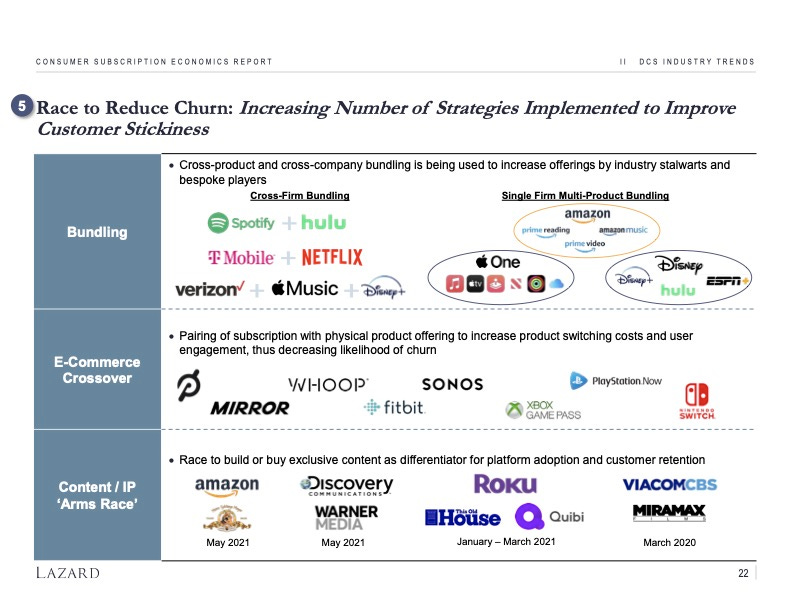

A recent Consumer Subscription Economics Report from Lazard provided a helpful summary on “aggregator 2.0” bundles in the marketplace, highlighting “Cross-Firm Bundling” and “Single Firm Multi-Product Bundling”, in particular.

The value proposition for the consumer is the same in all of these different types of bundles: a single point of contact for payment to multiple services.

There are two additional nuances worth highlighting:

Verizon and Apple both offer a single point of payment for bundles that the consumer can customize from a wide variety of first-party services; but,

Verizon is distinct from Apple in that offers a single point of payment for a customizable bundle from a wide variety of third-party services.

Those nuances result in two very different sets of supply side economics for “aggregator 2.0” bundles with a single point of payment.

For Apple, the economics are both captured in services amortized with new device sales, and in the economics of the Apple One bundle, which trades services margins in exchange for discounted pricing to drive growth.1

But for Verizon, the economics are all marginal revenues contingent on their ability to market these deals. The marginal costs of marketing these services to an existing base of 90.2MM postpaid subscribers and 13.3MM Fios connections are effectively zero.

Depending on whether the bundles are first-party or third-party services, “aggregator 2.0” bundles may result in very different customer relationships and very different economics for the streaming service. As popular as they are becoming, it is not clear how each “aggregator 2.0” bundle will drive growth for a streaming service.

“Aggregator 2.0” & The Outside+ Bundle

Recent profiles from Digiday and The Washington Post on active lifestyle publisher Outside help to highlight how a legacy media company may pursue “aggregator 2.0” model like Apple or Amazon:

At $99 for a one-year subscription, Outside+ introduces new perks for subscribers beyond access to the company’s 20 publications and one-year delivery of two of Outside’s print magazines: Outside Magazine and one of 12 titles a subscriber can choose from. Those new perks include access to member-exclusive digital content and online courses, a personalized feed from 20 publications, the Outside TV streaming channel and discounts to things like gear and apparel.

Digiday quoted Melissa Chowning, founder and CEO of Twenty-First Digital, on the challenge of this Outside+ model with consumers:

One subscription “is much easier to market, manage, and grow.” However, the challenge for the publisher may be to “convince a Yoga Journal reader that an Outside+ subscription makes sense for them,” she said.

An additional challenge is highlighted in The Washington Post article, writing about Outside Media owner Robin Thurston:

Outside still has a loyal base of 530,000 print subscribers, and the other magazines have a combined print circulation of 680,000. Thurston aims to shift revenue from 70 percent ads to 70 percent subscription in just three years. Thurston said converting 10 percent of the free visitors to his website to members will meet this goal.

Converting 10% of visitors to Outside+ membership is ambitious, to say the least, as Jacob Cohen Donnelly writes in A Media Operator:

If he is expecting a 10% conversion rate so he can hit his goal of profitability in a year, he is going to be in for a very rude awakening. The vast majority of paid subscriptions convert at a fraction of that. According to a research deck prepared by Piano back in 2019, the median paid conversion rate across the network of sites it powers is 0.20%.

While I think the Outside+ product is compelling and they are doing a good job with their subtle marketing, 10% just won’t happen. To assume otherwise is to set the company up for failure. Will the team start trying to get aggressive with discounts to get people to convert? That’s an additional risk that can have a negative impact on growth.

It is not necessarily a fair one-to-one comparison of publishing versus in streaming: the value propositions, the marketing conversion funnels and the economics are fundamentally different.2

But, the bundling strategies of Outside+ and “aggregator 2.0” bundles in streaming both have the same business logic around their value propositions betting on consumer “need”:

if a Yoga Journal reader needs Yoga Journal, will they also pay for the Outside streaming channel because it is discounted in a bundle?

if an Apple Arcade subscriber needs Apple Arcade, will they also pay for a streaming subscription to Apple TV+ because it is discounted in a bundle?

Neither is a straightforward question, and we have little evidence to deliver straightforward answers.

The Outside+ example offers some evidence to highlight the challenges of the math: if the median paid conversion rate across publishing sites is as low as 0.20%, it implies an “aggregator 2.0” bundle from a legacy media publisher like Outside+ may be trading higher operational complexity for low conversion rates.

Notably, the rumored total Apple TV+ subscriber base of 40MM subscribers reflects a similarly low conversion rate (nominally, 2% of 1.6B devices worldwide). Throw in data from a recent survey from Variety showing as many as 62% of Apple TV+ subscribers are still getting the service for free, and Apple has converted only 1% of its install base to paying subscribers for Apple TV+.

Maybe that has changed or will change with the Apple One bundle. But we have very little data to support a pro or con case.

The more interesting takeaway from the Outside+ example is the expectation of a 10% conversion rate from a bundle, or 50x the market standard in publishing and 5x what Apple has achieved over almost 1.5 years since the launch of Apple TV+. That seems ambitious from Outside management, even if the bet on a passionate niche behavior (active lifestyle) may have a more engaged fanbase than Apple device owners for TV+.

One has to wonder how many other first-party “aggregator 2.0” bundles have similar expectations, including Apple One.

Conclusion

Outside+ helps to highlight the fundamental challenge streaming services face: if a streaming service does not meet consumer needs on its own, does it better meet that need as part of a bundle of other services?

Or, is it better off with the Verizon-Disney approach: if a streaming service cannot answer its consumer needs on its own, is it better off passing the risk to a third-party bundler? So a consumer who needs the Disney+ bundle and needs Playstation gaming subscription may be best off signing up for a Verizon Wireless account which bundles both.

It may be better to let Verizon incur the risk at zero marginal costs with an established user base at scale than to incur those variable marginal costs out in the wild. Verizon may simply be better positioned to convert wireless consumers to streaming consumers.

This is what makes the Outside+ “aggregator 2.0” bundle so interesting as an example: it offers a clear and simple relationship between the target subscriber with an active lifestyle and the bundle of offerings. But the bundle also aggressively assumes that it meets the needs of that target subscriber in a way that will drive unusual adoption. The data suggests that is not true, and the model assumes both marginal marketing dollars and risk.

That makes the increasing popularity of the “aggregator 2.0” bundle a head-scratcher. Third-party aggregators of bundles seem better positioned to drive conversions than first-party aggregators. In this light it is no accident that Disney acquired 20% of its Disney+ subscriber via Verizon, or that Apple is now relying on Verizon to help drive adoption of Apple Arcade.

A third-party bundler with zero marginal costs of marketing multiple services to an existing user base at scale may be better positioned to help a streaming service scale than a first party bundler attempting to build an audience around a narrow set of interests.

Services amortization is reflected in these two sentences from its 2020 10-K (p.21). First:

Services net sales include sales from the Company’s advertising, AppleCare, digital content and other services. Services net sales also include amortization of the deferred value of Maps, Siri, and free iCloud® storage and Apple TV+ services, which are bundled in the sales price of certain products

And, second:

Services net sales increased during 2020 compared to 2019 due primarily to higher net sales from the App Store, advertising and cloud services.

In other words, the target consumer for a streaming service from Disney is different from the target consumer for a bundle of services that include Yoga Journal, and the economics for the publisher in both instances are different.